Question: Chapter 7 Assignment 4 ADDING MORE INFORMATION: DRONE CITY Restore the file Drone City Ch 07 (Backup) that you downloaded from the student companion

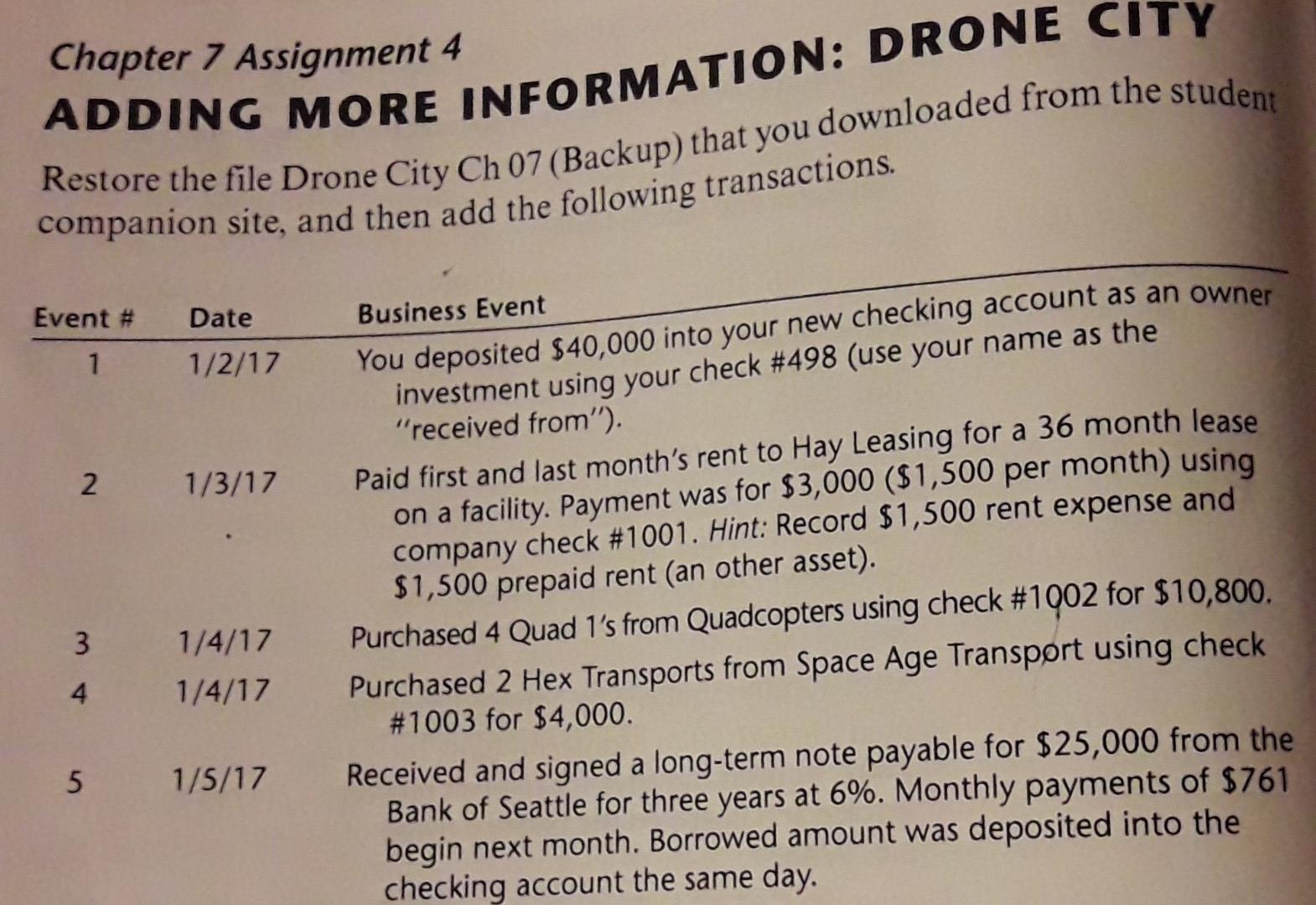

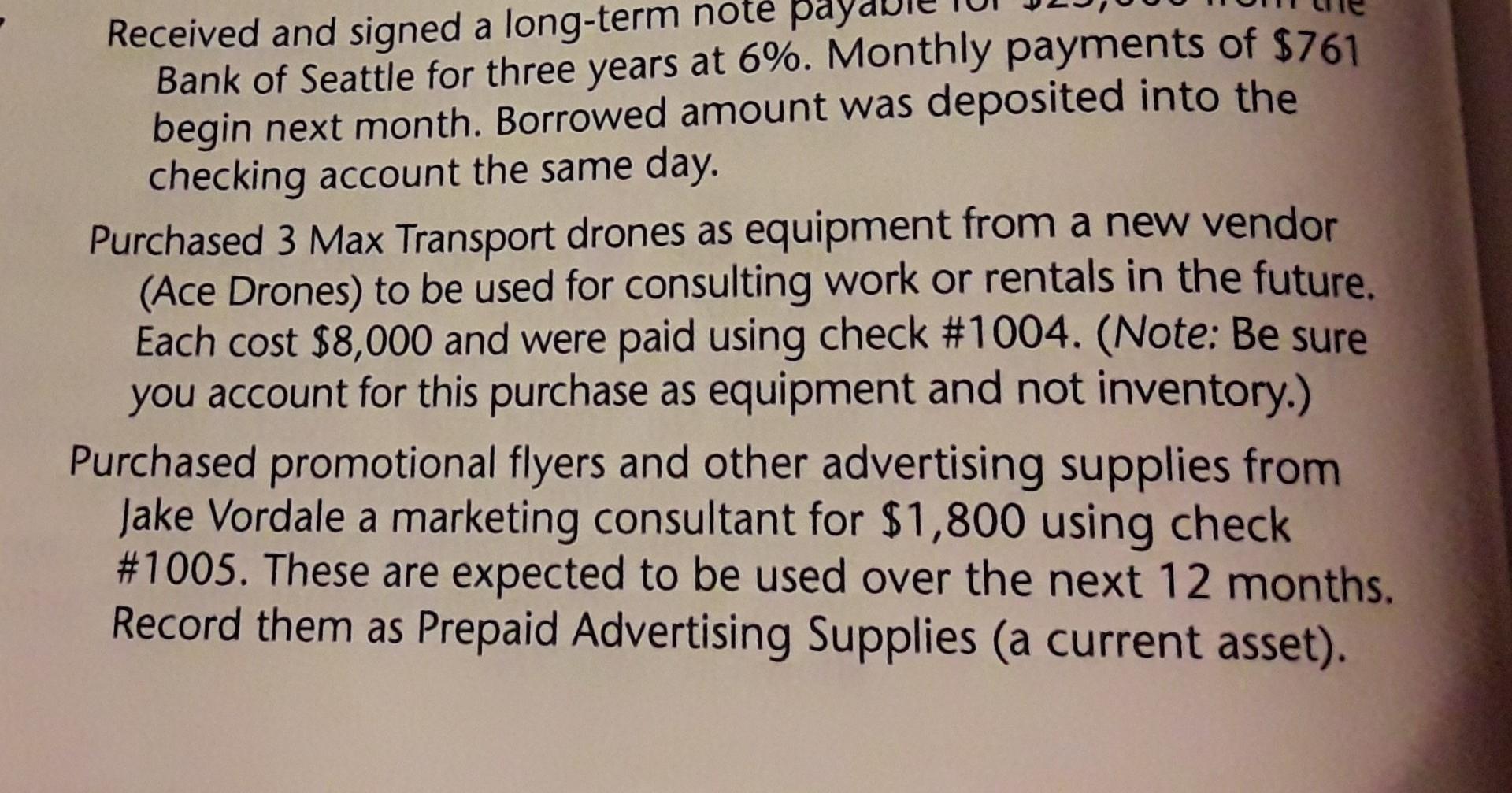

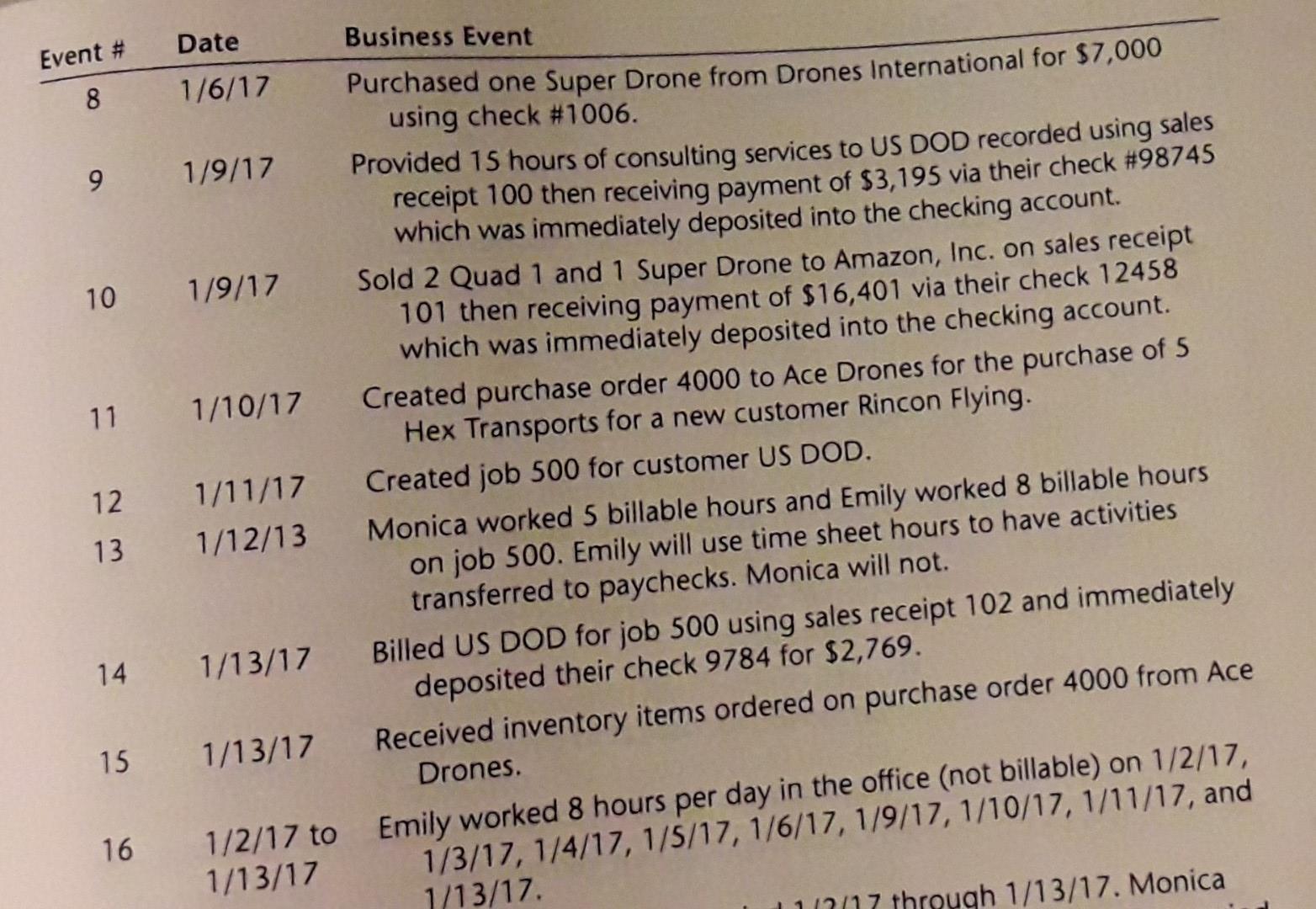

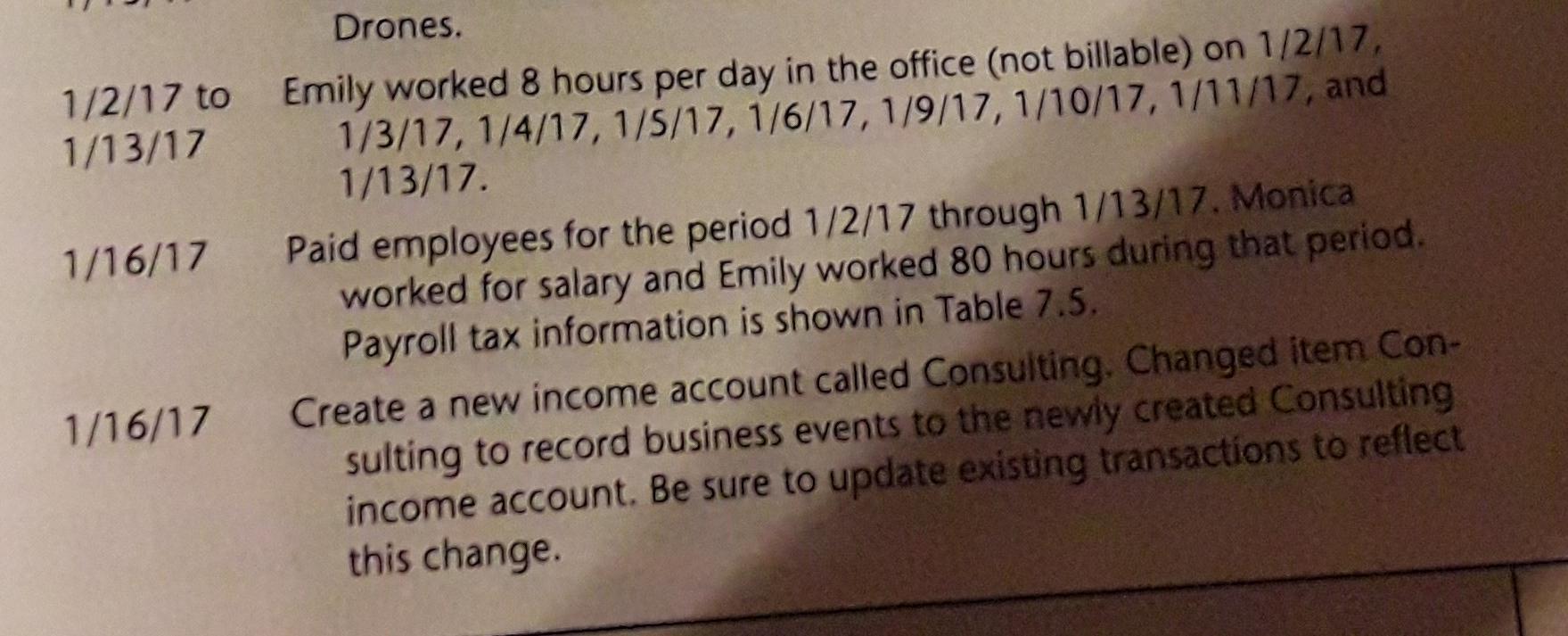

Chapter 7 Assignment 4 ADDING MORE INFORMATION: DRONE CITY Restore the file Drone City Ch 07 (Backup) that you downloaded from the student companion site, and then add the following transactions. Event # Date 1 1/2/17 2 1/3/17 3 4 1/4/17 1/4/17 5 1/5/17 Business Event You deposited $40,000 into your new checking account as an owner investment using your check #498 (use your name as the "received from"). Paid first and last month's rent to Hay Leasing for a 36 month lease on a facility. Payment was for $3,000 ($1,500 per month) using company check #1001. Hint: Record $1,500 rent expense and $1,500 prepaid rent (an other asset). Purchased 4 Quad 1's from Quadcopters using check #1902 for $10,800. Purchased 2 Hex Transports from Space Age Transport using check #1003 for $4,000. Received and signed a long-term note payable for $25,000 from the Bank of Seattle for three years at 6%. Monthly payments of $761 begin next month. Borrowed amount was deposited into the checking account the same day. Received and signed a long-term note paya Bank of Seattle for three years at 6%. Monthly payments of $761 begin next month. Borrowed amount was deposited into the checking account the same day. Purchased 3 Max Transport drones as equipment from a new vendor (Ace Drones) to be used for consulting work or rentals in the future. Each cost $8,000 and were paid using check #1004. (Note: Be sure you account for this purchase as equipment and not inventory.) Purchased promotional flyers and other advertising supplies from Jake Vordale a marketing consultant for $1,800 using check #1005. These are expected to be used over the next 12 months. Record them as Prepaid Advertising Supplies (a current asset). Event # 8 9 10 1/9/17 12 13 Date 1/6/17 11 1/10/17 14 1/9/17 16 1/11/17 1/12/13 1/13/17 15 1/13/17 1/2/17 to 1/13/17 Business Event Purchased one Super Drone from Drones International for $7,000 using check # 1006. Provided 15 hours of consulting services to US DOD recorded using sales receipt 100 then receiving payment of $3,195 via their check #98745 which was immediately deposited into the checking account. Sold 2 Quad 1 and 1 Super Drone to Amazon, Inc. on sales receipt 101 then receiving payment of $16,401 via their check 12458 which was immediately deposited into the checking account. Created purchase order 4000 to Ace Drones for the purchase of 5 Hex Transports for a new customer Rincon Flying. Created job 500 for customer US DOD. Monica worked 5 billable hours and Emily worked 8 billable hours on job 500. Emily will use time sheet hours to have activities transferred to paychecks. Monica will not. Billed US DOD for job 500 using sales receipt 102 and immediately deposited their check 9784 for $2,769. Received inventory items ordered on purchase order 4000 from Ace Drones. Emily worked 8 hours per day in the office (not billable) on 1/2/17, 1/3/17, 1/4/17, 1/5/17, 1/6/17, 1/9/17, 1/10/17, 1/11/17, and 1/13/17. (2/17 through 1/13/17. Monica 1/2/17 to 1/13/17 Drones. Emily worked 8 hours per day in the office (not billable) on 1/2/17, 1/3/17, 1/4/17, 1/5/17, 1/6/17, 1/9/17, 1/10/17, 1/11/17, and 1/13/17. 1/16/17 Paid employees for the period 1/2/17 through 1/13/17. Monica worked for salary and Emily worked 80 hours during that period. Payroll tax information is shown in Table 7.5. 1/16/17 Create a new income account called Consulting. Changed item Con- sulting to record business events to the newly created Consulting income account. Be sure to update existing transactions to reflect this change.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts