Question: (Chapter 18) During 2020, Cement 4 Life started a construction job with a total contract price of $22,000,000. The job was completed on December 29,

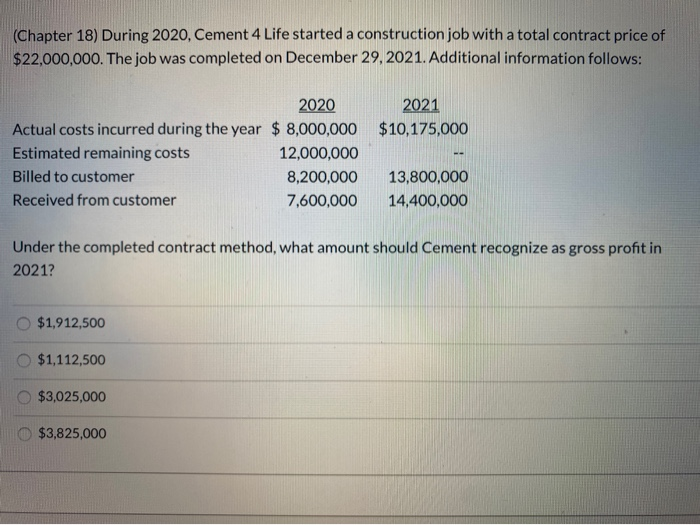

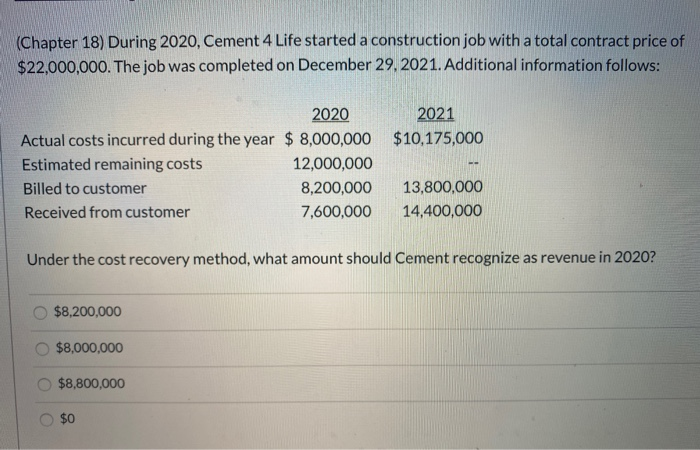

(Chapter 18) During 2020, Cement 4 Life started a construction job with a total contract price of $22,000,000. The job was completed on December 29, 2021. Additional information follows: 2021 $10,175,000 2020 Actual costs incurred during the year $ 8,000,000 Estimated remaining costs 12,000,000 Billed to customer 8,200,000 Received from customer 7,600,000 13,800,000 14,400,000 Under the completed contract method, what amount should Cement recognize as gross profit in 2021? $1,912,500 $1,112,500 $3,025,000 $3,825,000 (Chapter 18) During 2020, Cement 4 Life started a construction job with a total contract price of $22,000,000. The job was completed on December 29, 2021. Additional information follows: 2021 $10,175,000 2020 Actual costs incurred during the year $ 8,000,000 Estimated remaining costs 12,000,000 Billed to customer 8,200,000 Received from customer 7,600,000 13,800,000 14,400,000 Under the cost recovery method, what amount should Cement recognize as revenue in 2020? $8,200,000 $8,000,000 $8,800,000 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts