Question: can you answer these questions for me please? Chapter 9 Comprehension Check This is directly based on the readings for the week. You may take

can you answer these questions for me please?

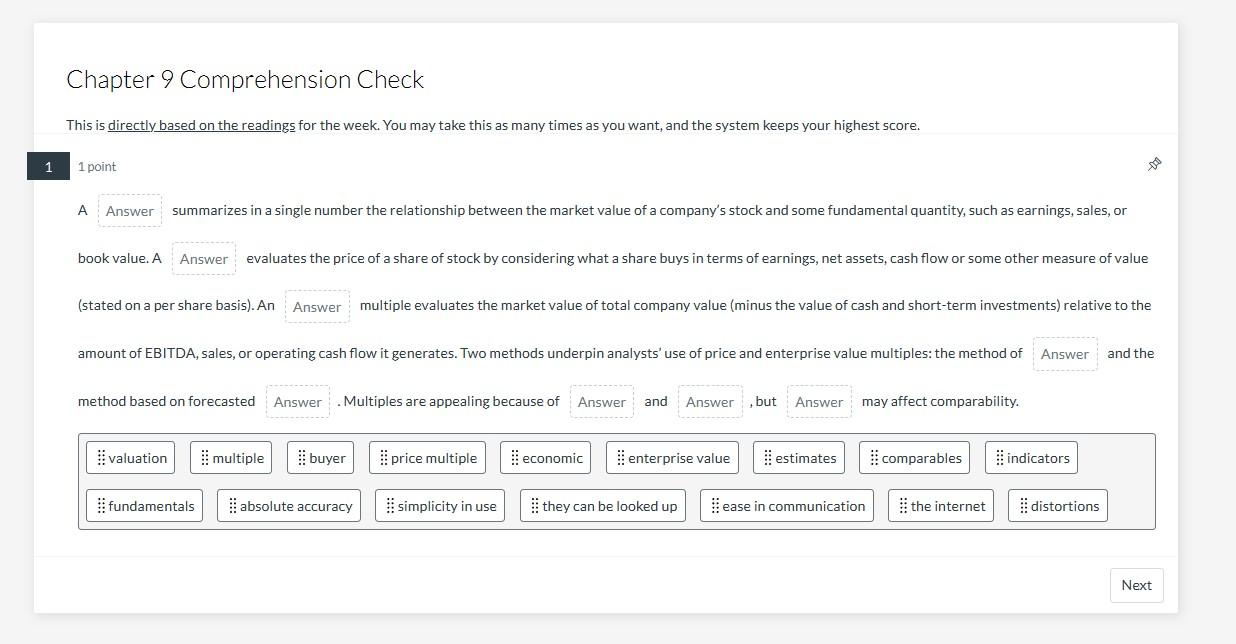

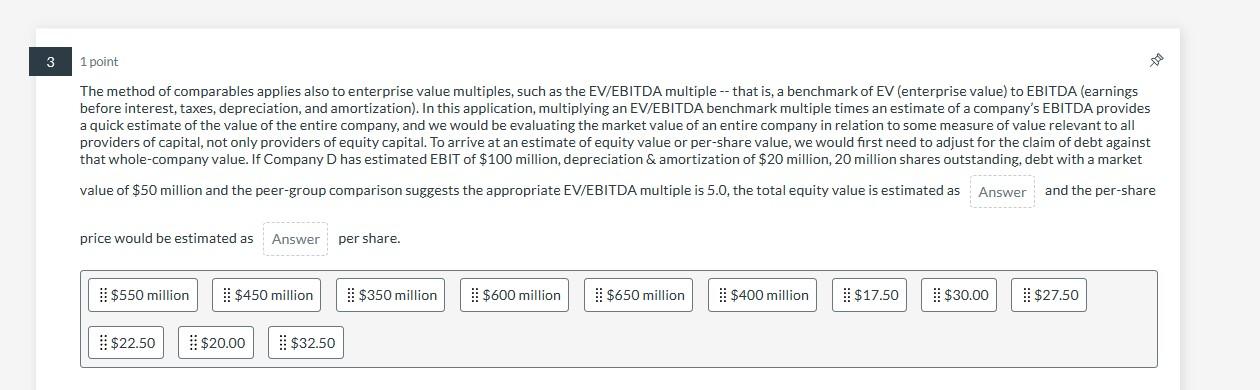

Chapter 9 Comprehension Check This is directly based on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point A summarizes in a single number the relationship between the market value of a company's stock and some fundamental quantity, such as earnings, sales, or book value. A evaluates the price of a share of stock by considering what a share buys in terms of earnings, net assets, cash flow or some other measure of value (stated on a per share basis). An multiple evaluates the market value of total company value (minus the value of cash and short-term investments) relative to the amount of EBITDA, sales, or operating cash flow it generates. Two methods underpin analysts' use of price and enterprise value multiples: the method of and the method based on forecasted Multiples are appealing because of and , but may affect comparability. The method of comparables applies also to enterprise value multiples, such as the EV/EBITDA multiple -- that is, a benchmark of EV (enterprise value) to EBITDA (earnings before interest, taxes, depreciation, and amortization). In this application, multiplying an EV/EBITDA benchmark multiple times an estimate of a company's EBITDA provides a quick estimate of the value of the entire company, and we would be evaluating the market value of an entire company in relation to some measure of value relevant to all providers of capital, not only providers of equity capital. To arrive at an estimate of equity value or per-share value, we would first need to adjust for the claim of debt against that whole-company value. If Company D has estimated EBIT of $100 million, depreciation \& amortization of $20 million, 20 million shares outstanding, debt with a market value of $50 million and the peer-group comparison suggests the appropriate EV/EBITDA multiple is 5.0, the total equity value is estimated as price would be estimated as per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts