Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q7) A firm evaluates all of its

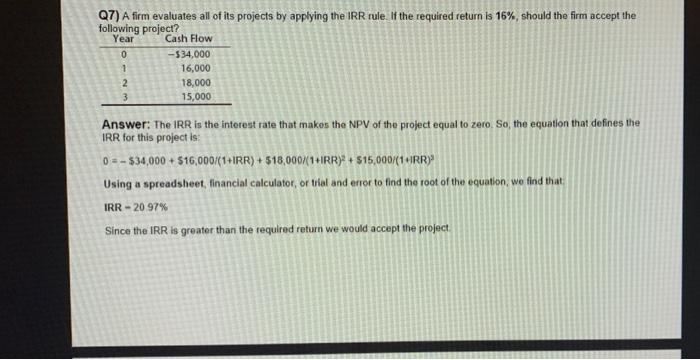

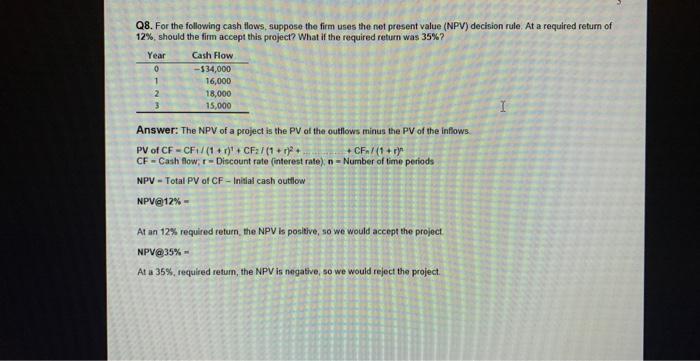

Q7) A firm evaluates all of its projects by applying the IRR rule. If the required return is 16%, should the firm accept the fnllawinn noniset? Answer: The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equation that defines the IRR for this project is: 0=$34,000+516,0001(1+1RR)+518,0001(1+1RR)2+515,000/(1+1RR)3 Using a spreadsheet, financial calculator, or tuial and error to find the root of the equation, we find that IRR =2097% Since the IRR is greater than the required return we would accept the project Q8. For the following cash flows, suppose the firm uses the net present value (NPV) decision rule. At a required return of 12%, should the firm accept this project? What if the required return was 35% ? Answer: The NPV of a project is the PV of the outflows minus the PV of the inflows. PV of CF =CF1/(1+r)1+CF2f(1+r)2++CFnl(1+r)n CF=Cash flow; r= Discount rate (interest rate), n= Number of time periods NPV - Total PV of CF - Initial cash outtiow NPVa 12%= At an 12% required return, the NPV is positive, so we would accept the project. NPVa 35%= At a 35%, required retum, the NPV is negative, so we would reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts