Question: Case Study - Business Ethics Please answer the following questions within 2 pages. No plagiarism. Introduction - what is the context or background of the

Case Study - Business Ethics Please answer the following questions within 2 pages. No plagiarism. Introduction - what is the context or background of the case? What is the key problem/pressure/issue in the case? Who are the main actors in the case? What are the main fraudulent activities in the case? What are the solutions/results in the case? Bibliography - 3-4 outsides sources suggested How could this fraud have been prevented? List as many controls as you can.

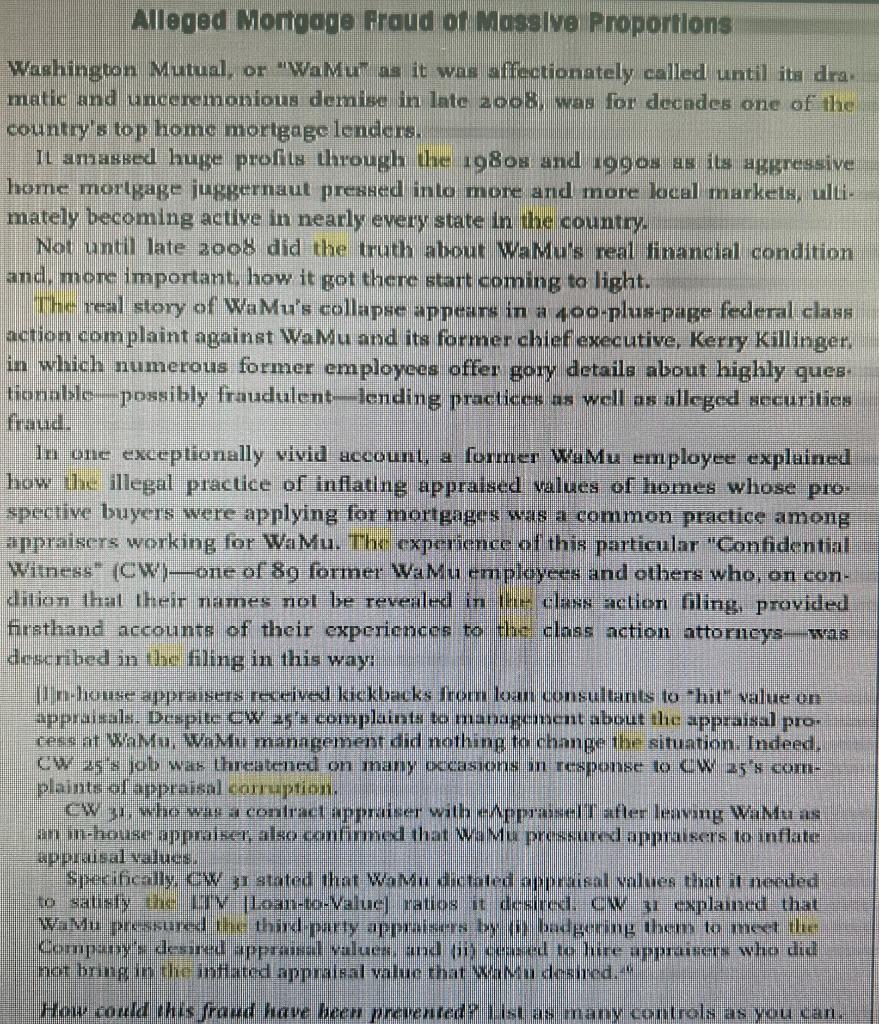

Mortgage Fraud

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts