Question: Can you please answer Question 2 from the case study using the triangular figure 8.1 illustrated. Chapter 7 was concemed with competitive strategy - the

Can you please answer Question 2 from the case study using the triangular figure 8.1 illustrated.

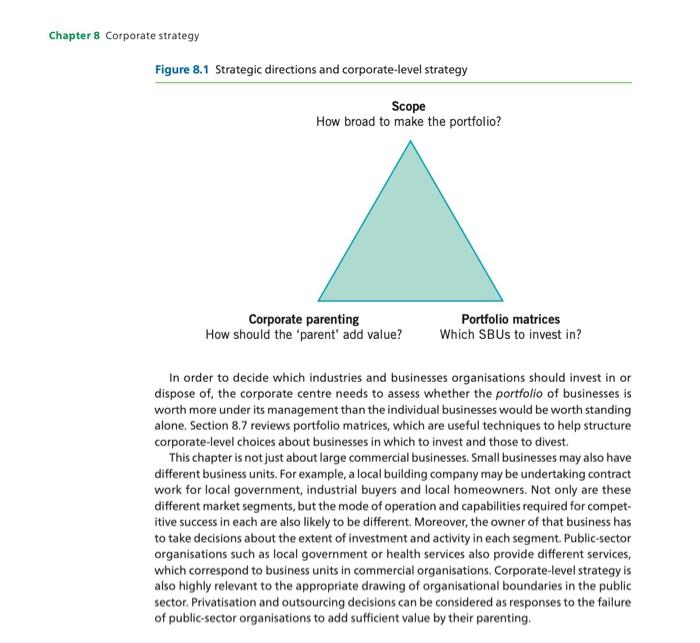

Chapter 7 was concemed with competitive strategy - the ways in which a single business unit. or organisational unit can compete in a given market space, for instance through cost leadership or differentiation. However organisations may choose to enter many new product and market areas (see Figure Pll.1 in Part II introduction). For example Tata Group, one of India's largest companies, began as a trading organisation and soon moved into hotels and textiles. Since that time Tata has diversified further into steel, motors, consultancy, technologies, tea, chemicals, power, communications. As organisations add new units and capabilities, their strategies may no longer be solely concerned with competitive strategy in one market space at the business level, but with choices concerning different businesses or markets. Corporate strategy is about the overall scope of the organisation and how value is added to the constituent businesses of the organisation as a whole. Choices about business areas, indus. tries and geographies to be active in will determine the direction(s) an organisation might pursue for growth, which business unit(s) to buy and dispose of, and how resources may be allocated efficiently across multiple business activities. For Tata, the corporate strategy questions are whether it should enter any more industries, whether it should exit some, and how far it should integrate the businesses it retains. For large public-sector organisations and charities these choices also have to be made. These choices, indicated in Figure 8.1, inform decisions about how broad an organisation should be. This 'scope' of an organisation is central to corporate strategy and the focus of this chapter. Scope is concerned with how far an organisation should be diversified in terms of two different dimensions: products and markets. As the Tata example shows, an organisation may increase its scope by engaging in industries different to its current ones. Section 8.2 introduces a classic product market framework that uses these categories for identifying different growth directions for an organisation. This indicates different diversification strategies open to an organisation, according to the novelty of products or markets. Underpinning diversiflcation choices are a range of drivers, which are discussed in Section 8.3, including increasing market power, reducing risk and exploiting superior internal processes. The performance implications of diversification are, then, reviewed in Section 8.4. Another way of increasing the scope of an organisation is vertical integration, discussed in Section 8.5. It allows an organisation to act as an internal supplier or a customer to itself (as for example an oil company supplies its petrol to its own petrol stations). Alternatively the organisation may decide to outsource certain activities - to "dis-integrate' by subcontracting an internal activity to an external supplier - or divest as both may improve organisational focus and efficiency. The scope of the organisation may therefore be adjusted through growth or contraction. Diversified corporations that operate in different areas of activity will have multiple SBUs (strategic business units) with their own strategies for their specific markets. They can be held accountable for their success or failure. Nevertheless, corporate head office, the 'corporate level', needs to select an appropriate portfolio of individual SBUs and manage them by establishing their boundaries, perhaps by market, geography or capability, so they add value to the group. t The value-adding effect of head office to individual SBUs that make up the organisation's portfolio is termed parenting advantage (see Section 8.6). Their ability to do this effectively may give them a competitive advantage over other corporate parents in acquiring and managing different businesses. The importance of parenting is underlined by a recent study that found a SBU's corporate parent accounts for more financial performance than the industry in which the 5BU competes. 2 But just how do corporate-level activities, decisions and resources add value to businesses? As will be seen at the end of the chapter in the Thinking Differently' section, some are sceptical about headquarters' ability to add value. 237 Figure 8.1 Strategic directions and corporate-level strategy Scope How broad to make the portfolio? In order to decide which industries and businesses organisations should invest in or dispose of, the corporate centre needs to assess whether the portfolio of businesses is worth more under its management than the individual businesses would be worth standing alone. Section 8.7 reviews portfolio matrices, which are useful techniques to help structure corporate-level choices about businesses in which to invest and those to divest. This chapter is not just about large commercial businesses. Small businesses may also have different business units. For example, a local building company may be undertaking contract work for local government, industrial buyers and local homeowners. Not only are these different market segments, but the mode of operation and capabilities required for competitive success in each are also likely to be different. Moreover, the owner of that business has to take decisions about the extent of investment and activity in each segment. Public-sector organisations such as local government or health services also provide different services, which correspond to business units in commercial organisations. Corporate-level strategy is also highly relevant to the appropriate drawing of organisational boundaries in the public sector. Privatisation and outsourcing decisions can be considered as responses to the failure of public-sector organisations to add sufficient value by their parenting. Illustration 8.1 Choosing new directions at Tesco? Why has Tesco's successful growth strategy changed