Question: Case 2: Risk management Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in

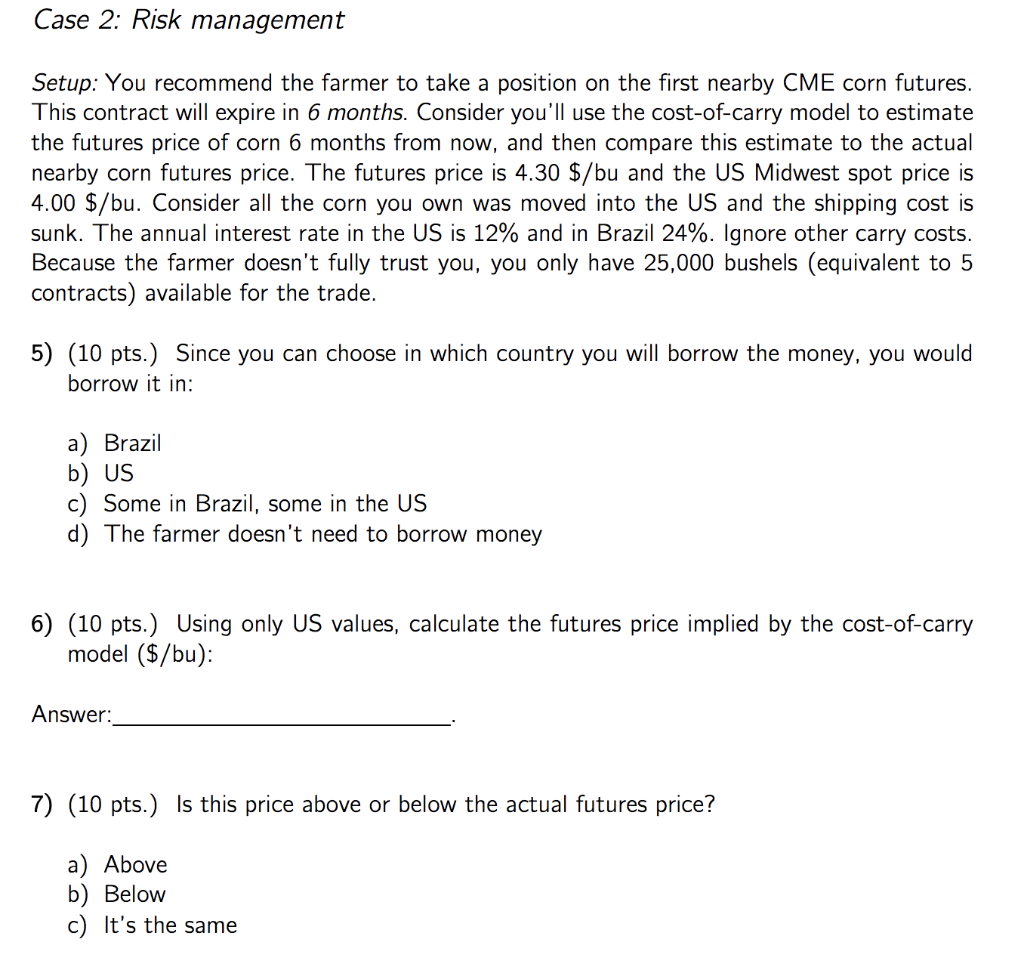

Case 2: Risk management Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in 6 months. Consider you'll use the cost-of-carry model to estimate the futures price of corn 6 months from now, and then compare this estimate to the actual nearby corn futures price. The futures price is 4.30 $/bu and the US Midwest spot price is 4.00 $/bu. Consider all the corn you own was moved into the US and the shipping cost is sunk. The annual interest rate in the US is 12% and in Brazil 24%. Ignore other carry costs. Because the farmer doesn't fully trust you, you only have 25,000 bushels (equivalent to 5 contracts) available for the trade. 5) (10 pts.) Since you can choose in which country you will borrow the money, you would borrow it in: a) Brazil b) US c) Some in Brazil, some in the US d) The farmer doesn't need to borrow money 6) (10 pts.) Using only US values, calculate the futures price implied by the cost-of-carry model ($/bu): Answer: 7) (10 pts.) Is this price above or below the actual futures price? a) Above b) Below c) It's the same Case 2: Risk management Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in 6 months. Consider you'll use the cost-of-carry model to estimate the futures price of corn 6 months from now, and then compare this estimate to the actual nearby corn futures price. The futures price is 4.30 $/bu and the US Midwest spot price is 4.00 $/bu. Consider all the corn you own was moved into the US and the shipping cost is sunk. The annual interest rate in the US is 12% and in Brazil 24%. Ignore other carry costs. Because the farmer doesn't fully trust you, you only have 25,000 bushels (equivalent to 5 contracts) available for the trade. 5) (10 pts.) Since you can choose in which country you will borrow the money, you would borrow it in: a) Brazil b) US c) Some in Brazil, some in the US d) The farmer doesn't need to borrow money 6) (10 pts.) Using only US values, calculate the futures price implied by the cost-of-carry model ($/bu): Answer: 7) (10 pts.) Is this price above or below the actual futures price? a) Above b) Below c) It's the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts