Question: can someone please explain where the .667 year comes from? is it interest? I do not understand why that is multipled by one year and

can someone please explain where the .667 year comes from? is it interest? I do not understand why that is multipled by one year and the rest by 3 years total. TIA.

this is all info provided, I am mostly confused on concept.

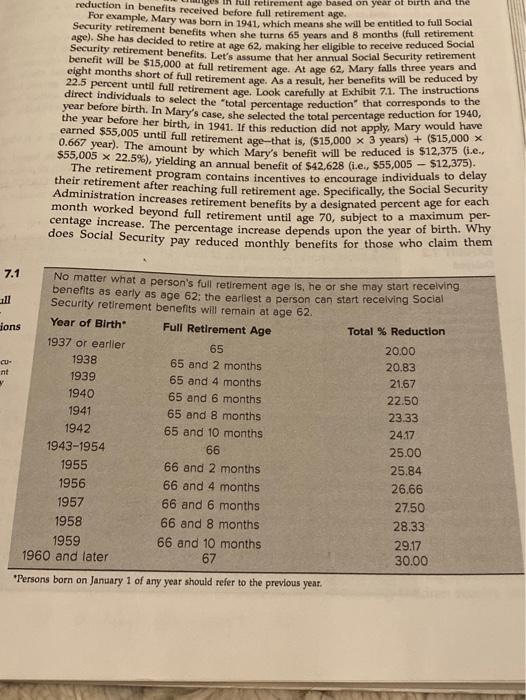

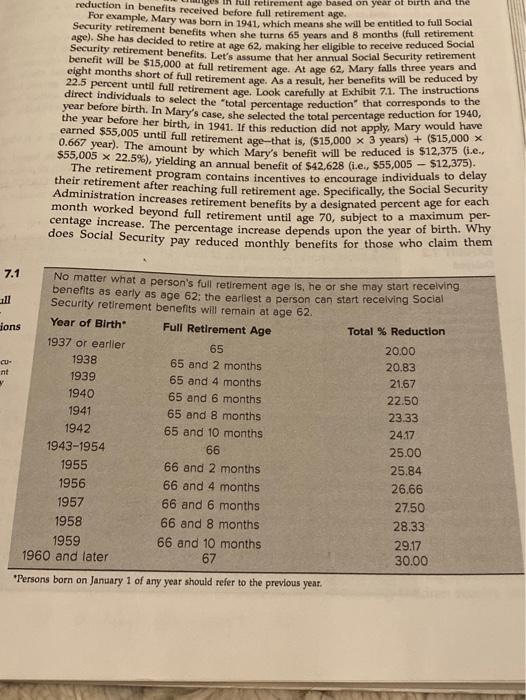

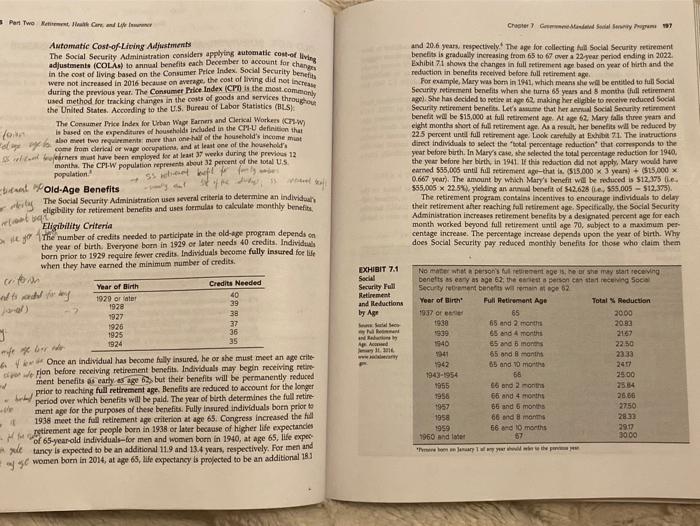

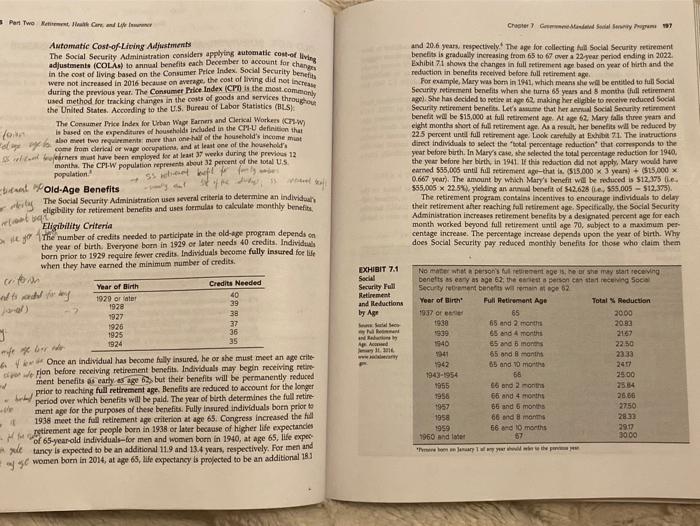

reduction in benefits received before full retirement age. in full retirement age based on year of birth and the For example, Mary was born in 1941, which means she will be entitled to full Social Security retirement benefits when she turns 65 years and 8 months (full retirement age). She has decided to retire at age 62, making her eligible to receive reduced Social Security retirement benefits. Let's assume that her annual Social Security retirement eight months short of full retirement age. As a result, her benefits will be reduced by 22.5 percent until full retirement age. Look carefully at Exhibit7.1. The instructions year before birth. In Mary's case, she selected the total percentage reduction for 1940. the year before her birth, in 1941. If this reduction did not apply, Mary would have earned $55,005 until full retirement age-that is, ($15,000 > 3 years) + ($15,900 $55,005 22.5%), yielding an annual benefit of $42,628 (i.e., $55,005 - $12,375). their retirement after reaching full retirement age. Specifically, the Social Security The retirement program contains incentives to encourage individuals to delay Administration increases retirement benefits by a designated percent age for each month worked beyond full retirement until age 70, subject to a maximum per centage increase. The percentage increase depends upon the year of birth. Why does Social Security pay reduced monthly benefits for those who claim them nt 7.1 No matter what a person's full retirement age is, he or she may start receiving benefits as early as age 62: the earliest a person can start receiving Social Security retirement benefits will remain at age 62 - dons Year of Birth Full Retirement Age Total % Reduction 1937 or earlier 65 20.00 CU- 1938 65 and 2 months 20.83 1939 65 and 4 months 2167 1940 65 and 6 months 22.50 1941 65 and 8 months 23.33 1942 65 and 10 months 24.17 1943-1954 66 25.00 1955 66 and 2 months 25.84 1956 66 and 4 months 26.66 1957 66 and 6 months 27.50 1958 66 and 8 months 28.33 1959 66 and 10 months 29.17 1960 and later 67 30.00 *Persons born on January 1 of any year should refer to the previous year. Part Two West Cars and Crawl and 20.6 years, respectively. The app for collecting full Social Security retirement benefits is gradually increasing from 65 to 7 over 22year period ending in 2022 Exhibit71 shows the changes in full retirement age based on year of birth and the reduction in benefits received before full retirement age. For example, Mary was born in 1941, which means she will be entitled to full Social Security retirement benefits when she turns 65 years and 3 months (hill retirement age). She has decided to retire at age 62 making her eligible to receive reduced Social Security retirement benet. Let's me that her annual Social Security retirement benefit will be $15,000 at full retirement At age 62. Mary falls three year and eight months short of full retirement age. As a result, her benefits will be reduced by 225 percent until full petirement age. Look carefully at Exhiba 21. The instructions direct individuals to select the total percentage reduction that corresponds to the year before buth. In Mary's case, the selected the total percentage reduction for 1940, the year before her birth in 1941. If this redaction did not apply. Mary would have earned $55.005 until full retirement age-that l. 515.000 x 3 years) + ($15,000 0.667 years. The amount by which Mary's benefit will be reduced is $12.375 0. $55.005 22.5% yielding an annual benefit of 42,628 le, $55.005 - $12,375). The retirement program contains incentives to encourage individuals to delay their retirement after reaching full retirement age. Specifically, the Social Security Administration increases retirement benefits by a designated percentage for each month worked beyond full retirement until age 70, sabject to a maximum per centage increase. The percentage increme depends upon the year of birth. Why does Social Security pay reduced monthly benefits for those who claim them ontb Automatic Cost-of-Living Adjustments adjuste COLAR to benefits each December to account for changes in the cost of living based on the Consumer Price Index. Social Security benefits were not increased in 2016 because on average the cost of living did not during the previous year. The Consumer Price Index (CPT) is the most commonly und method for tracking changes in the costs of goods and services through the United States. According to the U.S. Bureau of Labor Statistics (BLS) The Consumer Price Index for Urban Warners and Clerical Workers (C7w) tom is based on the expenditure of household Indluded in the CI'S-U definition the el me op , also meet two requirements more than one half of the households income mua buerners must have been employed for at least 37 weeks during the previous 12 month. The CPI.W population represents about 32 percent of the total US population." se Wife bat Pold-Age Benefits Abils eligibility for retirement benefits and uses formulas to calculate monthly benefit Eligibility Criteria do The number of credits needed to participate in the old-age program depends on the year of birth. Everyone born in 1929 or later needs 40 credits. Individual born prior to 1929 require fewer credits. Individuals become fully insured for life when they have earned the minimum number of credits. u. Year of Birth Credits Needed ed to call for by 1929 or later 40 1928 39 1927 38 1926 37 1925 36 1924 35 Once an individual has become fully insured, he or she must meet an ape crite werjon before receiving retirement benefits. Individuals may begin receiving retire ment benefits as early as age > but their benefits will be permanently reduced prior to reaching full retirement age. Benefits are reduced to account for the longer period over which benefits will be paid. The year of birth determines the full retire ment age for the purposes of these benefits. Fully insured individuals born prior to 1938 meet the full retirement age criterion at age 65. Congress increased the hill cetirement age for people born in 1938 or later because of higher life expectancies e tancy is expected to be an additional 11.9 and 13,4 years, respectively. For men and yc women born in 2014, at age 65, life expectancy s projected to be an additional 183 EXHIBIT 7.1 Social Security Retirement and Reductions by App NR Apm rife of her no www. No matter what a person's Montage her she may start receving benefits as early as age 62, the resta persona recering Social Securty retranten benefits remain 62 Year of birth Pall Retirement Age Total Reduction 1937 ore 65 2000 1930 65 and 2 months 2083 1939 65 and 4 months 21:57 1940 65 and 5 manns 22.50 1941 65 and 8 months 23.33 1942 85 and 10 months 2017 1943-1954 56 2500 1955 66 and 2 oth 2534 1956 65 and 4 months 26.66 1957 65 and 6 months 2750 1958 66 and 8 moms 2833 1959 66 - 10 months 29.17 1960 and later 67 3000 Parte be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock