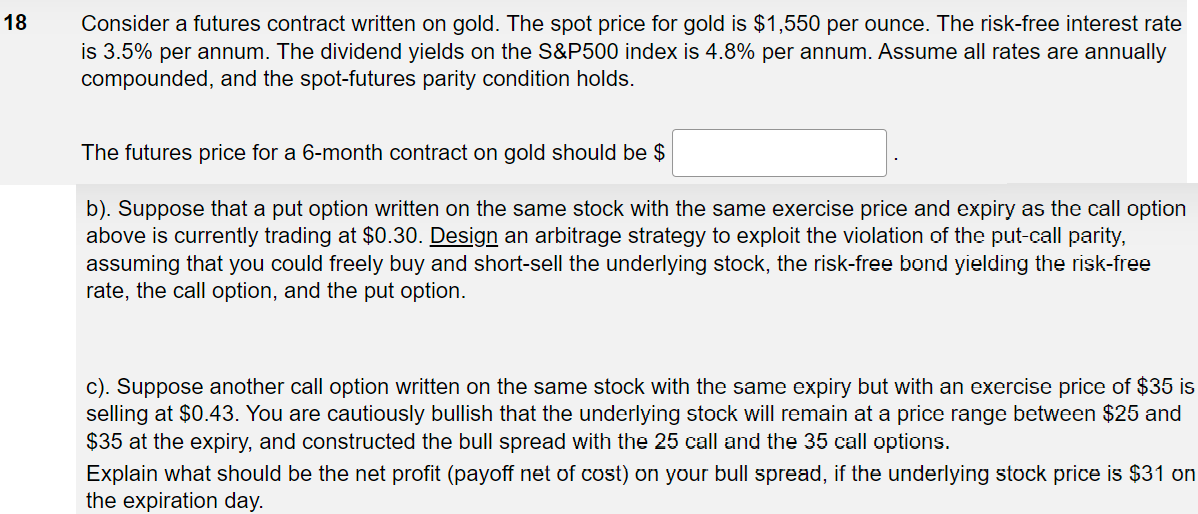

Question: b ) . Suppose that a put option written on the same stock with the same exercise price and expiry as the call option above

b Suppose that a put option written on the same stock with the same exercise price and expiry as the call option

above is currently trading at $ Design an arbitrage strategy to exploit the violation of the putcall parity,

assuming that you could freely buy and shortsell the underlying stock, the riskfree bond yielding the riskfree

rate, the call option, and the put option.

c Suppose another call option written on the same stock with the same expiry but with an exercise price of $ is

selling at $ You are cautiously bullish that the underlying stock will remain at a price range between $ and

$ at the expiry, and constructed the bull spread with the call and the call options.

Explain what should be the net profit payoff net of cost on your bull spread, if the underlying stock price is $ on

the expiration day.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock