Question: can you please show me how this problem will laid out and reference every cells answer. thank you H K D E 1 Investment Decision

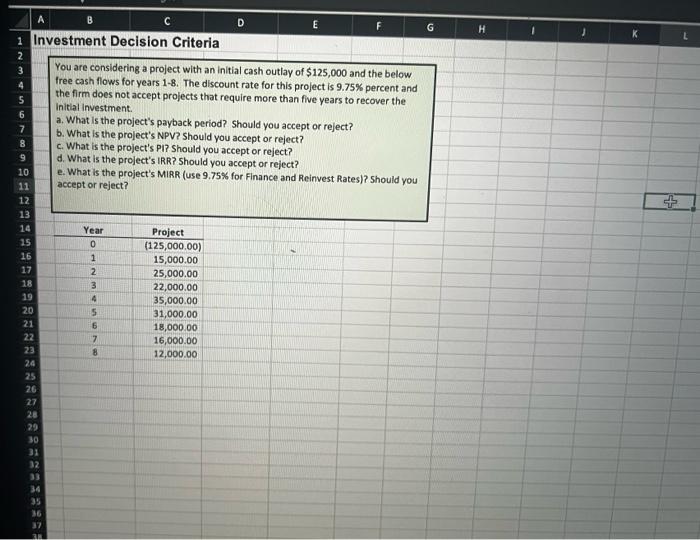

H K D E 1 Investment Decision Criteria 2 3 You are considering a project with an initial cash outlay of $125,000 and the below 4 free cash flows for years 1-8. The discount rate for this project is 9.75% percent and the firm does not accept projects that require more than five years to recover the 5 Initial Investment 6 a. What is the project's payback period? Should you accept or reject? 7 b. What is the project's NPV? Should you accept or reject? 8 c. What is the project's PI? Should you accept or reject? 9 d. What is the project's IRR? Should you accept or reject? 10 e. What is the project's MIRR (use 9.75% for Finance and Reinvest Rates)? Should you 11 accept or reject? 12 13 14 Year Project 15 (125,000.00) 16 15,000.00 17 25,000.00 18 22,000.00 19 4 35,000.00 20 31,000.00 21 18,000.00 22 16,000.00 23 12,000.00 24 25 26 27 28 29 30 31 32 33 34 35 36 17 1 2 ONMN 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts