Question: Can you please answer this using this logic from a similar question? a. When you write a contract, you receive the option premium. So, given

Can you please answer this using this logic from a similar question?

Can you please answer this using this logic from a similar question?

a.

When you write a contract, you receive the option premium. So, given 100 shares per contract:

Premium received = $2.40(80)(100) = $19,200

| At $98.00: | Payoff per share = MIN[$98.00 100, 0] = $2.00 |

| Terminal value = $2.00(80)(100) = $16,000 | |

| Net gain = $19,200 16,000 = $3,200 | |

| At $112: | Payoff per share = MIN[$112 100, 0] = $0 |

| Terminal value = $0(80)(100) = $0 | |

| Net gain = $19,200 0 = $19,200 |

b.

The break-even stock price when you write a put option is:

Break-even stock price = Exercise price Option premium = $100 2.40 = $97.60

The writer of a put option has a net gain when the stock price exceeds the break-even price. The maximum amount a put writer can earn is the initial premium received, which occurs when the put finishes out-of-the-money.

Next Visit question map

Question19of20Total19 of

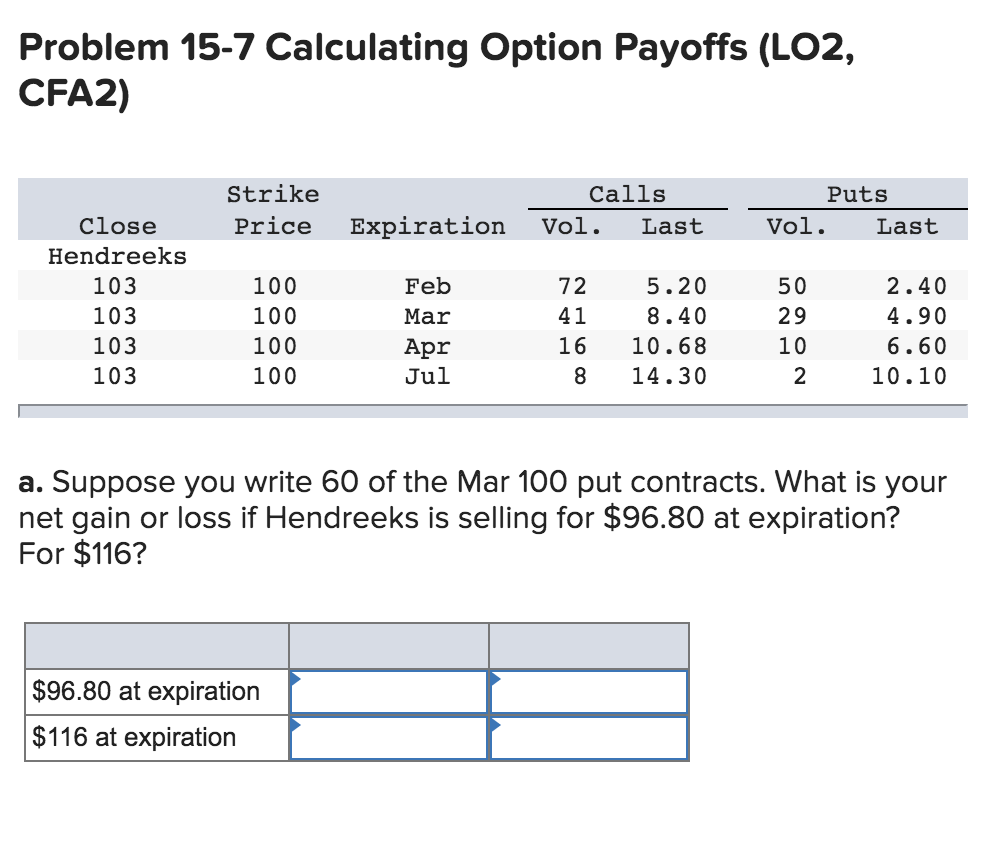

Problem 15-7 Calculating Option Payoffs (LO2, CFA2) Calls Strike Puts Vol. Last Price Expiration Vol. Last Close Hendreeks 103 103 103 103 100 100 100 100 72 41 5.20 8.40 16 10.68 8 14.30 2.40 4.90 Feb Mar Apr Jul 29 10 2 10.10 a. Suppose you write 60 of the Mar 100 put contracts. What is your net gain or loss if Hendreeks is selling for $96.80 at expiration? For $116? $96.80 at expiration $116 at expiration b. What is the break-even price, that is, the terminal stock price that results in a zero profit? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Break-even price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts