Question: Calculating a beta coefficient for a portfolio Avangard Aviation is a public company, and Aviation Fund is a relatively well - diversified mutual fund. The

Calculating a beta coefficient for a portfolio

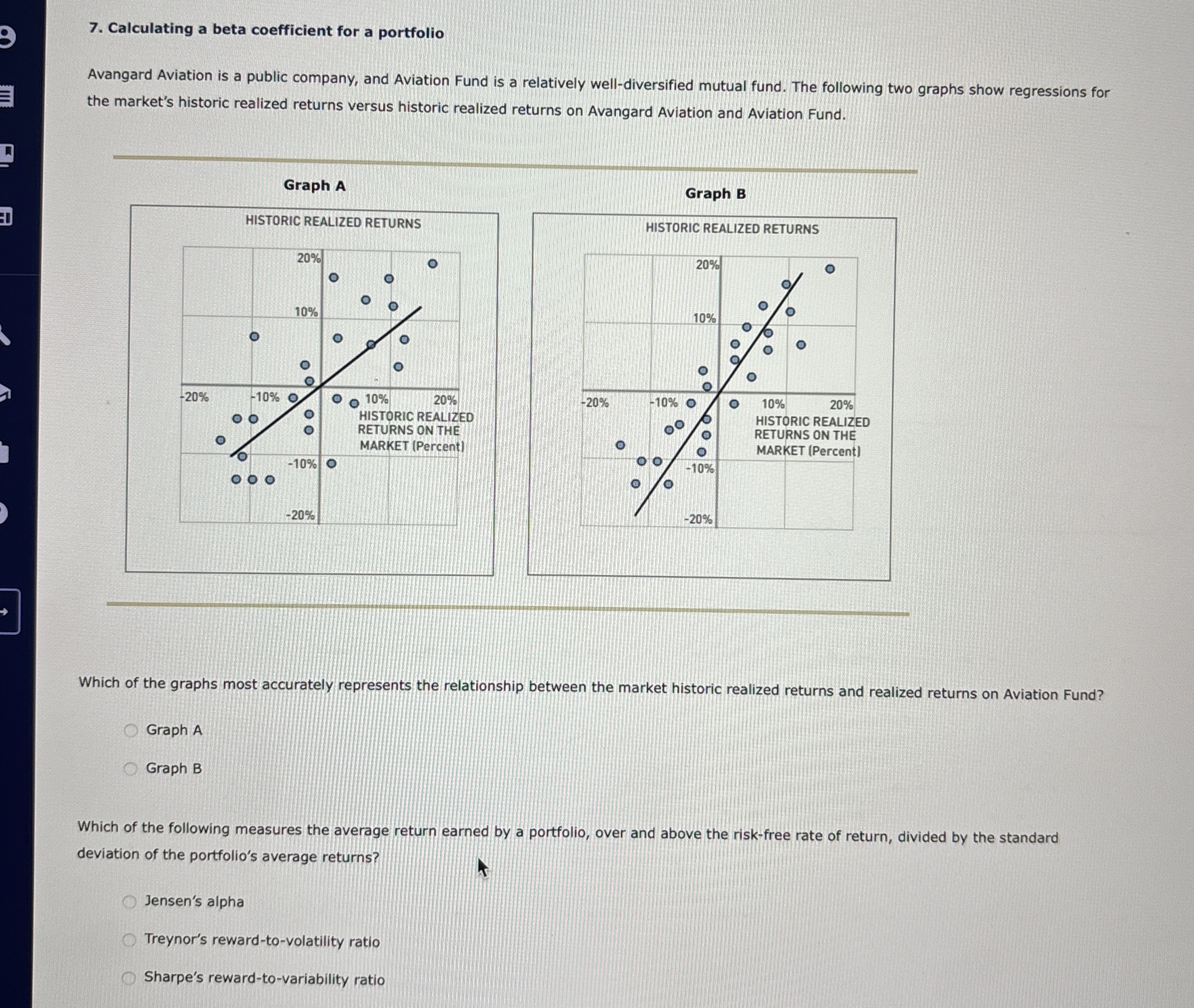

Avangard Aviation is a public company, and Aviation Fund is a relatively welldiversified mutual fund. The following two graphs show regressions for the market's historic realized returns versus historic realized returns on Avangard Aviation and Aviation Fund.

Which of the graphs most accurately represents the relationship between the market historic realized returns and realized returns on Aviation Fund?

Graph A

Graph B

Which of the following measures the average return earned by a portfolio, over and above the riskfree rate of return, divided by the standard deviation of the portfolio's a verage returns?

Jensen's alpha

Treynor's rewardtovolatility ratio

Sharpe's rewardtovariability ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock