Question: can you please show me how this problem will laid out and reference every cells answer. thank you D M 3 4 1 Time Value

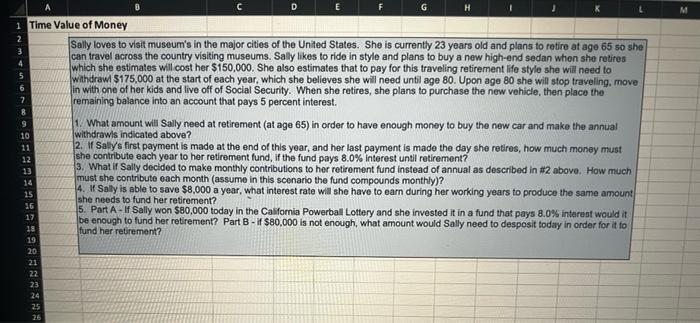

D M 3 4 1 Time Value of Money 2 Sally loves to visit museum's in the major cities of the United States. She is currently 23 years old and plans to retire at age 65 so she can travel across the country visiting museums. Sally likes to ride in style and plans to buy a new high-end sedan when she retires which she estimates will cost her $150,000. She also estimates that to pay for this traveling retirement life style she will need to 5 withdrawl $175,000 at the start of each year, which she believes she will need until age 80. Upon age 80 she will stop traveling, move in with one of her kids and live off of Social Security. When she retires, she plans to purchase the new vehicle, then place the 7 remaining balance into an account that pays 5 percent interest. 8 9 What amount will Sally need at retirement (at age 65) in order to have enough money to buy the new car and make the annual 10 withdrawls indicated above? 11 2. M Salys first payment is made at the end of this year, and her last payment is made the day she retires, how much money must 12 she contributo each year to her retirement fund, if the fund pays 8.0% Interest until retirement? 3. What if Sally decided to make monthly contributions to her retirement fund instead of annual as described in #2 above. How much must she contribute each month (assume in this scenario the fund compounds monthly)? 4. 1 Sally is able to save $8,000 a year, what interest rate will she have to earn during her working years to produce the same amount 25 she needs to fund her retirement? 5. Part A - Sally won $80,000 today in the California Powerball Lottery and she invested it in a fund that pays 8.0% interest would it be enough to fund her retirement? Part B - 1 $80,000 is not enough, what amount would Sally need to desposit today in order for it to fund her retirement? 13 14 16 17 18 19 20 21 22 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts