Question: can you please show me how this problem will laid out and reference every cells answer. thank you A B C G . 1 Non-Cash

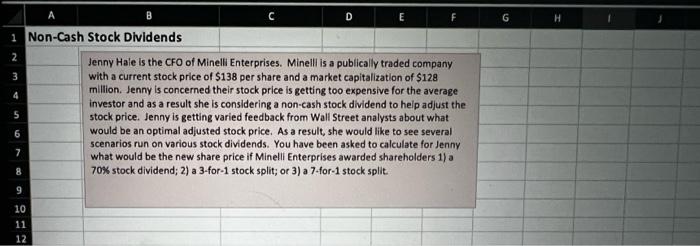

A B C G . 1 Non-Cash Stock Dividends 2 Jenny Hale is the CFO of Minelli Enterprises. Minelli is a publically traded company with a current stock price of $138 per share and a market capitalization of $128 million. Jenny is concerned their stock price is getting too expensive for the average investor and as a result she is considering a non-cash stock dividend to help adjust the stock price. Jenny is getting varied feedback from Wall Street analysts about what would be an optimal adjusted stock price. As a result, she would like to see several scenarios run on various stock dividends. You have been asked to calculate for Jenny 7 what would be the new share price if Minelli Enterprises awarded shareholders 1) a 70% stock dividend; 2) a 3-for-1 stock split; or 3) a 7-for-1 stock split. 6 8 9 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts