Question: d. Consider the butterfly spread using call options. Let ci, c3 be the prices of the two long call options with exercise prices E1, E3

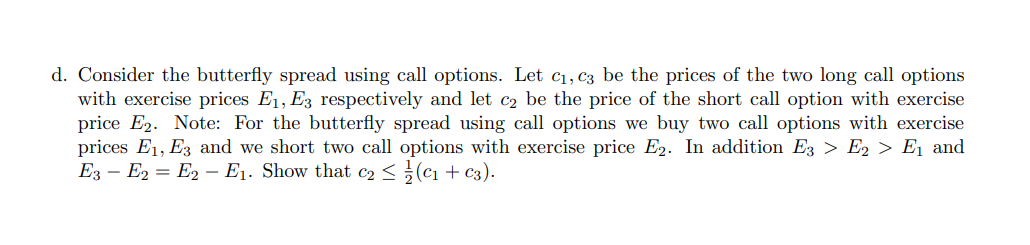

d. Consider the butterfly spread using call options. Let ci, c3 be the prices of the two long call options with exercise prices E1, E3 respectively and let c2 be the price of the short call option with exercise price E2. Note: For the butterfly spread using call options we buy two call options with exercise prices E1, E3 and we short two call options with exercise price E2. In addition E3 > E2 > Ej and E3 E2 = E2 E1. Show that c2 5 ] (c1 + c3). d. Consider the butterfly spread using call options. Let ci, c3 be the prices of the two long call options with exercise prices E1, E3 respectively and let c2 be the price of the short call option with exercise price E2. Note: For the butterfly spread using call options we buy two call options with exercise prices E1, E3 and we short two call options with exercise price E2. In addition E3 > E2 > Ej and E3 E2 = E2 E1. Show that c2 5 ] (c1 + c3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts