Question: can someone help me to solve question c ; thank you! | CIUTO COM y de problem-199p solution 9780078034800 exe NEW egg Study Textbook Solutions

can someone help me to solve question c ; thank you!

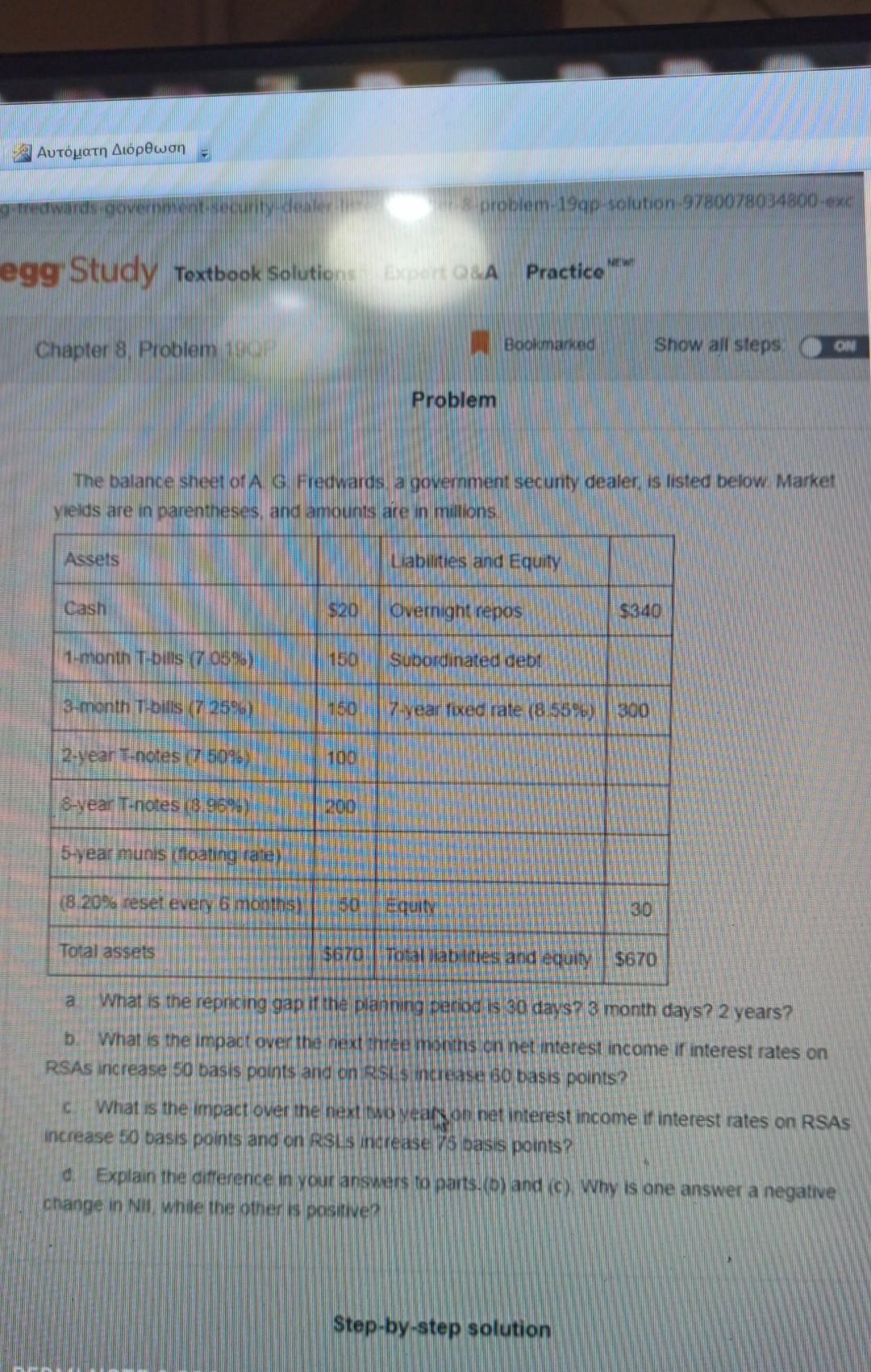

| CIUTO COM y de problem-199p solution 9780078034800 exe NEW egg Study Textbook Solutions pert OA Practice Chapter 8 Problem Bookmarked Show all steps CM Problem The balance sheet of A G Fredwards a government secunty dealer is listed below Market Mields are in parentheses and amounts are n millions Assets Labuties and Equity Cash Overnight repos $340 1-month Tbilis (705%) 150 Subordinated debt 3-month T bills 2590) 7 vear lixed rate (8.55%) 300 12-year T-notes 7 502 100 s-vear Tinotes 9690) 200 5-year munis floating rate) (8.20% reset every 6 months 50 Equity 30 Total assets $670 Total kaburies and equity $670 What is the repncing gap it the plannng period is $0 days? 3 month days? 2 years? b. What is the impact over the next free months on net interest income if interest rates on RSAS increase 50 basis points and on R$ $ ncrease 80 basis points C What is the impact over the next two yearson het interest income if interest rates on RSAS increase 50 basis points and on RSLS increase 5 basis points d. Explain the difference in your answers to parts. D) and (c) Why is one answer a negative change in NII while the other is positive Step-by-step solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts