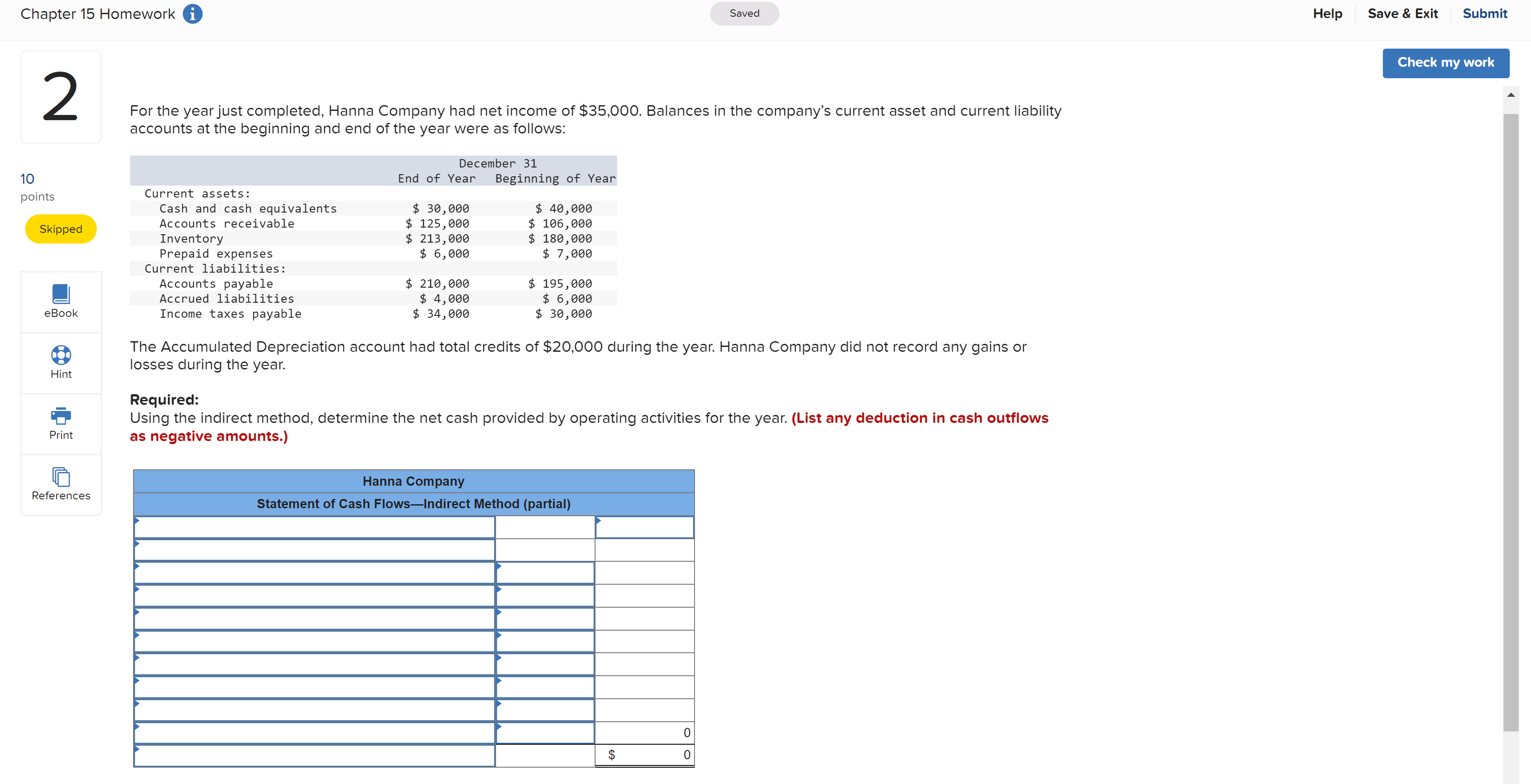

Question: Chapter 15 Homework 0 Saved Help Save& Exit Submit heck my work A For the yearjust completed, Hanna Company had net income of $35,000, Balances

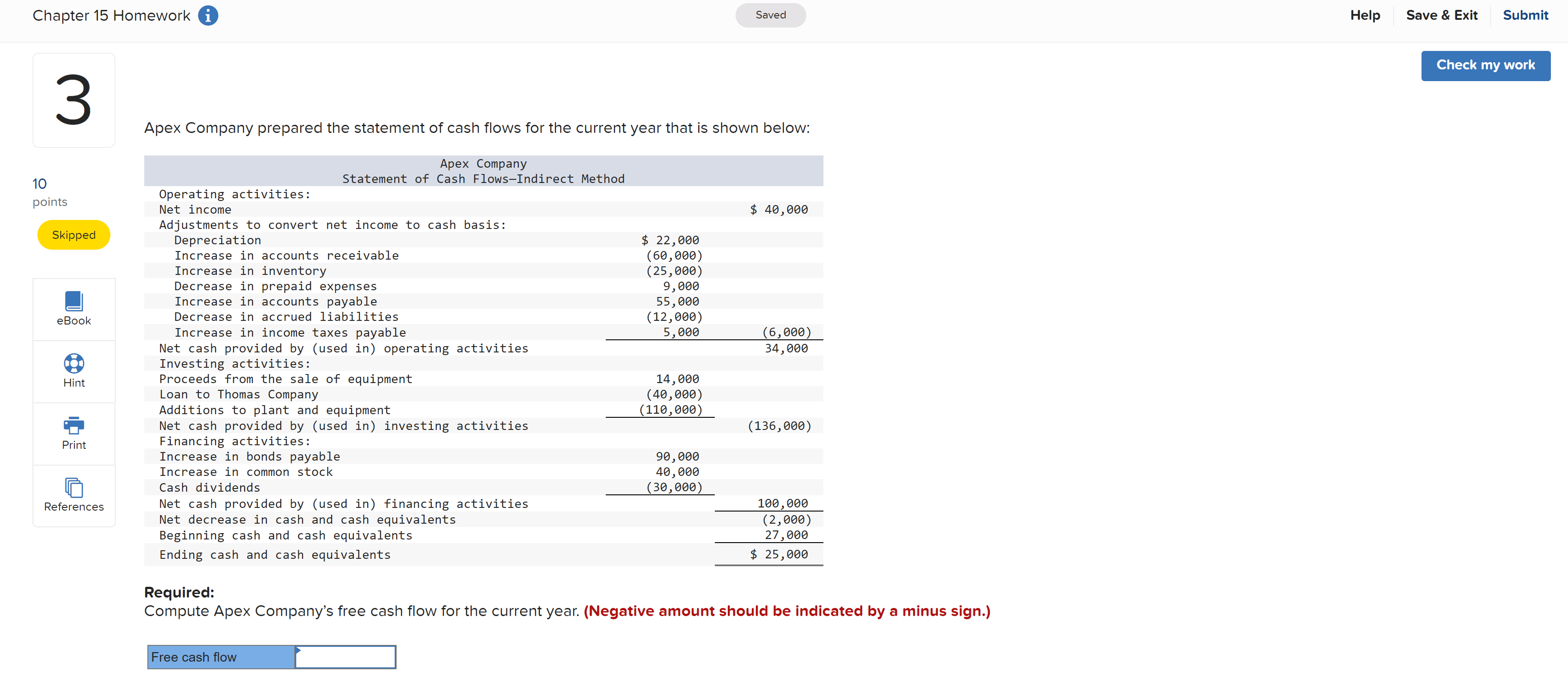

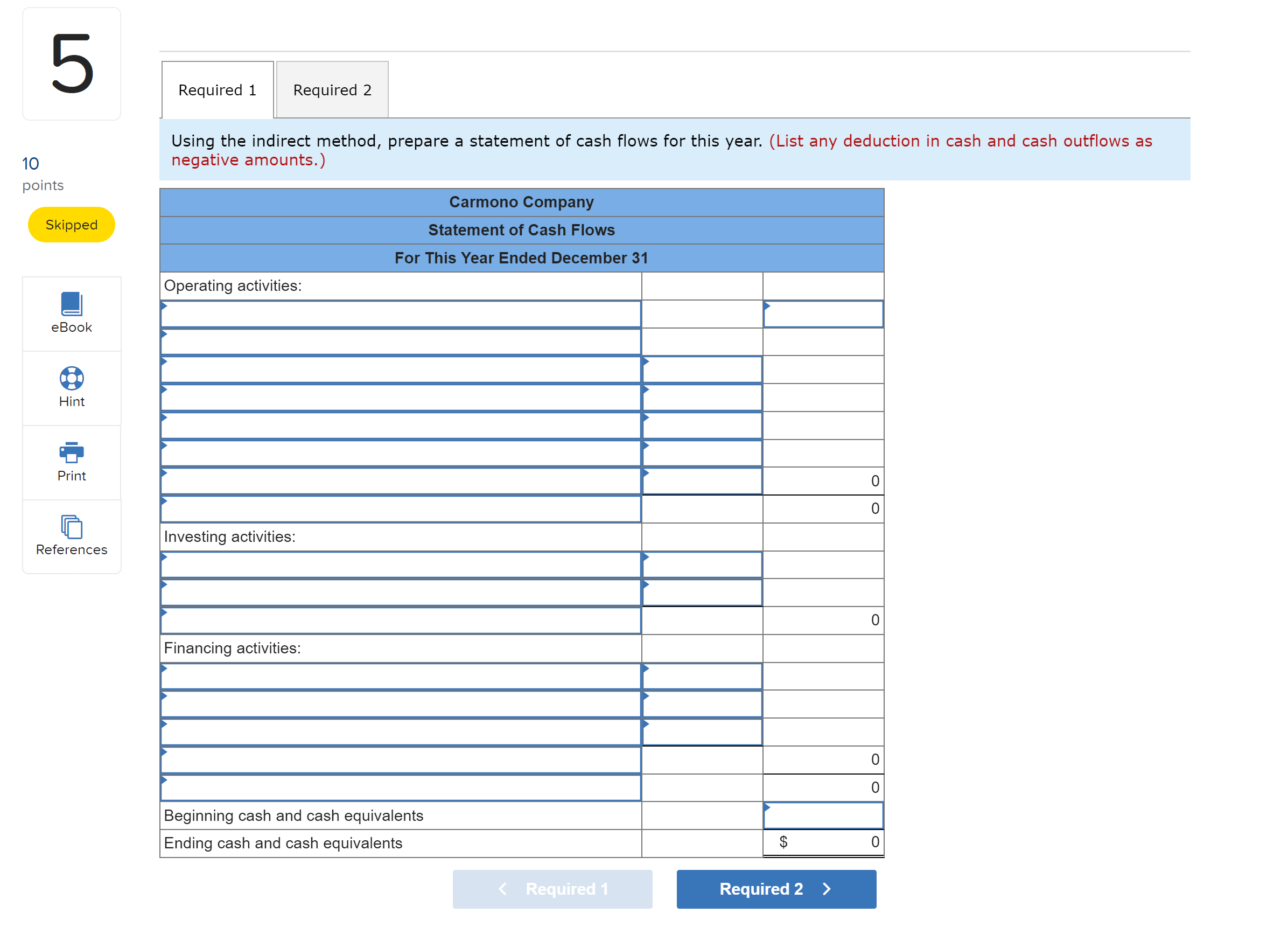

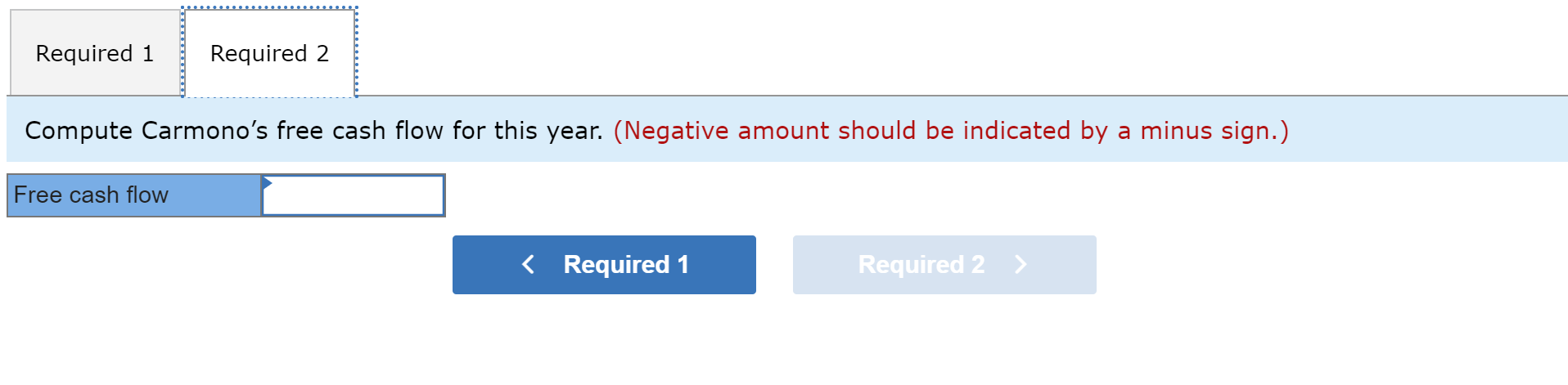

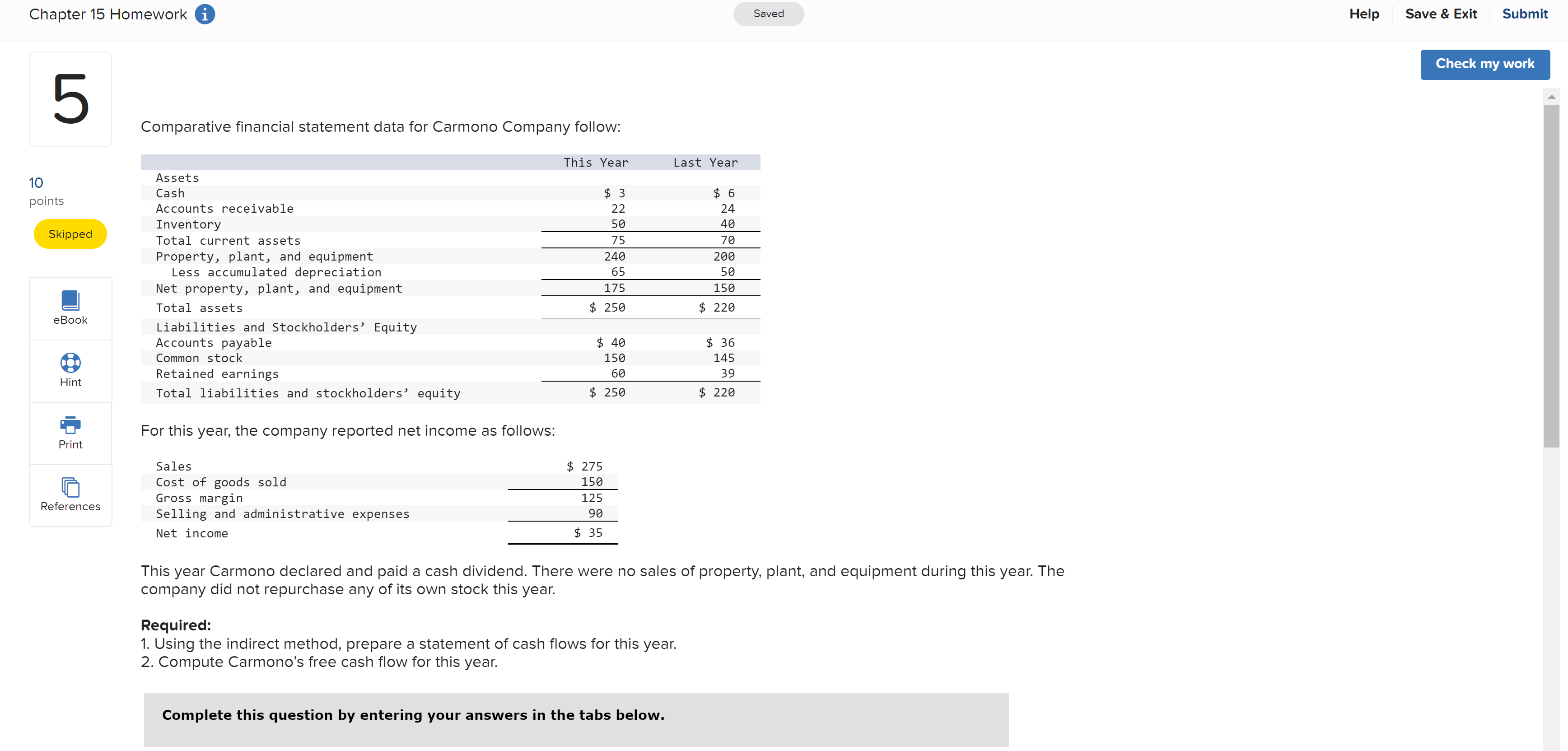

Chapter 15 Homework 0 Saved Help Save& Exit Submit heck my work A For the yearjust completed, Hanna Company had net income of $35,000, Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 10 End of Vear Beginning of Year points Current assets: Cash and cash equivalents 3 39,999 3 49,999 skipped Accounts receivable $ 125,000 $ 106,000 Inventory $ 213,000 $ 180,000 Prepaid expenses 3 6,999 3 7,999 Current liabilities: Accounts payable 5 210,000 3 195,000 El Accrued liabilities 3 4,000 $ 6,000 eBook Income taxes payable 3 34,999 $ 39,999 9 The Accumulated Depreciation account had total credits of $20,000 during the year. Hanna Company did not record any gains or , losses during the year lelt _ Required: Using the indirect method, determine the net cash provided by operating activities for the yean (List any deduction in cash outflows Print as negative amounts.) References Chapter15 Homework 0 Saved Apex Company prepared the statement of cash flows for the current year that is shown below: Apex Company 10 Statement of Cash FlowsIndirect Method Operating activities: poms Net income a; 49,999 , Adjustments to convert net income to cash basis: Sk'pped Depreciation $ 22,000 Increase in accounts receivable (60,000) Increase in inventory (25,000) Decrease in prepaid expenses 9,999 Increase in accounts payable 55,000 eEook Decrease in accrued liabilities (12,000) Increase in income taxes payable 5,000 (6,000) Net cash provided by (used in) operating activities 34,999 Investing activities: Him Proceeds from the sale of equipment 14,999 Loan to Thomas Company (40,000) _ Additions to plant and equipment (119,999) a Net cash provided by (used in) investing activities (136,000) prim Financing activities: Increase in bonds payable 90,000 Increase in common stock 40,000 Cash dividends (30,000) Rehmces Net cash provided by (used in) financing activities 199,999 Net decrease in cash and cash equivalents (2,000) Beginning cash and cash equivalents 27,000 Ending cash and cash equivalents 3 25,000 Required: Compute Apex Company's free cash ow for the current year. (Negative amount should be indicated by a minus sign.) : Help Save & Exit Submit Required 1 Required 2 Using the indirect method, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as 10 negative amounts.) points Skipped Operating activities: Investing activities: References Financing activities: Beginning cash and cash equivalents Ending cash and cash equivalents Required 2 > Required 1 Required 2 Compute Carmono's free cash flow for this year. (Negative amount should be indicated by a minus sign.) Free cash flow Chapter 15 Homework 0 10 poms skipped Reierences Comparative financiai statement data for Carmono Company follow: This Vear Assets Cash 3 3 Accounts receivable 22 Inventory 56 Total current assets 75 Property, plant, and equipment 248 Less accumulated depreciation 65 Net property, plant, and equipment 175 Total assets 3 259 Liabilities and Stockholders' Equity Accounts payable $ 4e Common stock 156 Retained earnings 60 Total liabilities and stockholders' equity 3 250 For this year, the company reported net income as foliows: Sales $ 275 Cost of goods sold 159 Gross margin 125 Selling and administrative expenses 96 Net income $ 35 Saved Help Save & Exit Submit Last Vear $ 6 24 40 70 200 59 159 $ 228 3 36 145 39 $ 229 This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year. Requlred: 1, Using the indirect method, prepare a statement of cash ows for this year, 2. Compute Carmono's free cash ow for this year. Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts