Question: heelp please Chapter 5 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you

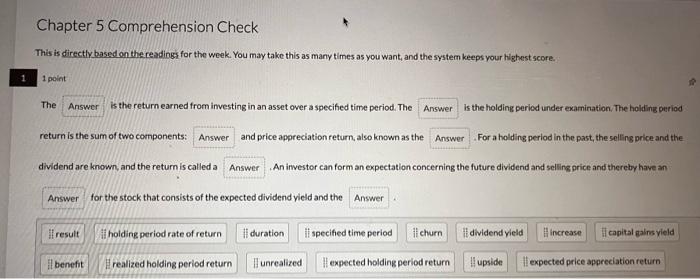

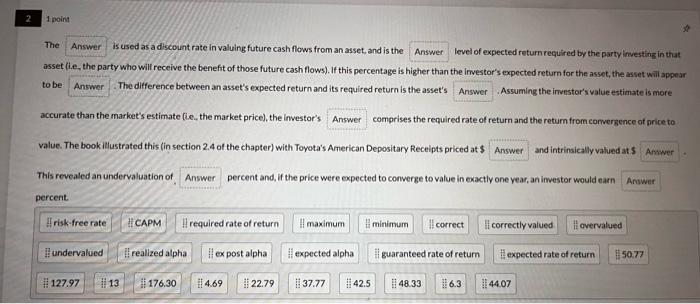

Chapter 5 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point The is the return earned from investing in an asset over a specified time period. The return is the sum of two components: dividend are known, and the return is called a price appreciation return, also known as the . An investor can form an expectation conceriod under perioding in the past, the selling price and the the future dividend and selling price and thereby have an for the stock that consists of the expected dividend yield and the The is used as a discount rate in valuing future cash flows from an asset, and is the level of expected return required by the party investing in that asset (ie. the party who will receive the benefit of those future cash flows). If this percentage is higher than the irvestor's expected return for the assot, the asset will appear to be The difference between an asset's expected return and its required return is the asset's Assuming the investor's value estimate is more accurate than the market's estimate (lic. the market price), the inwestor's comprises the required rate of return and the retum from comversence of price to value. The bookillustrated this (in section 2.4 of the chapter) with Toyota's American Depositary Receipts priced ats and intrinsically vahued at 5 This revealed an undervaluation of. percent and, if the price were expected to converge to value in exactly one year, an investor would earn percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts