Question: B. Numerical Problems and Questions [Each problem/question worth 8 points a. You submitted a bid for building the Euro Tower (ET) in Torino, Italy. If

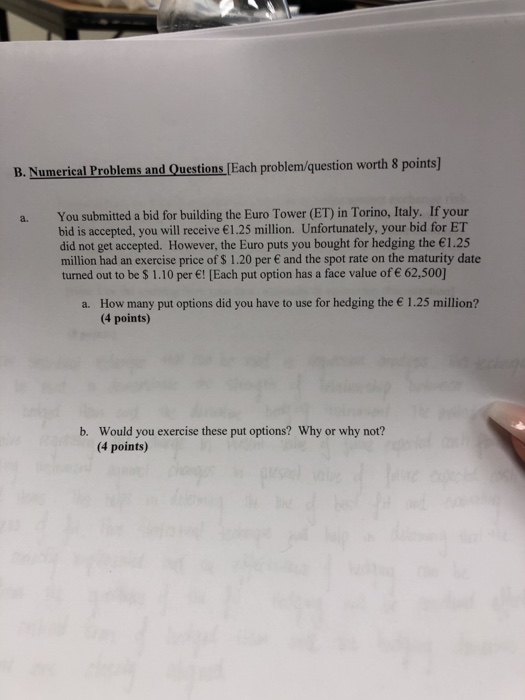

B. Numerical Problems and Questions [Each problem/question worth 8 points a. You submitted a bid for building the Euro Tower (ET) in Torino, Italy. If your bid is accepted, you will receive 1.25 million. Unfortunately, your bid for ET did not get accepted. However, the Euro puts you bought for hedging the 1.25 million had an exercise price of $ 1.20 per and the spot rate on the maturity date turned out to be $ 1.10 per ! [Each put option has a face value of 62,500] a. How many put options did you have to use for hedging the 1.25 million? (4 points) b. Would you exercise these put options? Why or why not? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts