Question: Calculate the same subperiod means and standard deviations for small stocks as Table 5.4 of the text provides for large stocks a. Have small stocks

Calculate the same subperiod means and standard deviations for small stocks as Table 5.4 of the text provides for large stocks

a. Have small stocks provided better reward-to-volatility (Sharpe) ratios than large stocks?

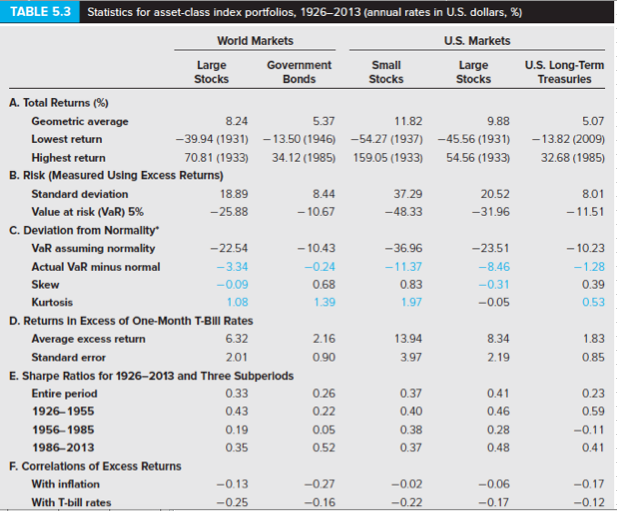

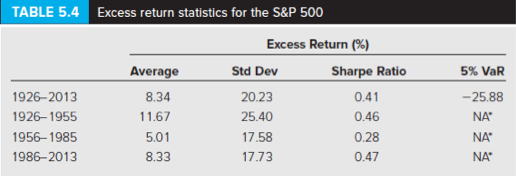

TABLE 5.3 Statistics for asset-class index portfolios, 19262013 (annual rates in U.S. dollars, %) World Markets U.S. Markets Small Stocks Large Stocks U.S. Long-Term Treasurles 11.82 -54.27 (1937) 159.05 (1933) 9.88 -45.56 (1931) 54.56 (1933) 5.07 -13.82 (2009) 32.68 (1985) 37.29 -48.33 20.52 -31.96 8.01 - 11.51 -024 Large Government Stocks Bonds A. Total Returns (%) Geometric average 8.24 5.37 Lowest return -39.94 (1931) - 13.50 (1946) Highest return 70.81 (1933) 34.12 (1985) B. Risk (Measured Using Excess Returns) Standard deviation 18.89 8.44 Value at risk (VaR) 5% -25.88 -10.67 C. Deviation from Normality VaR assuming normality -22.54 - 10.43 Actual VaR minus normal -3.34 Skew -0.09 Kurtosis 1.08 D. Returns In Excess of One-Month T-Bill Rates Average excess return 6.32 2.16 Standard error 201 0.90 E. Sharpe Ratios for 1926-2013 and Three Subperiods Entire period 0.33 1926-1955 0.43 1956-1985 0.19 1986-2013 0.35 F. Correlations of Excess Returns With inflation -0.13 -0.27 With T-bill rates -0.25 -0.16 - 36.96 -11.37 0.83 1.97 -23.51 8.46 -0.31 -0.05 - 10.23 -1.28 0.39 0.53 13.94 3.97 8.34 1.83 0.85 2.19 0.23 0.41 0.46 0.28 0.48 059 -0.11 0.52 0.37 0.41 -0.06 -0.02 -0.22 -0.17 -0.17 -0.12 TABLE 5.4 Excess return statistics for the S&P 500 Average 5% VaR 1926-2013 1926-1955 1956-1985 1986-2013 8.34 11.67 5.01 8.33 Excess Return (%) Std Dev Sharpe Ratio 20.23 0.41 25.40 0.46 17.58 0.28 17.73 0.47 -25.88 NA NA NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts