Question: Answer the following question: Eligible property includes all property except for CCA classes 1 to 6 , 14.1, 17, 47, 49, and 51 (those definitely

Answer the following question:

Eligible property includes all property except for CCA classes 1 to 6 , 14.1, 17, 47, 49, and 51 (those definitely cannot be immediately expensed). Not immediately expense Class 12 and Class 53 because they're at a 100% anyway.

Immediate Expensed Items: Everything except manufacturing building and customer lists. Total is 198500.

| Manufacturing building | Class 1 - MB (10%) |

| Manufacturing equipment | Class 53 (50%) |

| Tools (each costing under $500) | Class 12 (100%) |

| Dies and moulds | Class 12 (100%) |

| Computer equipment and systems software | Class 50 (55%) |

| Office furnishing | Class 8 (20%) |

| Customer lists | Class 14.1 (5%) |

| Delivery van | Class 10 (30%) |

| Design Software | Class 12 (100%) |

| Chairs and tables | Class 8 (20%) |

| Automobile | Class 10.1 (30%) |

| Liscense to manufacture | Class 14 |

| Made improvements to the office | Class 13 |

| Additions | Class 1 10% | Class 10.1 30% | Class 12 100% | Class 14.1 5% | Class 53 100% |

| Manufacturing building | |||||

| Manufacturing equipment | |||||

| Tools | |||||

| Dies and Moulds | |||||

| Customer lists | |||||

| Design Software |

Why do we only include Class 1, 10%, Class 10.1 30%, Class 12 100%, Class 14.1 5%, and Class 53 100% in the chart and not the others? Explain very clearly.

The automobile under Class 10.1 30% is -23684. Show how this was calculated clearly.

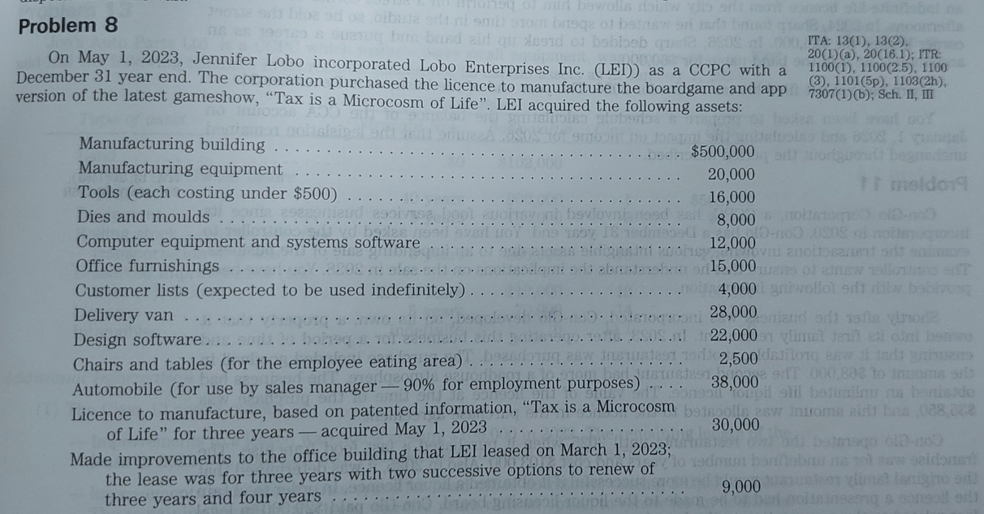

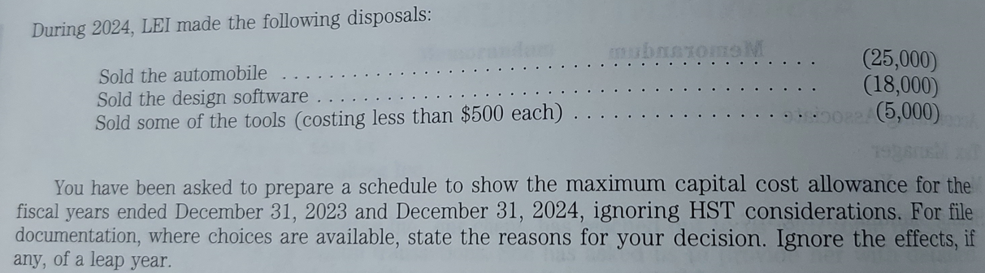

Problem 8 On May 1, 2023, Jennifer Lobo incorporated Lobo Enterprises Inc. (LEI)) as a CCPC with a December 31 year end. The corporation purchased the licence to manufacture the boardgame and app version of the latest gameshow, "Tax is a Microcosm of Life". LEI acquired the following assets: ITA: 13(1),13(2), 20(1)(a), 20(16.1); ITR 1100(1),1100(2.5),1100 (3), 1101(5p),1103(2h), 7307 (1)(b); Sch. II, III You have been asked to prepare a schedule to show the maximum capital cost allowance for the fiscal years ended December 31, 2023 and December 31, 2024, ignoring HST considerations. For file documentation, where choices are available, state the reasons for your decision. Ignore the effects, if any, of a leap year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts