Question: can someone please solve this on excel Online TEST WMCW tests. mat.com Acos 5p Atlas Mr. -S. Stanfordonnt Traste 3 UCAS Welco Section 1 of

can someone please solve this on excel

can someone please solve this on excel

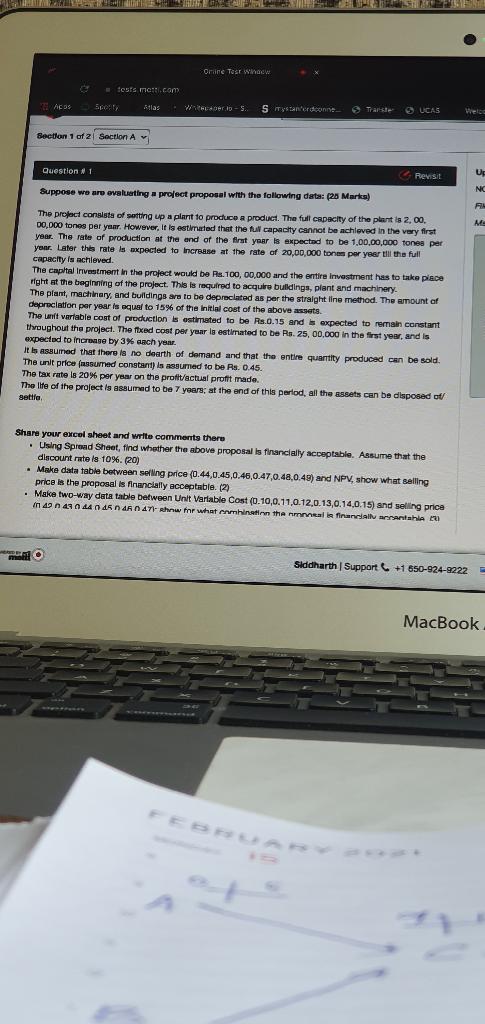

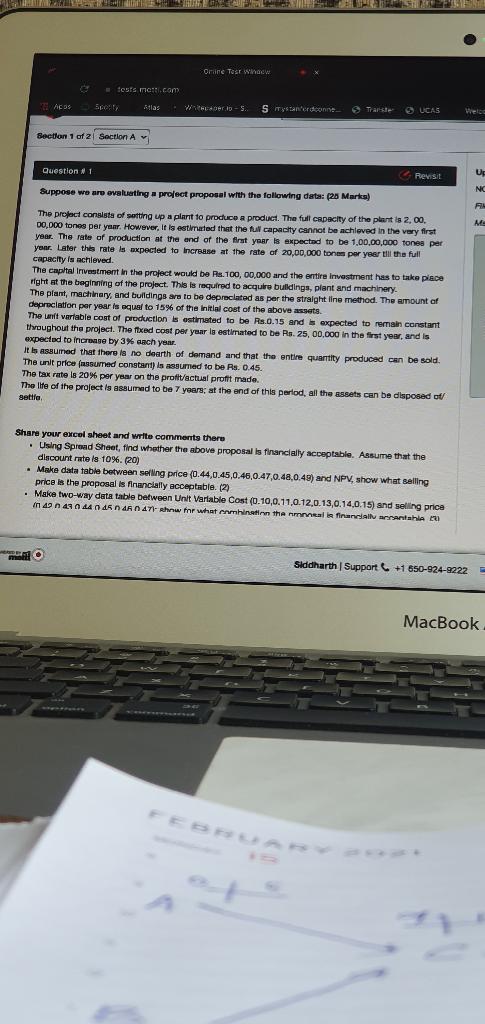

Online TEST WMCW tests. mat.com Acos 5p Atlas Mr. -S. Stanfordonnt Traste 3 UCAS Welco Section 1 of 2 Section A Question 11 Up Revisit Suppose we are evaluating a project proposal with the following data (28 Marks NC ME The project consists of setting up a plant to produce a product. The full capacity of the plant is 2,00 00.000 tones per year. However, it is estimated that the full capacity cannot be achieved in the very first year. The rate of production at the end of the first year is expected to be 1.00.00.000 tones per year. Later this rate is expected to increase at the rate of 20,00,000 ton per year till the full capacity is achieved The capital Investment in the project would be a. 100,00,000 and the entire investment has to take place right at the beginning of the project. This is required to acquire buildings, plant and machinery The plant, machinery and buildings are to be depreciated as per the straight line method. The amount of depreciation per year is equal to 15% of the initial cost of the above assets The unft variable cost of production is estimated to be Rs.0.15 and is expected to remain constant throughout the project. The fixed cost per year la estimated to be Rs. 25,00,000 in the first year, and is expected to increase by 3% each year. It is assumed that there is no death of demand and that the entire quantity produced can be sold. The unit price assumed constant) is assumed to be Rs. 0.45. The tax rate is 20% per year on the profit/actual profft made. The life of the project is assumed to be 7 years at the end of this period, all the assets can be disposed of settle Share your excel sheet and write comments there . Using Spread Sheet, find whether the above proposal is financially acceptable. Assume that the discount rate is 10%. (20) Make data table between selling price (0.44,0.45,0.46,0.47,0.48.0.49) and NPV, show what selling price is the proposal is financially acceptable. (2) Make two-way data table between Unit Variable Cost (0.10,0.11,0.12,0.13,0.14,0.15) and selling price in 42 43 44 45 NANAT how for what combination the main financiranih u Siddharth Support +1 650-924-9222 MacBook Online TEST WMCW tests. mat.com Acos 5p Atlas Mr. -S. Stanfordonnt Traste 3 UCAS Welco Section 1 of 2 Section A Question 11 Up Revisit Suppose we are evaluating a project proposal with the following data (28 Marks NC ME The project consists of setting up a plant to produce a product. The full capacity of the plant is 2,00 00.000 tones per year. However, it is estimated that the full capacity cannot be achieved in the very first year. The rate of production at the end of the first year is expected to be 1.00.00.000 tones per year. Later this rate is expected to increase at the rate of 20,00,000 ton per year till the full capacity is achieved The capital Investment in the project would be a. 100,00,000 and the entire investment has to take place right at the beginning of the project. This is required to acquire buildings, plant and machinery The plant, machinery and buildings are to be depreciated as per the straight line method. The amount of depreciation per year is equal to 15% of the initial cost of the above assets The unft variable cost of production is estimated to be Rs.0.15 and is expected to remain constant throughout the project. The fixed cost per year la estimated to be Rs. 25,00,000 in the first year, and is expected to increase by 3% each year. It is assumed that there is no death of demand and that the entire quantity produced can be sold. The unit price assumed constant) is assumed to be Rs. 0.45. The tax rate is 20% per year on the profit/actual profft made. The life of the project is assumed to be 7 years at the end of this period, all the assets can be disposed of settle Share your excel sheet and write comments there . Using Spread Sheet, find whether the above proposal is financially acceptable. Assume that the discount rate is 10%. (20) Make data table between selling price (0.44,0.45,0.46,0.47,0.48.0.49) and NPV, show what selling price is the proposal is financially acceptable. (2) Make two-way data table between Unit Variable Cost (0.10,0.11,0.12,0.13,0.14,0.15) and selling price in 42 43 44 45 NANAT how for what combination the main financiranih u Siddharth Support +1 650-924-9222 MacBook

can someone please solve this on excel

can someone please solve this on excel