Question: Back to Assignment Attempts 0 0 Keep the Highest (0)/(1) 4. Domestic valuation model Consider the valuation of a purely domestic firm that does

Back to Assignment\ Attempts\ 0\ 0\ Keep the Highest

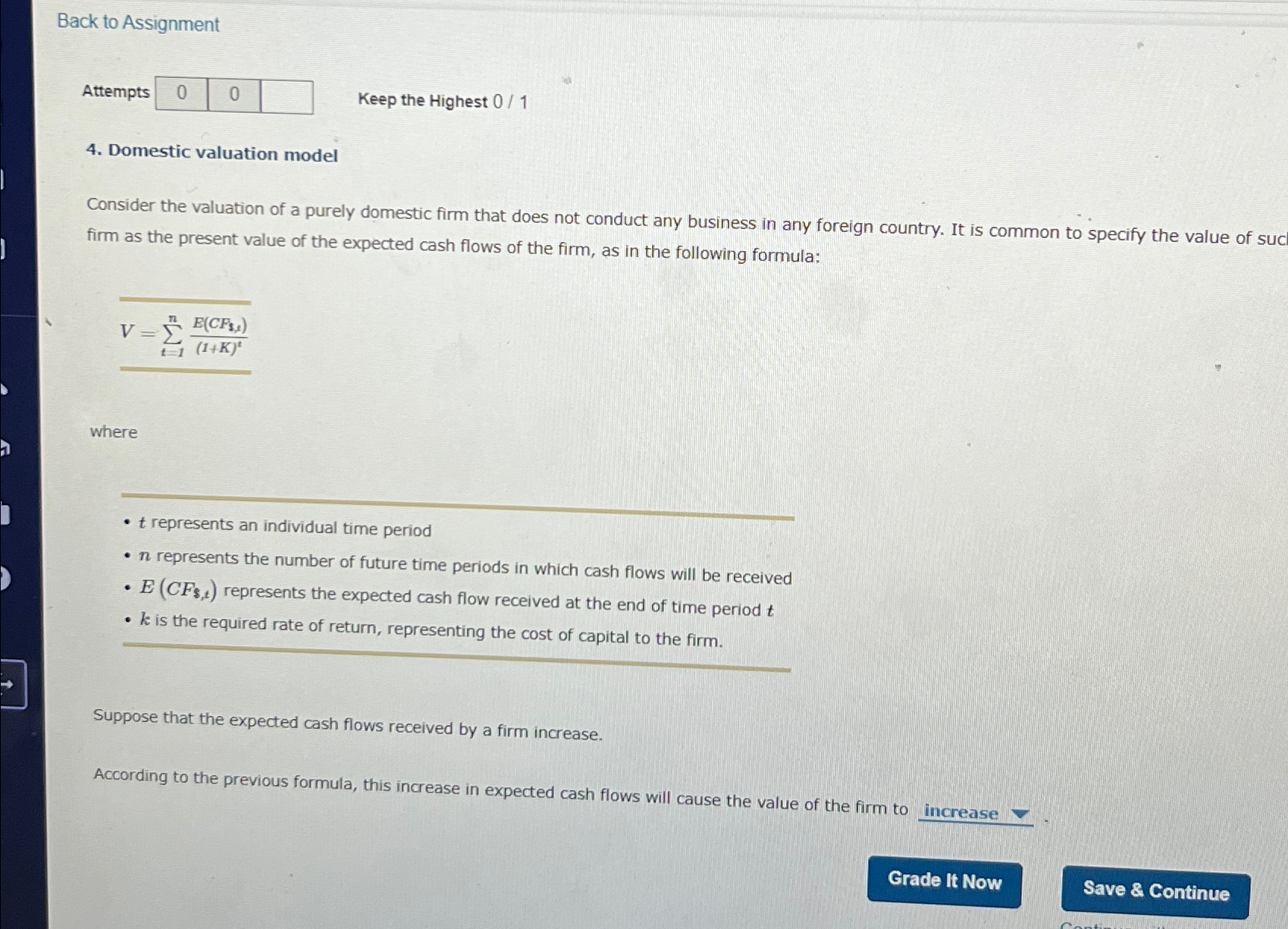

(0)/(1)\ 4. Domestic valuation model\ Consider the valuation of a purely domestic firm that does not conduct any business in any foreign country. It is common to specify the value of suc firm as the present value of the expected cash flows of the firm, as in the following formula:\

V=\\\\sum_(t=1)^n (E(CF_(3,t)))/((1+K)^(t))\ where\

trepresents an individual time period\

nrepresents the number of future time periods in which cash flows will be received\

E(CF_($,t))represents the expected cash flow received at the end of time period

t\

kis the required rate of return, representing the cost of capital to the firm.\ Suppose that the expected cash flows received by a firm increase.\ According to the previous formula, this increase in expected cash flows will cause the value of the firm to\ increase

Consider the valuation of a purely domestic firm that does not conduct any business in any foreign country. It is common to specify the value of suc firm as the present value of the expected cash flows of the firm, as in the following formula: V=t=1n(1+K)tE(CF3,t) where - t represents an individual time period - n represents the number of future time periods in which cash flows will be received - E(CF,t) represents the expected cash flow received at the end of time period t - k is the required rate of return, representing the cost of capital to the firm. Suppose that the expected cash flows received by a firm increase. According to the previous formula, this increase in expected cash flows will cause the value of the firm to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts