Question: Attempts Keep the Highest / 2 2. 2: The Cost of Capital: Cost of Debt A firm's before-tax cost of debt, rd, is the interest

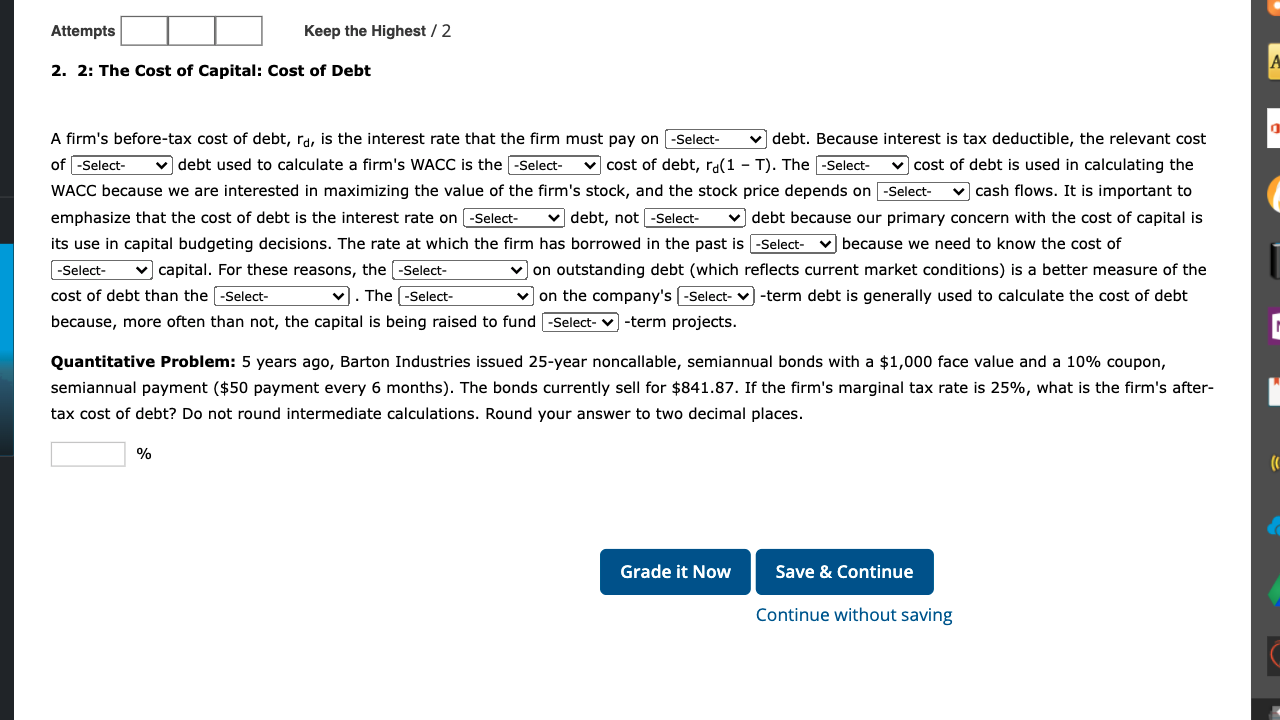

Attempts Keep the Highest / 2 2. 2: The Cost of Capital: Cost of Debt A firm's before-tax cost of debt, rd, is the interest rate that the firm must pay on -Select- debt. Because interest is tax deductible, the relevant cost of -Select- debt used to calculate a firm's WACC is the -Select- cost of debt, ra(1 - T). The -Select- cost of debt is used in calculating the WACC because we are interested in maximizing the value of the firm's stock, and the stock price depends on -Select- cash flows. It is important to emphasize that the cost of debt is the interest rate on -Select- debt, not -Select- debt because our primary concern with the cost of capital is its use in capital budgeting decisions. The rate at which the firm has borrowed in the past is -Select- v because we need to know the cost of -Select- y capital. For these reasons, the -Select- on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the [-Select- The -Select- v on the company's -Select- v-term debt is generally used to calculate the cost of debt because, more often than not, the capital is being raised to fund -Select --term projects. Quantitative Problem: 5 years ago, Barton Industries issued 25-year noncallable, semiannual bonds with a $1,000 face value and a 10% coupon, semiannual payment ($50 payment every 6 months). The bonds currently sell for $841.87. If the firm's marginal tax rate is 25%, what is the firm's after- tax cost of debt? Do not round intermediate calculations. Round your answer to two decimal places. % Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts