Question: Can someone help me to solve this question? Form a long butterfly spread using the three call options in the table below. C1 C2 c3

Can someone help me to solve this question?

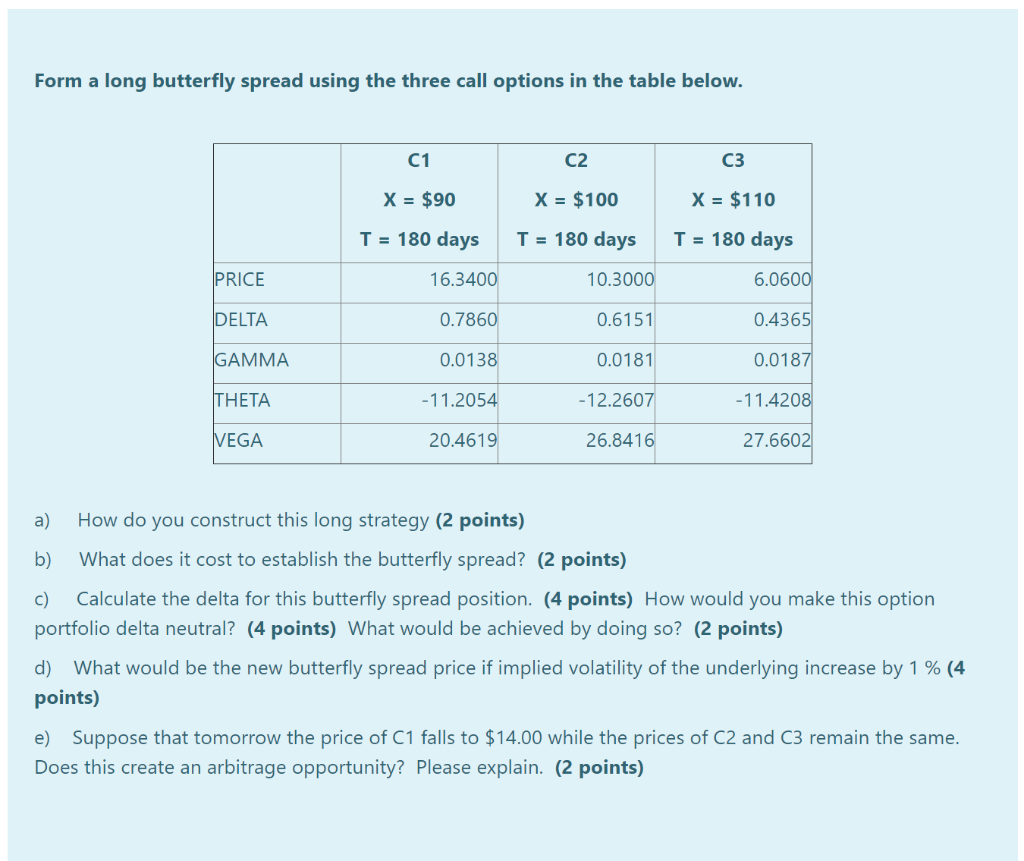

Form a long butterfly spread using the three call options in the table below. C1 C2 c3 X = $90 X = $100 X = $110 T = 180 days T = 180 days T = 180 days PRICE 16.3400 10.3000 6.0600 DELTA 0.7860 0.6151 0.4365 GAMMA 0.0138 0.0181 0.0187 THETA -11.2054 -12.2607 -11.4208 VEGA 20.4619 26.8416 27.6602 a) How do you construct this long strategy (2 points) b) What does it cost to establish the butterfly spread? (2 points) Calculate the delta for this butterfly spread position. (4 points) How would you make this option portfolio delta neutral? (4 points) What would be achieved by doing so? (2 points) d) What would be the new butterfly spread price if implied volatility of the underlying increase by 1 % (4 points) e) Suppose that tomorrow the price of C1 falls to $14.00 while the prices of C2 and C3 remain the same. Does this create an arbitrage opportunity? Please explain. (2 points) Form a long butterfly spread using the three call options in the table below. C1 C2 c3 X = $90 X = $100 X = $110 T = 180 days T = 180 days T = 180 days PRICE 16.3400 10.3000 6.0600 DELTA 0.7860 0.6151 0.4365 GAMMA 0.0138 0.0181 0.0187 THETA -11.2054 -12.2607 -11.4208 VEGA 20.4619 26.8416 27.6602 a) How do you construct this long strategy (2 points) b) What does it cost to establish the butterfly spread? (2 points) Calculate the delta for this butterfly spread position. (4 points) How would you make this option portfolio delta neutral? (4 points) What would be achieved by doing so? (2 points) d) What would be the new butterfly spread price if implied volatility of the underlying increase by 1 % (4 points) e) Suppose that tomorrow the price of C1 falls to $14.00 while the prices of C2 and C3 remain the same. Does this create an arbitrage opportunity? Please explain. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts