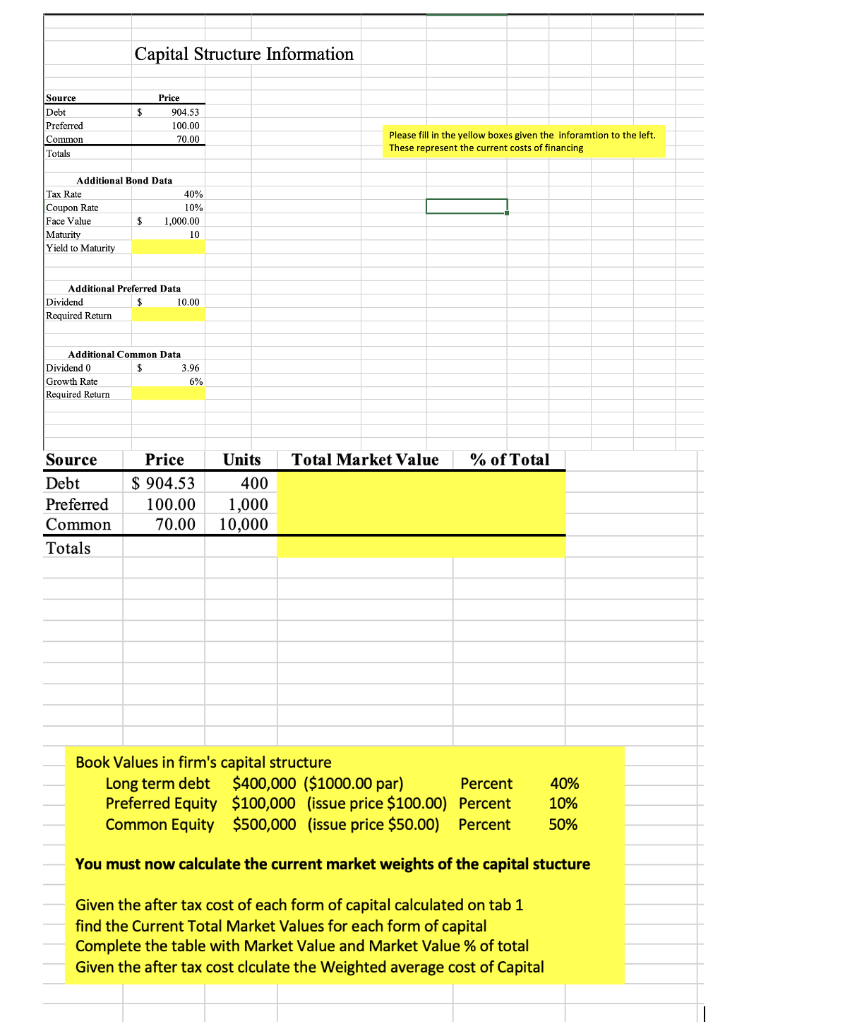

Question: Capital Structure Information $ Source Debt Preferred Common Totals Price 904.53 100.00 70.00 Please fill in the yellow boxes given the inforamtion to the left.

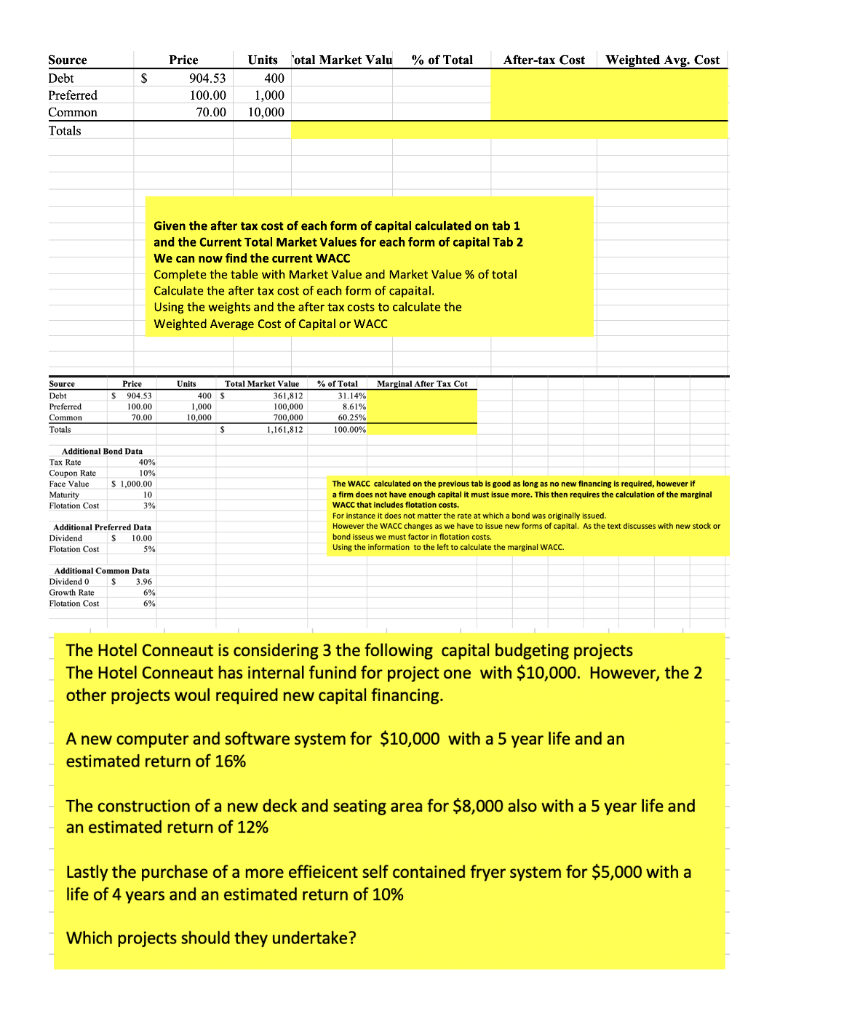

Capital Structure Information $ Source Debt Preferred Common Totals Price 904.53 100.00 70.00 Please fill in the yellow boxes given the inforamtion to the left. These represent the current costs of financing Additional Bond Data Tax Rate 40% Coupon Rate 10% Face Value $ 1,000.00 Maturity 10 Yield to Maturity Additional Preferred Data Dividend 10.00 Required Return Additional Common Data Dividend 0 $ 3.96 Growth Rate 6% Required Return Total Market Value % of Total Source Debt Preferred Common Totals Price $ 904.53 100.00 70.00 Units 400 1,000 10,000 Book Values in firm's capital structure Long term debt $400,000 ($1000.00 par) Percent Preferred Equity $100,000 (issue price $100.00) Percent Common Equity $500,000 (issue price $50.00) Percent 40% 10% 50% You must now calculate the current market weights of the capital stucture Given the after tax cost of each form of capital calculated on tab 1 find the Current Total Market Values for each form of capital Complete the table with Market Value and Market Value % of total Given the after tax cost clculate the Weighted average cost of Capital % of Total After-tax Cost Weighted Avg. Cost S Source Debt Preferred Common Totals Price 904.53 100.00 70.00 Unitsotal Market Valu 400 1,000 10,000 Given the after tax cost of each form of capital calculated on tab 1 and the Current Total Market Values for each form of capital Tab 2 We can now find the current WACC Complete the table with Market value and Market Value % of total Calculate the after tax cost of each form of capaital. Using the weights and the after tax costs to calculate the Weighted Average Cost of Capital or WACC Marginal After Tax Cot Source Debt Preferred Commor Totals Price $ 904.53 100.00 70.00 Units Total Market Value 400 $ 361,812 1.000 100,000 10,000 700,000 $ 1.161,812 % of Total 31.14% 8,61% 60.25% 100.00% Additional Bend Data Tax Rate 40% Coupon Rate 10% Face Value $ 1.000.00 Maturity 10 Flotation Cost 39 The WACC calculated on the previous tab is good as long as no new financing is required, however if a firm does not have enough capital it must issue more. This then requires the calculation of the marginal WACC that includes flotation costs. For instance it does not matter the rate at which a bond was originally Issued. However the WACC changes as we have to issue new forms of capital. As the text discusses with new stock or bondisseus we must factor in flotation costs. Using the information to the left to calculate the marginal WACC. Additional Preferred Data Dividend $ 10.00 Flotation Cost 5% Additional Common Data Dividendo $ 3.96 Growth Rate 6% Flotation Cost 6% The Hotel Conneaut is considering 3 the following capital budgeting projects The Hotel Conneaut has internal funind for project one with $10,000. However, the 2 other projects woul required new capital financing. A new computer and software system for $10,000 with a 5 year life and an estimated return of 16% The construction of a new deck and seating area for $8,000 also with a 5 year life and an estimated return of 12% Lastly the purchase of a more effieicent self contained fryer system for $5,000 with a life of 4 years and an estimated return of 10% Which projects should they undertake? Capital Structure Information $ Source Debt Preferred Common Totals Price 904.53 100.00 70.00 Please fill in the yellow boxes given the inforamtion to the left. These represent the current costs of financing Additional Bond Data Tax Rate 40% Coupon Rate 10% Face Value $ 1,000.00 Maturity 10 Yield to Maturity Additional Preferred Data Dividend 10.00 Required Return Additional Common Data Dividend 0 $ 3.96 Growth Rate 6% Required Return Total Market Value % of Total Source Debt Preferred Common Totals Price $ 904.53 100.00 70.00 Units 400 1,000 10,000 Book Values in firm's capital structure Long term debt $400,000 ($1000.00 par) Percent Preferred Equity $100,000 (issue price $100.00) Percent Common Equity $500,000 (issue price $50.00) Percent 40% 10% 50% You must now calculate the current market weights of the capital stucture Given the after tax cost of each form of capital calculated on tab 1 find the Current Total Market Values for each form of capital Complete the table with Market Value and Market Value % of total Given the after tax cost clculate the Weighted average cost of Capital % of Total After-tax Cost Weighted Avg. Cost S Source Debt Preferred Common Totals Price 904.53 100.00 70.00 Unitsotal Market Valu 400 1,000 10,000 Given the after tax cost of each form of capital calculated on tab 1 and the Current Total Market Values for each form of capital Tab 2 We can now find the current WACC Complete the table with Market value and Market Value % of total Calculate the after tax cost of each form of capaital. Using the weights and the after tax costs to calculate the Weighted Average Cost of Capital or WACC Marginal After Tax Cot Source Debt Preferred Commor Totals Price $ 904.53 100.00 70.00 Units Total Market Value 400 $ 361,812 1.000 100,000 10,000 700,000 $ 1.161,812 % of Total 31.14% 8,61% 60.25% 100.00% Additional Bend Data Tax Rate 40% Coupon Rate 10% Face Value $ 1.000.00 Maturity 10 Flotation Cost 39 The WACC calculated on the previous tab is good as long as no new financing is required, however if a firm does not have enough capital it must issue more. This then requires the calculation of the marginal WACC that includes flotation costs. For instance it does not matter the rate at which a bond was originally Issued. However the WACC changes as we have to issue new forms of capital. As the text discusses with new stock or bondisseus we must factor in flotation costs. Using the information to the left to calculate the marginal WACC. Additional Preferred Data Dividend $ 10.00 Flotation Cost 5% Additional Common Data Dividendo $ 3.96 Growth Rate 6% Flotation Cost 6% The Hotel Conneaut is considering 3 the following capital budgeting projects The Hotel Conneaut has internal funind for project one with $10,000. However, the 2 other projects woul required new capital financing. A new computer and software system for $10,000 with a 5 year life and an estimated return of 16% The construction of a new deck and seating area for $8,000 also with a 5 year life and an estimated return of 12% Lastly the purchase of a more effieicent self contained fryer system for $5,000 with a life of 4 years and an estimated return of 10% Which projects should they undertake

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts