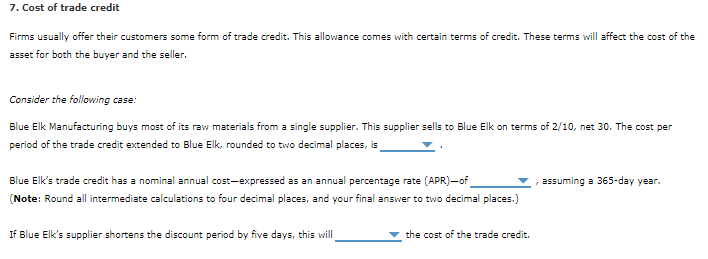

Question: CHAP 14 - Q9 DROPDOWN OPTIONS 1- 1.80% ,1.96% , 2.04% , 2.20% 2- 33.51% , 36.49% , 37.23% , 41.70% 3- increase , decrease

CHAP 14 - Q9

DROPDOWN OPTIONS

1- 1.80% ,1.96% , 2.04% , 2.20%

2- 33.51% , 36.49% , 37.23% , 41.70%

3- increase , decrease

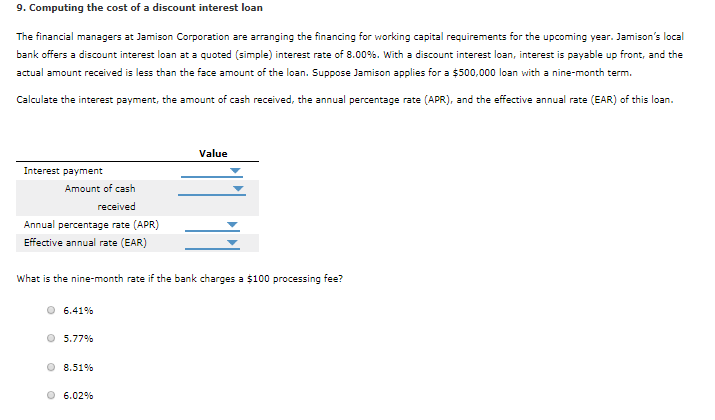

CHAP 14 - Q9

DROPDOWN OPTIONS ARE

1- 28,200 - 37,600 - 40,000 - 30,000

2- 462,400 - 460,000 - 470,000 - 500,000

3- 4.78% - 6.38% - 6.00% - 8.51%

4- 8.51% - 8.60% - 4.75% - 6.38%

7. Cost of trade credit Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit. These terms will affect the cost of the asset for both the buyer and the seller Consider the following case: Blue Elk Manufacturing buys most of its raw materials from a single supplier. This supplier sells to Blue Elk on terms of 2/10, net 30. The cost per period of the trade credit extended to Blue Elk, rounded to two decimal places, is assuming a 365-day year Blue Elk's trade credit has a nominal annual cost-expressed as an annual percentage rate (APR)-of (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) If Blue Elk's supplier shortens the discount period by five days, this will the cost of the trade credit. 9. Computing the cost of a discount interest loan The financial managers at Jamison Corporation are arranging the financing for working capital requirements for the upcoming year. Jamison's local bank offers a discount interest loan at a quoted (simple) interest rate of 8.00 % . With a discount interest loan, interest is payable up front, and the actual amount received is less than the face amount of the loan. Suppose Jamison applies for a $500,000 loan with a nine-month term. (EAR) of this loan. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate Value Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) What is the nine-month rate if the bank charges a $100 processing fee? O 6.41% 5.77% 8.51% 6.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts