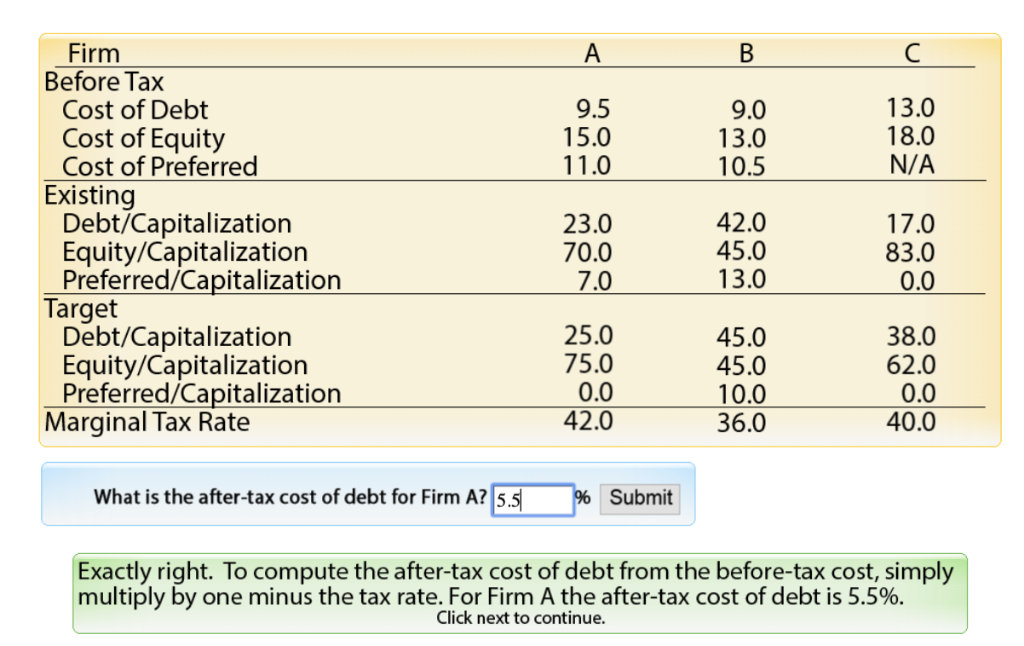

Question: Could someone explain how to get this answer? What is the after-tax cost of debt for Firm A? 9.5 15.0 11.0 9.0 13.0 10.5 13.0

Could someone explain how to get this answer? What is the after-tax cost of debt for Firm A?

9.5 15.0 11.0 9.0 13.0 10.5 13.0 18.0 N/A Firm Before Tax Cost of Debt Cost of Equity Cost of Preferred Existing Debt Capitalization Equity/Capitalization Preferred/Capitalization Target Debt/Capitalization Equity/Capitalization Preferred/Capitalization Marginal Tax Rate 23.0 70.0 7.0 42.0 45.0 13.0 17.0 83.0 0.0 38.0 62.0 25.0 75.0 0.0 42.0 45.0 45.0 10.0 36.0 0.0 40.0 What is the after-tax cost of debt for Firm A? 5.5 % Submit Exactly right. To compute the after-tax cost of debt from the before-tax cost, simply multiply by one minus the tax rate. For Firm A the after-tax cost of debt is 5.5%. Click next to continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts