Question: Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in 6 months. Consider you'll

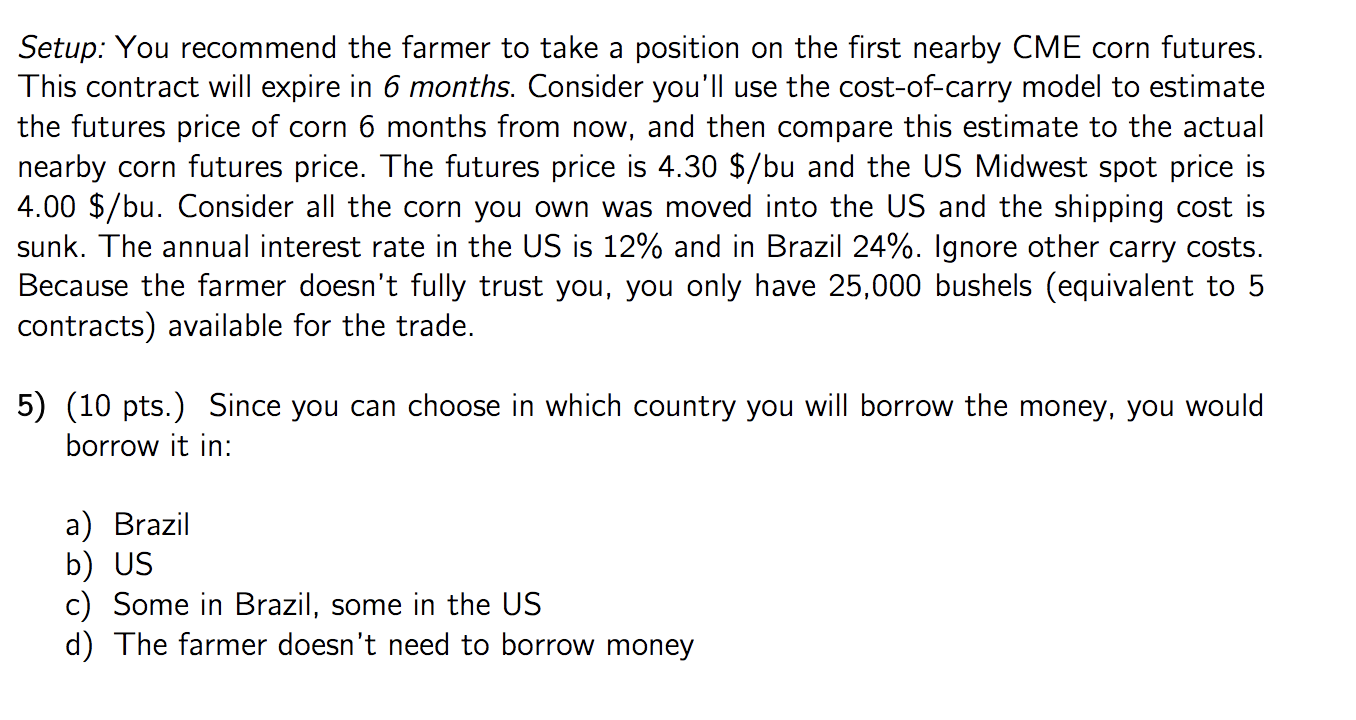

Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in 6 months. Consider you'll use the cost-of-carry model to estimate the futures price of corn 6 months from now, and then compare this estimate to the actual nearby corn futures price. The futures price is 4.30 $/bu and the US Midwest spot price is 4.00 $/bu. Consider all the corn you own was moved into the US and the shipping cost is sunk. The annual interest rate in the US is 12% and in Brazil 24%. Ignore other carry costs. Because the farmer doesn't fully trust you, you only have 25,000 bushels (equivalent to 5 contracts) available for the trade. 5) (10 pts.) Since you can choose in which country you will borrow the money, you would borrow it in: a) Brazil b) US c) Some in Brazil, some in the US d) The farmer doesn't need to borrow money Setup: You recommend the farmer to take a position on the first nearby CME corn futures. This contract will expire in 6 months. Consider you'll use the cost-of-carry model to estimate the futures price of corn 6 months from now, and then compare this estimate to the actual nearby corn futures price. The futures price is 4.30 $/bu and the US Midwest spot price is 4.00 $/bu. Consider all the corn you own was moved into the US and the shipping cost is sunk. The annual interest rate in the US is 12% and in Brazil 24%. Ignore other carry costs. Because the farmer doesn't fully trust you, you only have 25,000 bushels (equivalent to 5 contracts) available for the trade. 5) (10 pts.) Since you can choose in which country you will borrow the money, you would borrow it in: a) Brazil b) US c) Some in Brazil, some in the US d) The farmer doesn't need to borrow money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts