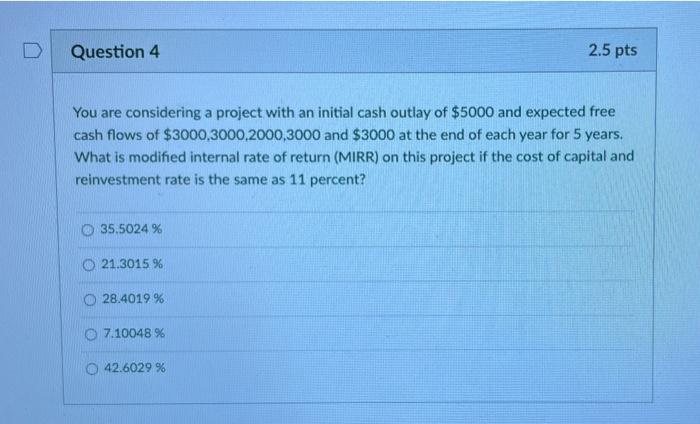

Question: D Question 4 2.5 pts You are considering a project with an initial cash outlay of $5000 and expected free cash flows of $3000,3000,2000,3000 and

D Question 4 2.5 pts You are considering a project with an initial cash outlay of $5000 and expected free cash flows of $3000,3000,2000,3000 and $3000 at the end of each year for 5 years. What is modified internal rate of return (MIRR) on this project if the cost of capital and reinvestment rate is the same as 11 percent? 35.5024 % O 21.3015 % O 28.4019 % O 7.10048 % 42.6029 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts