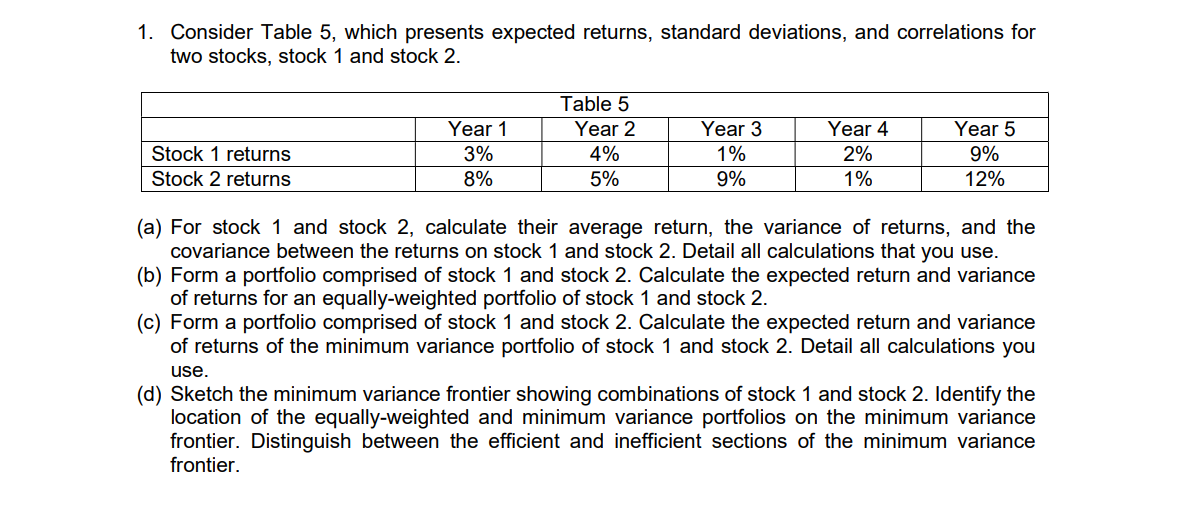

Question: Consider Table 5 , which presents expected returns, standard deviations, and correlations for two stocks, stock 1 and stock 2 . ( a ) For

Consider Table which presents expected returns, standard deviations, and correlations for

two stocks, stock and stock

a For stock and stock calculate their average return, the variance of returns, and the

covariance between the returns on stock and stock Detail all calculations that you use.

b Form a portfolio comprised of stock and stock Calculate the expected return and variance

of returns for an equallyweighted portfolio of stock and stock

c Form a portfolio comprised of stock and stock Calculate the expected return and variance

of returns of the minimum variance portfolio of stock and stock Detail all calculations you

use.

d Sketch the minimum variance frontier showing combinations of stock and stock Identify the

location of the equallyweighted and minimum variance portfolios on the minimum variance

frontier. Distinguish between the efficient and inefficient sections of the minimum variance

frontier.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock