Question: can you answer these questions for me please? Chapter 8 Comprehension Check This is directly based on the readings for the week. You may take

can you answer these questions for me please?

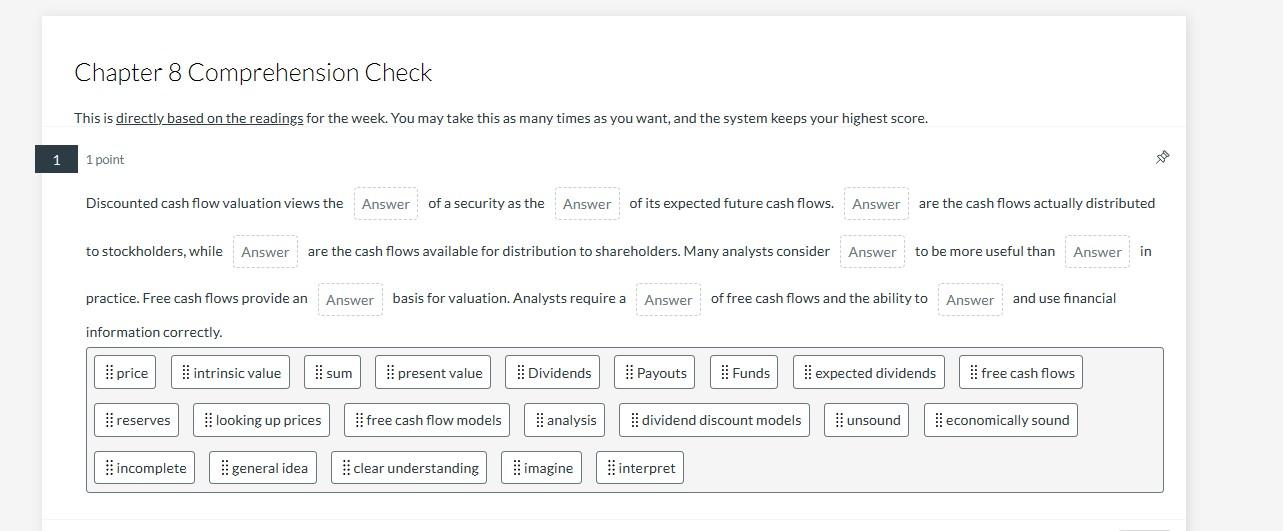

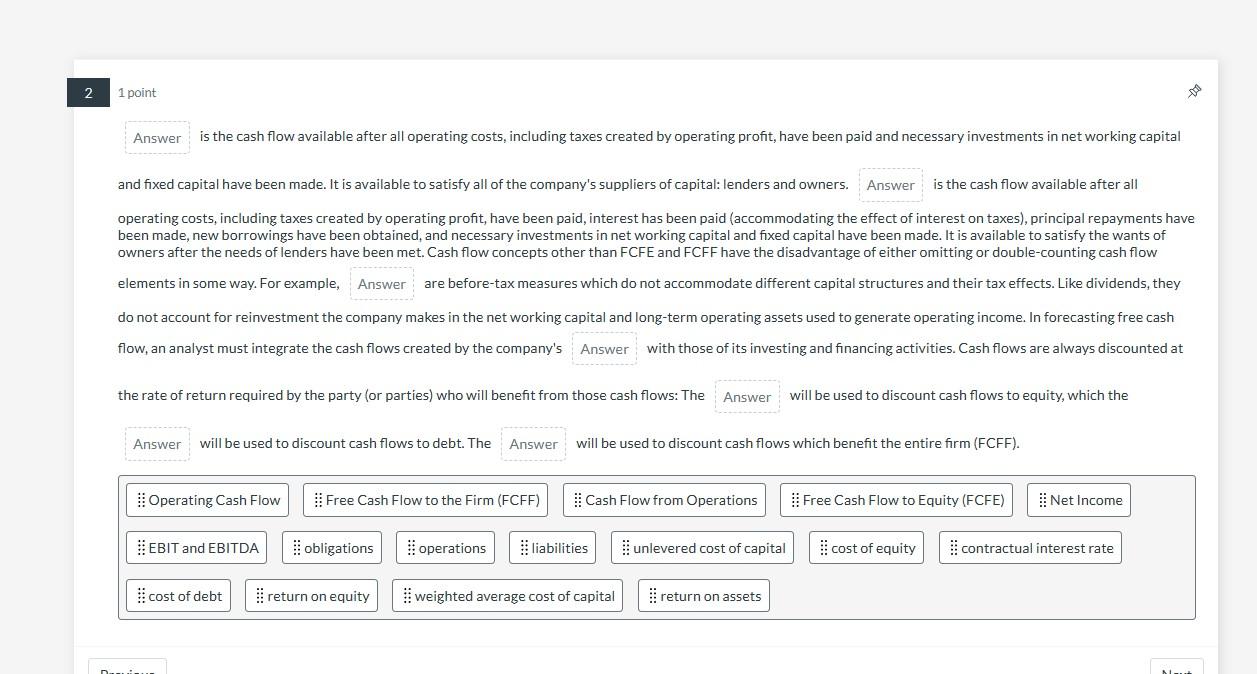

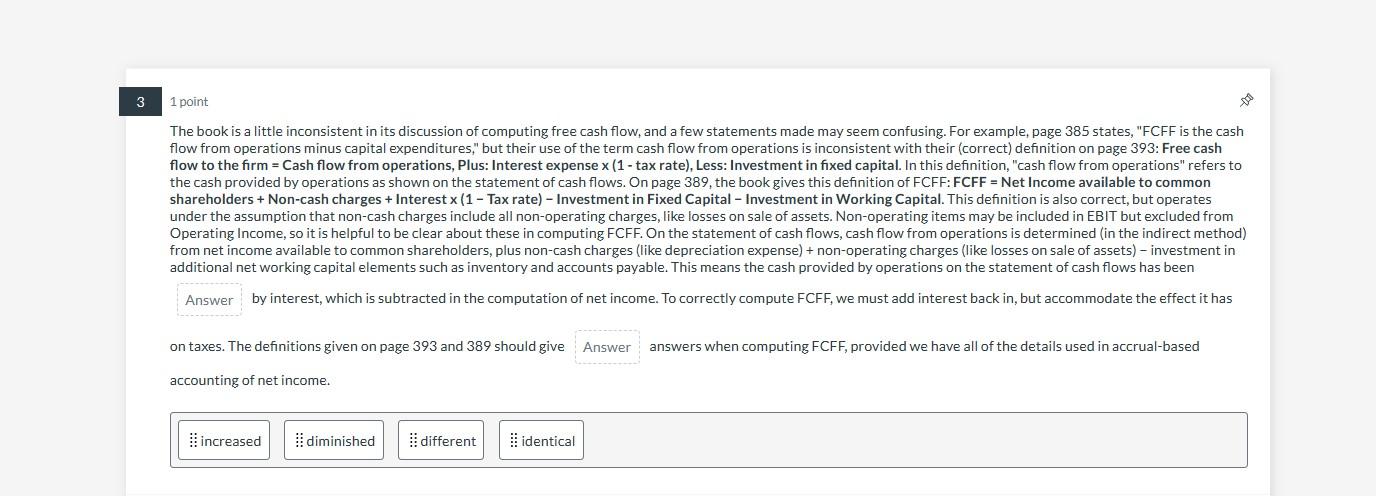

Chapter 8 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point Discounted cash flow valuation views the of a security as the of its expected future cash flows. are the cash flows actually distributed to stockholders, while are the cash flows available for distribution to shareholders. Many analysts consider to be more useful than practice. Free cash flows provide an basis for valuation. Analysts require a of free cash flows and the ability to and use financial information correctly. is the cash flow available after all operating costs, including taxes created by operating profit, have been paid and necessary investments in net working capital and fixed capital have been made. It is available to satisfy all of the company's suppliers of capital: lenders and owners. is the cash flow available after all operating costs, including taxes created by operating profit, have been paid, interest has been paid (accommodating the effect of interest on taxes), principal repayments have been made, new borrowings have been obtained, and necessary investments in net working capital and fixed capital have been made. It is available to satisfy the wants of owners after the needs of lenders have been met. Cash flow concepts other than FCFE and FCFF have the disadvantage of either omitting or double-counting cash flow elements in some way. For example, are before-tax measures which do not accommodate different capital structures and their tax effects. Like dividends, they do not account for reinvestment the company makes in the net working capital and long-term operating assets used to generate operating income. In forecasting free cash flow, an analyst must integrate the cash flows created by the company's with those of its investing and financing activities. Cash flows are always discounted at the rate of return required by the party (or parties) who will benefit from those cash flows: The will be used to discount cash flows to equity, which the will be used to discount cash flows to debt. The will be used to discount cash flows which benefit the entire firm (FCFF). The book is a little inconsistent in its discussion of computing free cash flow, and a few statements made may seem confusing. For example, page 385 states, "FCFF is the cash flow from operations minus capital expenditures," but their use of the term cash flow from operations is inconsistent with their (correct) definition on page 393 : Free cash flow to the firm = Cash flow from operations, Plus: Interest expense x ( 1 - tax rate), Less: Investment in fixed capital. In this definition, "cash flow from operations" refers to the cash provided by operations as shown on the statement of cash flows. On page 389 , the book gives this definition of FCFF: FCFF = Net Income available to common shareholders + Non-cash charges + Interest x ( 1 - Tax rate) - Investment in Fixed Capital - Investment in Working Capital. This definition is also correct, but operates under the assumption that non-cash charges include all non-operating charges, like losses on sale of assets. Non-operating items may be included in EBIT but excluded from Operating Income, so it is helpful to be clear about these in computing FCFF. On the statement of cash flows, cash flow from operations is determined (in the indirect method) from net income available to common shareholders, plus non-cash charges (like depreciation expense) + non-operating charges (like losses on sale of assets) - investment in additional net working capital elements such as inventory and accounts payable. This means the cash provided by operations on the statement of cash flows has been by interest, which is subtracted in the computation of net income. To correctly compute FCFF, we must add interest back in, but accommodate the effect it has on taxes. The definitions given on page 393 and 389 should give answers when computing FCFF, provided we have all of the details used in accrual-based accounting of net income. Chapter 8 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point Discounted cash flow valuation views the of a security as the of its expected future cash flows. are the cash flows actually distributed to stockholders, while are the cash flows available for distribution to shareholders. Many analysts consider to be more useful than practice. Free cash flows provide an basis for valuation. Analysts require a of free cash flows and the ability to and use financial information correctly. is the cash flow available after all operating costs, including taxes created by operating profit, have been paid and necessary investments in net working capital and fixed capital have been made. It is available to satisfy all of the company's suppliers of capital: lenders and owners. is the cash flow available after all operating costs, including taxes created by operating profit, have been paid, interest has been paid (accommodating the effect of interest on taxes), principal repayments have been made, new borrowings have been obtained, and necessary investments in net working capital and fixed capital have been made. It is available to satisfy the wants of owners after the needs of lenders have been met. Cash flow concepts other than FCFE and FCFF have the disadvantage of either omitting or double-counting cash flow elements in some way. For example, are before-tax measures which do not accommodate different capital structures and their tax effects. Like dividends, they do not account for reinvestment the company makes in the net working capital and long-term operating assets used to generate operating income. In forecasting free cash flow, an analyst must integrate the cash flows created by the company's with those of its investing and financing activities. Cash flows are always discounted at the rate of return required by the party (or parties) who will benefit from those cash flows: The will be used to discount cash flows to equity, which the will be used to discount cash flows to debt. The will be used to discount cash flows which benefit the entire firm (FCFF). The book is a little inconsistent in its discussion of computing free cash flow, and a few statements made may seem confusing. For example, page 385 states, "FCFF is the cash flow from operations minus capital expenditures," but their use of the term cash flow from operations is inconsistent with their (correct) definition on page 393 : Free cash flow to the firm = Cash flow from operations, Plus: Interest expense x ( 1 - tax rate), Less: Investment in fixed capital. In this definition, "cash flow from operations" refers to the cash provided by operations as shown on the statement of cash flows. On page 389 , the book gives this definition of FCFF: FCFF = Net Income available to common shareholders + Non-cash charges + Interest x ( 1 - Tax rate) - Investment in Fixed Capital - Investment in Working Capital. This definition is also correct, but operates under the assumption that non-cash charges include all non-operating charges, like losses on sale of assets. Non-operating items may be included in EBIT but excluded from Operating Income, so it is helpful to be clear about these in computing FCFF. On the statement of cash flows, cash flow from operations is determined (in the indirect method) from net income available to common shareholders, plus non-cash charges (like depreciation expense) + non-operating charges (like losses on sale of assets) - investment in additional net working capital elements such as inventory and accounts payable. This means the cash provided by operations on the statement of cash flows has been by interest, which is subtracted in the computation of net income. To correctly compute FCFF, we must add interest back in, but accommodate the effect it has on taxes. The definitions given on page 393 and 389 should give answers when computing FCFF, provided we have all of the details used in accrual-based accounting of net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts