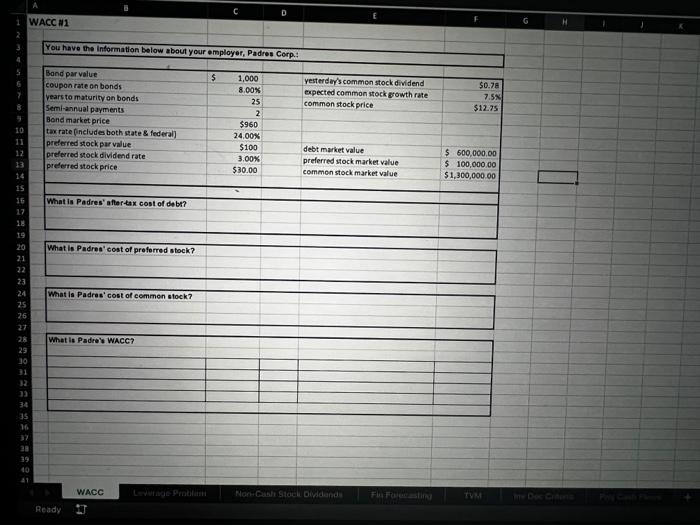

Question: can you please show me how this problem will laid out and reference every cells answer. thank you D WACC N1 You have the information

D WACC N1 You have the information below about your employer, Padres Corp.: $ $0.78 yesterday's common stock dividend expected common stock growth rate common stock price 7.5 $12.75 Band par value coupon rate on bonds Vears to maturity on bonds Semi-annual payments Band market price tax rate includes both state & federal preferred stock par value preferred stock dividend rate preferred stock price 1,000 8.00% 25 2 $960 24.00% $100 3.00% $30.00 10 12 13 debt market value preferred stock market value common stock market value $ 600,000.00 $ 100,000.00 $1,300,000.00 What is Padres' after-tax cost of debt? What is Padres cost of preferred stock? 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 10 What is Padres cost of common stock? What is Padre's WACC? 33 34 35 16 38 10 21 WACC Non-Cash Stock Dividonda TYM Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts