Question: AutoSave C H - Assignment 2 now. Protected View - o Scarch A A aaaburahma@gmail.com CS File Home Insert Page Layout Formulas Data Review View

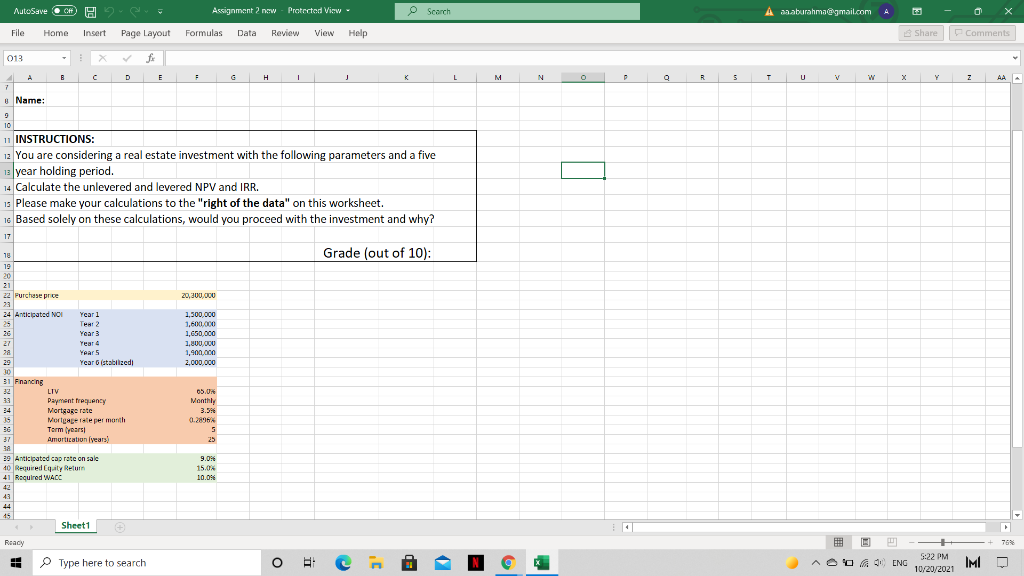

AutoSave C H - Assignment 2 now. Protected View - o Scarch A A aaaburahma@gmail.com CS File Home Insert Page Layout Formulas Data Review View Help Share Comments 013 f B E . G H 1 I L M N P o R 5 T U v w x Y Z AA 7 8 Name: 9 10 I INSTRUCTIONS: 12 You are considering a real estate investment with the following parameters and a five 13 year holding period. 14 Calculate the unlevered and levered NPV and IRR. Please make your calculations to the "right of the data" on this worksheet. Based solely on these calculations, would you proceed with the investment and why? 17 Grade (out of 10): 20,300.000 1,500,000 1.600.000 1,650,000 1,800.000 1,900,000 2,000,000 78 19 2011 21 22 Purchase price 23 24 Anticipated NOI Year 1 25 Tear 2 Year 3 Year 21 Years Year (stabilized 30 31 Financing 32 LTV 33 Payment frequency 34 Mortgage rate 15 Mortgage rate per month 36 Torm years 37 Amortization years) () sa 29 Anticipated caprate on sale 40 Required Equity Return 41 Required WACC 42 43 44 45 Sheet1 05.01 Monthly 3.596 5 25 9.0% 15.04 10.0% Reacy 76% Type here to search O o G+ 5:22 PM 10/20/2021 EH AOOAENG IM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts