Question: can you answer these questions for me please ? Chapter 4 Comprehension Check This is directly based on the readings for the week. You may

can you answer these questions for me please ?

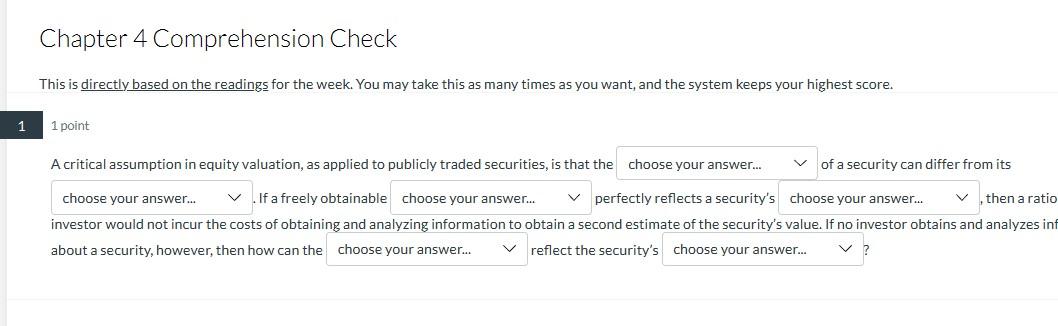

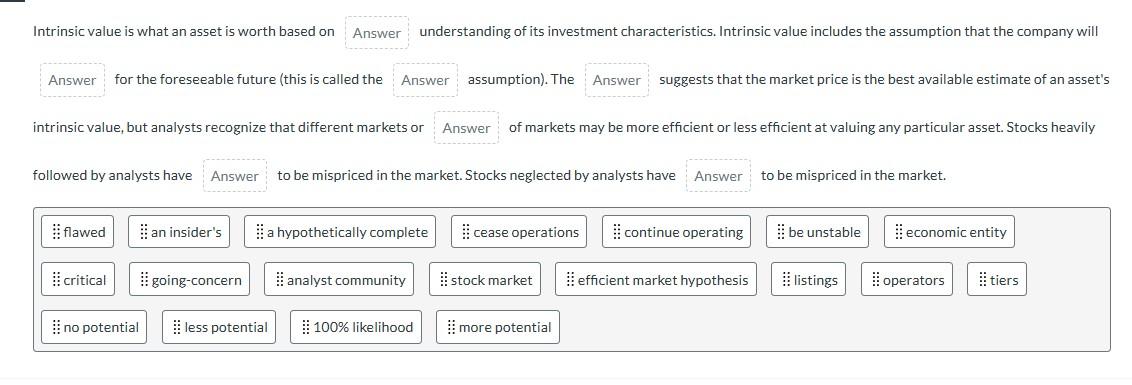

Chapter 4 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point A critical assumption in equity valuation, as applied to publicly traded securities, is that the of a security can differ from its . If a freely obtainable perfectly reflects a security's , then a ratio investor would not incur the costs of obtaining and analyzing information to obtain a second estimate of the security's value. If no investor obtains and analyzes in about a security, however, then how can the reflect the security's Intrinsic value is what an asset is worth based on understanding of its investment characteristics. Intrinsic value includes the assumption that the company will for the foreseeable future (this is called the assumption). The suggests that the market price is the best available estimate of an asset's intrinsic value, but analysts recognize that different markets or of markets may be more efficient or less efficient at valuing any particular asset. Stocks heavily followed by analysts have to be mispriced in the market. Stocks neglected by analysts have to be mispriced in the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts