Question: Can you Please explain me this Problem? Thanks! It is a complete question 5. Dividends received from a Canadian public corporation $900. 6. Loss on

Can you Please explain me this Problem? Thanks!

It is a complete question

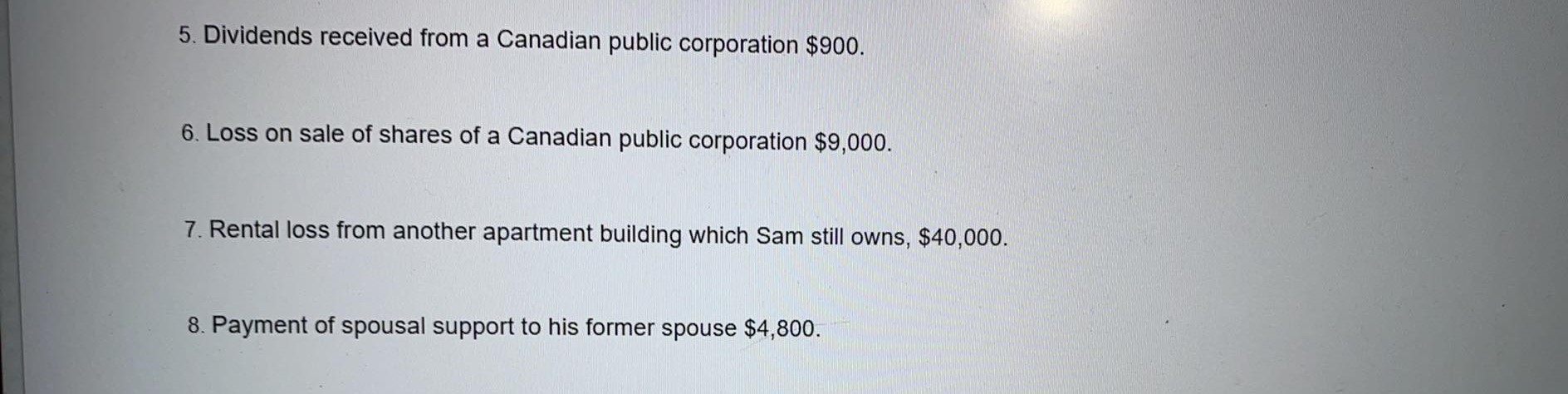

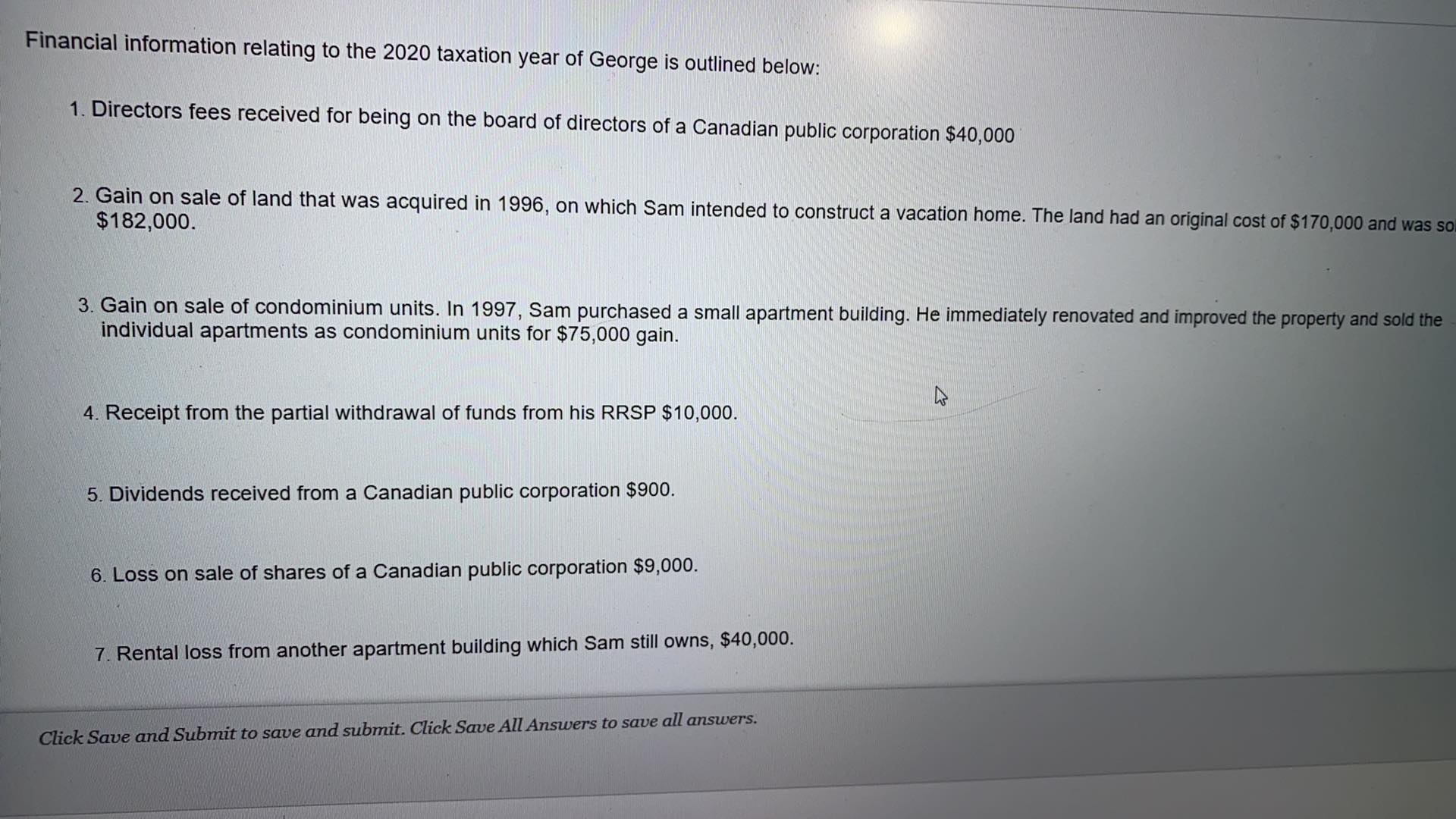

5. Dividends received from a Canadian public corporation $900. 6. Loss on sale of shares of a Canadian public corporation $9,000. 7. Rental loss from another apartment building which Sam still owns, $40,000. 8. Payment of spousal support to his former spouse $4,800.Financial information relating to the 2020 taxation year of George is outlined below: 1. Directors fees received for being on the board of directors of a Canadian public corporation $40,000 2. Gain on sale of land that was acquired in 1996, on which Sam intended to construct a vacation home. The land had an original cost of $170,000 and was so $182,000. 3. Gain on sale of condominium units. In 1997, Sam purchased a small apartment building. He immediately renovated and improved the property and sold the individual apartments as condominium units for $75,000 gain. 4. Receipt from the partial withdrawal of funds from his RRSP $10,000. 5. Dividends received from a Canadian public corporation $900. 6. Loss on sale of shares of a Canadian public corporation $9,000. 7. Rental loss from another apartment building which Sam still owns, $40,000. Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts