Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q5) Glenhill Co. is expected to maintain

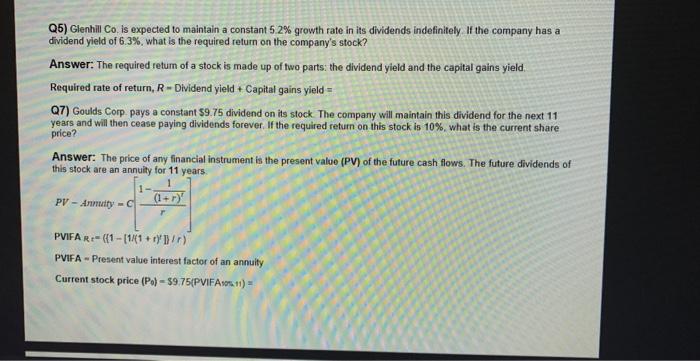

Q5) Glenhill Co. is expected to maintain a constant 5.2% growth rate in its dividends indefinitely. If the company has a dividend yield of 6.3%, what is the required return on the company's stock? Answer: The required retum of a stock is made up of two parts: the dividend yield and the capital gains yield. Required rate of return, R = Dividend yield + Capital gains yield = Q7) Goulds Corp. pays a constant $9.75 dividend on its stock. The company will maintain this dividend for the next 11 years and will then cease paying dividends forever. If the required return on this stock is 10%, what is the current share price? Answer: The price of any financial instrument is the present value (PV) of the future cash flows. The future dividends of this stock are an annuity for 11 years. PVAnmuity=C[r1(1+r)r1]PVIFAAr=({1[1/(1+r)r]}/r) PVIFA - Present value interest factor of an annuity Current stock price (P0)=$9.75(PVIFA Ass:11) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts