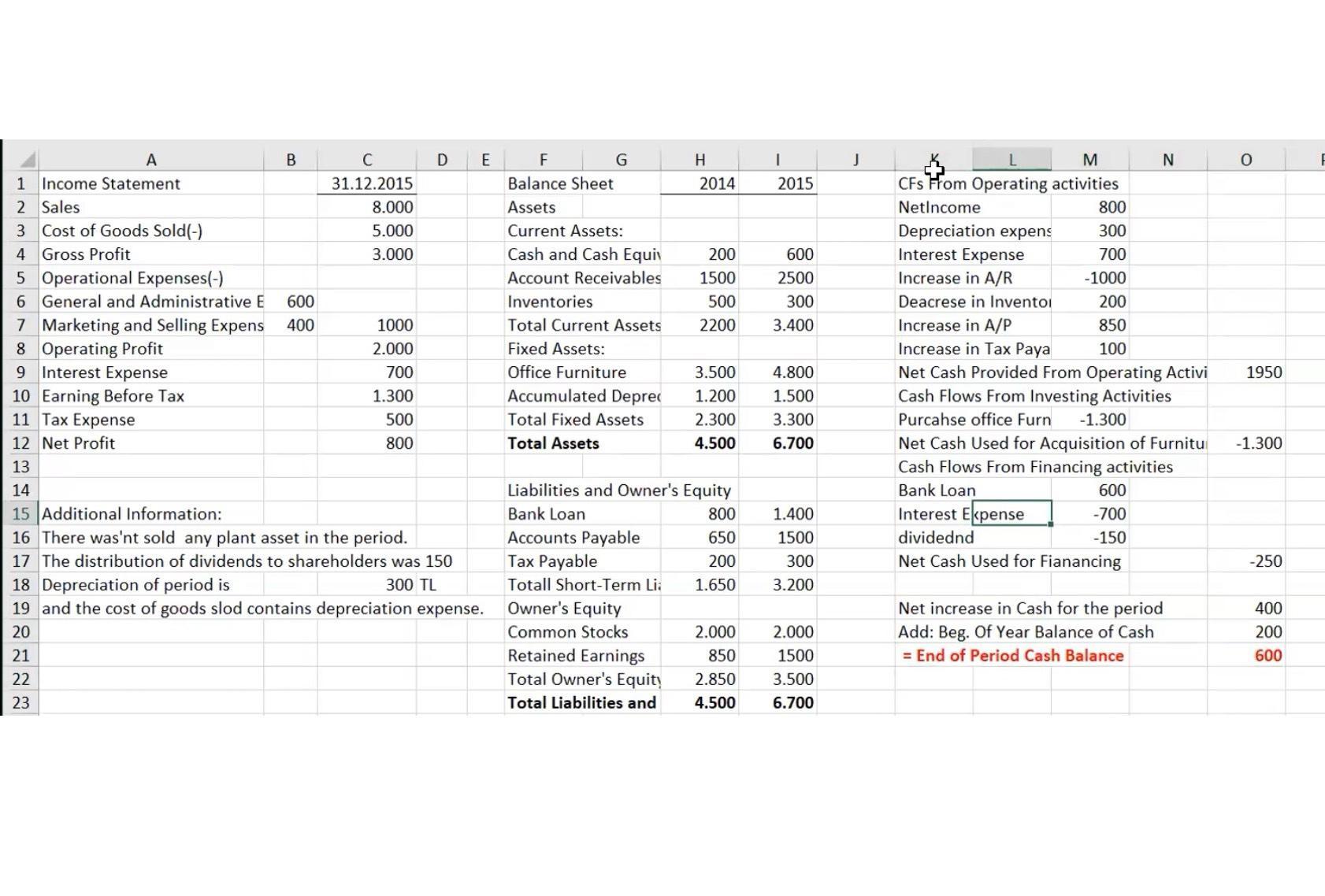

Question: Could you prepare a cash flow with using indirect method A 1 Income Statement 2 Sales 3 4 Gross Profit 5 Operational Expenses(-) 6 General

Could you prepare a cash flow with using "indirect method"

A 1 Income Statement 2 Sales 3 4 Gross Profit 5 Operational Expenses(-) 6 General and Administrative E 600 7 Marketing and Selling Expens 400 8 Operating Profit 9 Interest Expense 10 Earning Before Tax 11 Tax Expense 12 Net Profit 13 14 15 Additional Information: 16 There was'nt sold any plant asset in the period. 17 The distribution of dividends to shareholders was 150 300 TL Cost of Goods Sold(-) B C 31.12.2015 8.000 5.000 3.000 1000 2.000 700 1.300 500 800 D E 18 Depreciation of period is 19 and the cost of goods slod contains depreciation expense. 20 21 22 23 F Balance Sheet Assets Current Assets: Cash and Cash Equiv Account Receivables Inventories G Total Current Assets Fixed Assets: Office Furniture Accumulated Deprec Total Fixed Assets Total Assets H Total Owner's Equity Total Liabilities and 2014 200 1500 500 2200 3.500 1.200 2.300 4.500 Liabilities and Owner's Equity 800 Bank Loan Accounts Payable Tax Payable 650 200 1.650 Totall Short-Term Li Owner's Equity Common Stocks Retained Earnings 2.000 850 2.850 4.500 I 2015 600 2500 300 3.400 4.800 1.500 3.300 6.700 1.400 1500 300 3.200 2.000 1500 3.500 6.700 J L M CFs From Operating activities NetIncome Depreciation expens Interest Expense Increase in A/R 800 300 700 -1000 200 850 100 Deacrese in Invento Increase in A/P Increase in Tax Paya Net Cash Provided From Operating Activi Cash Flows From Investing Activities N Purcahse office Furn -1.300 Net Cash Used for Acquisition of Furnitu Cash Flows From Financing activities Bank Loan 600 -700 -150 Interest Expense dividednd Net Cash Used for Fianancing Net increase in Cash for the period Add: Beg. Of Year Balance of Cash = End of Period Cash Balance 0 1950 -1.300 -250 400 200 600

Step by Step Solution

There are 3 Steps involved in it

Cash Flow from Operating Activities Net Income 800 Adjustments for noncash items Depreciation 300 In... View full answer

Get step-by-step solutions from verified subject matter experts