Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q7) A new electronic process monitor costs

Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work

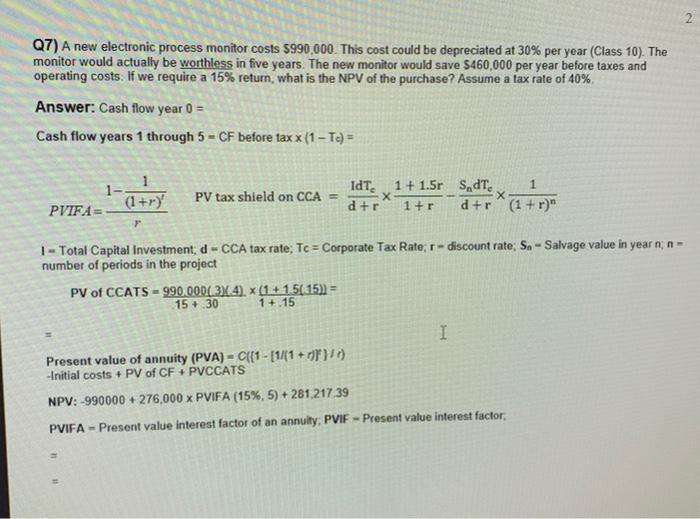

Q7) A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would actually be worthless in five years. The new monitor would save $460,000 per year before taxes and operating costs. If we require a 15% return, what is the NPV of the purchase? Assume a tax rate of 40%. Answer: Cash flow year 0= Cash flow years 1 through 5= CF before taxx(1Tc)= PVIFA =r1(1+r)t1 PV tax shield on CCA =d+r1Idc1+r1+1.5rd+rSndTc(1+r)n1 I - Total Capital Investment, d - CCA tax rate; Tc= Corporate Tax Rate; r - discount rate; Sn - Salvage value in year n;n = number of periods in the project PVofCCATS=15+.30990.000(3)(4)1+.15(1+1.5(15))= Present value of annuity (PVA) =C({1[1/(1+r)]3]/1) - Initial costs + PV of CF + PVCCATS NPV: 990000+276,000 XPVIFA (15%,5)+281,217,39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts