Question: Assessment Use the preceding table to answer nos. 1-3. Issuer Ask Price Maturity Par Value Bid Price Coupon ABC Trading 9/30/2018 10 000 3.00% 99.00

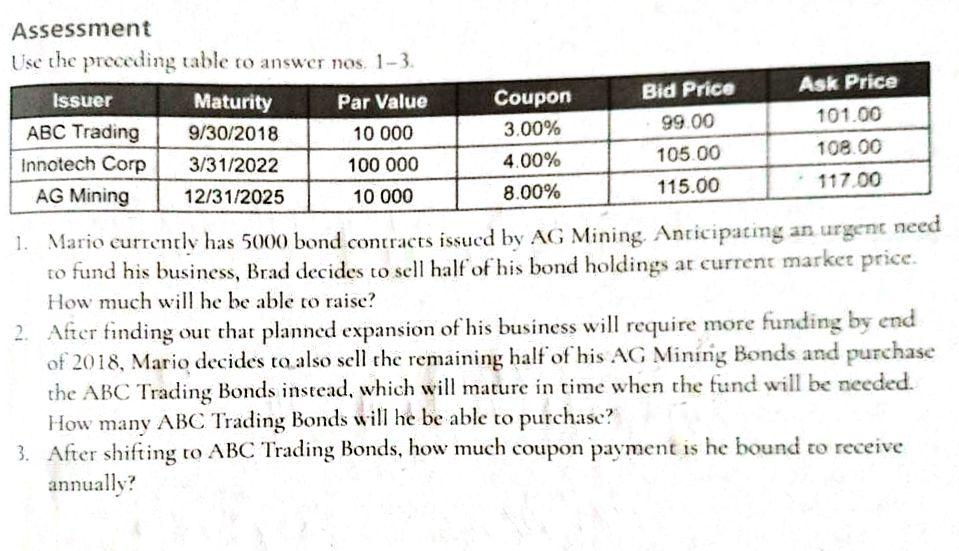

Assessment Use the preceding table to answer nos. 1-3. Issuer Ask Price Maturity Par Value Bid Price Coupon ABC Trading 9/30/2018 10 000 3.00% 99.00 101.00 Innotech Corp 3/31/2022 100 000 4.00% 105.00 108.00 AG Mining 12/31/2025 10 000 8.00% 117.00 115.00 1. Mario currently has 5000 bond contracts issued by AG Mining. Anticipating an urgent need to fund his business, Brad decides to sell half of his bond holdings at current market price. How much will he be able to raise? 2. After finding out that planned expansion of his business will require more funding by end of 2018, Mario decides to also sell the remaining half of his AG Mining Bonds and purchase the ABC Trading Bonds instead, which will mature in time when the fund will be needed. How many ABC Trading Bonds will he be able to purchase? 3. After shifting to ABC Trading Bonds, how much coupon payment is he bound to receive annually? Assessment Use the preceding table to answer nos. 1-3. Issuer Ask Price Maturity Par Value Bid Price Coupon ABC Trading 9/30/2018 10 000 3.00% 99.00 101.00 Innotech Corp 3/31/2022 100 000 4.00% 105.00 108.00 AG Mining 12/31/2025 10 000 8.00% 117.00 115.00 1. Mario currently has 5000 bond contracts issued by AG Mining. Anticipating an urgent need to fund his business, Brad decides to sell half of his bond holdings at current market price. How much will he be able to raise? 2. After finding out that planned expansion of his business will require more funding by end of 2018, Mario decides to also sell the remaining half of his AG Mining Bonds and purchase the ABC Trading Bonds instead, which will mature in time when the fund will be needed. How many ABC Trading Bonds will he be able to purchase? 3. After shifting to ABC Trading Bonds, how much coupon payment is he bound to receive annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts