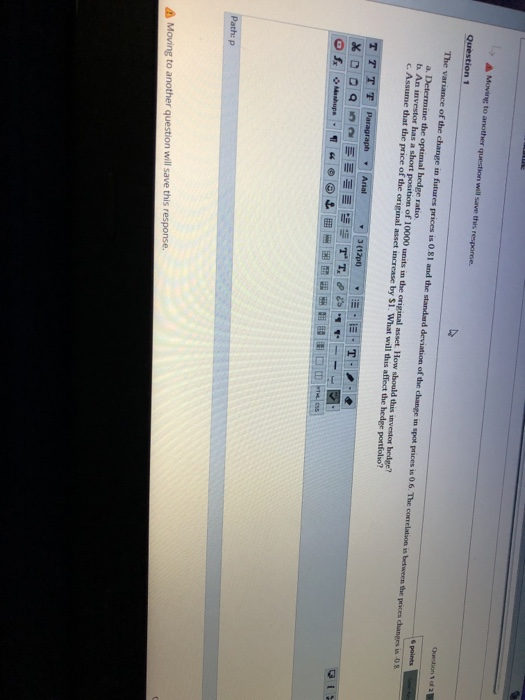

Question: cry A Moving to another question will save this response Question 1 The variance of the change in futures prices is 0.81 and the standard

A Moving to another question will save this response Question 1 The variance of the change in futures prices is 0.81 and the standard deviation of the change in spor prices is 0.6. The correlation is between the prices changes is 08 a. Determine the optimal hedge ratio. b. An investor has a short position of 10000 units in the original asset How should this vestorhede? c. Assume that the price of the original asset increase by $1. What will this affect the hedes portfolio? TTTT Paragraph Arial 3(120 E E - T- Pathep A Moving to another question will save this response. A Moving to another question will save this response Question 1 The variance of the change in futures prices is 0.81 and the standard deviation of the change in spor prices is 0.6. The correlation is between the prices changes is 08 a. Determine the optimal hedge ratio. b. An investor has a short position of 10000 units in the original asset How should this vestorhede? c. Assume that the price of the original asset increase by $1. What will this affect the hedes portfolio? TTTT Paragraph Arial 3(120 E E - T- Pathep A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts