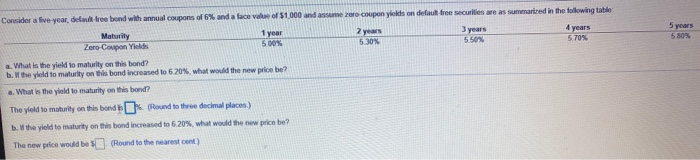

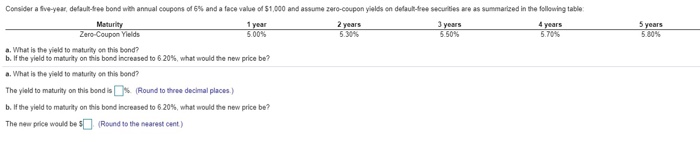

Question: Consider a five year, default bree bond with annual coupons of 6% and a face value of $1.000 anda me zero coupon yields on default

Consider a five year, default bree bond with annual coupons of 6% and a face value of $1.000 anda me zero coupon yields on default tree securities are as summarized in the following table Maturity Zero Coupon Yields 4 years 570% 5005 a. What is the led to mawily on this bond? b. If the yield to maturity on this bond increased to 6.20%, what would the new price be? a. What is the yield to maturity on this bond? The yield to maturity on this bond (Round to three decimal places) b. W the yield to maturity on this bond increased to 6.20%, what would the new price be? The new price would be (Round to the nearest cent) Consider a five-year default tree bond with annual coupons of 6% and a face value of $1000 and assumer -coupon yields on default tree securities we as summarized in the following table Maturity Zero-Coupon Yields 5.50% a. What is the yield to maturity on this bond? b. If the yield to maturity on this bond increased to 6. 20%, what would the new price be? a. What is the yield to maturity on this bond? The yield to maturity on this bond is (Round to three decimal places) b. If the yield to maturity on this bond increased to 6 20%, what would the new price be? The new price would be $ (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts