Question: Bookmark Windows IL MIG C C Question 7 The wowo wil heste SD Solo 11 NA YO Ostian C 18. As x C 18. As

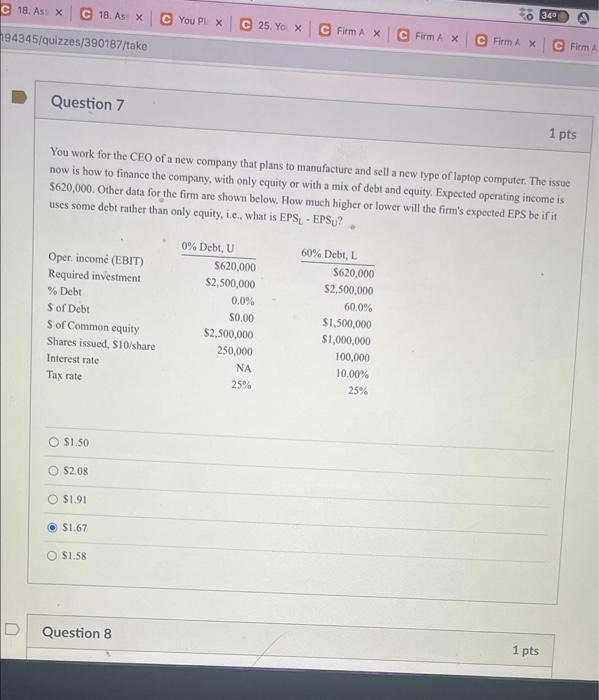

Bookmark Windows IL MIG C C Question 7 The wowo wil heste SD Solo 11 NA YO Ostian C 18. As x C 18. As X C You PLX 0 340 25. Yox C Firm A X 94345/quizzes/390187/take C FirmAX FirmAX C Firm Question 7 1 pts You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $620,000. Other data for the firm are shown below. How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity, i.c, what is EPSLEPSU? Oper. income (EBIT) Required investment % Debt S of Debt S of Common equity Shares issued, S10 share Interest rate Tax rate 0% Debt, U 5620,000 $2,500,000 0.0% $0.00 $2,500,000 250,000 NA 25% 60% Debt, $620,000 $2,500,000 60.0% $1,500,000 $1,000,000 100,000 10.00% 25% $1.50 S2,08 $1.91 $1.67 O $1.58 Question 8 1 pts Bookmark Windows IL MIG C C Question 7 The wowo wil heste SD Solo 11 NA YO Ostian C 18. As x C 18. As X C You PLX 0 340 25. Yox C Firm A X 94345/quizzes/390187/take C FirmAX FirmAX C Firm Question 7 1 pts You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $620,000. Other data for the firm are shown below. How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity, i.c, what is EPSLEPSU? Oper. income (EBIT) Required investment % Debt S of Debt S of Common equity Shares issued, S10 share Interest rate Tax rate 0% Debt, U 5620,000 $2,500,000 0.0% $0.00 $2,500,000 250,000 NA 25% 60% Debt, $620,000 $2,500,000 60.0% $1,500,000 $1,000,000 100,000 10.00% 25% $1.50 S2,08 $1.91 $1.67 O $1.58 Question 8 1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts