Question: 12. Given information in Table 2, what's the standard deviation of the residuals (error) for Stock A in a Single-Index Model? a. 2.24% b.

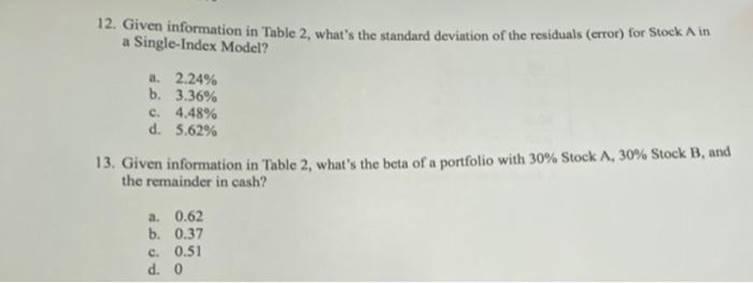

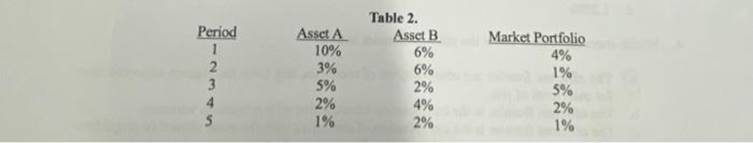

12. Given information in Table 2, what's the standard deviation of the residuals (error) for Stock A in a Single-Index Model? a. 2.24% b. 3.36% c. 4.48% d. 5.62% 13. Given information in Table 2, what's the beta of a portfolio with 30% Stock A, 30% Stock B, and the remainder in cash? a. 0.62 b. 0.37 c. 0.51 d. 0 Period 1 12345 3 Asset A 10% 3% 5% 2% 1% Table 2. Asset B 6% 6% 2% 4% 2% Market Portfolio 4% 1% 5% 2% 1%

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Answer To calculate the standard deviation of the residuals for Stock A in a SingleIndex Model we need to calculate the residuals first Residuals are the differences between the actual returns of Stoc... View full answer

Get step-by-step solutions from verified subject matter experts