Question: D) real return on investment is equal to 4% E) aity to purchase goods has declined over the past yenr 26. Given no change in

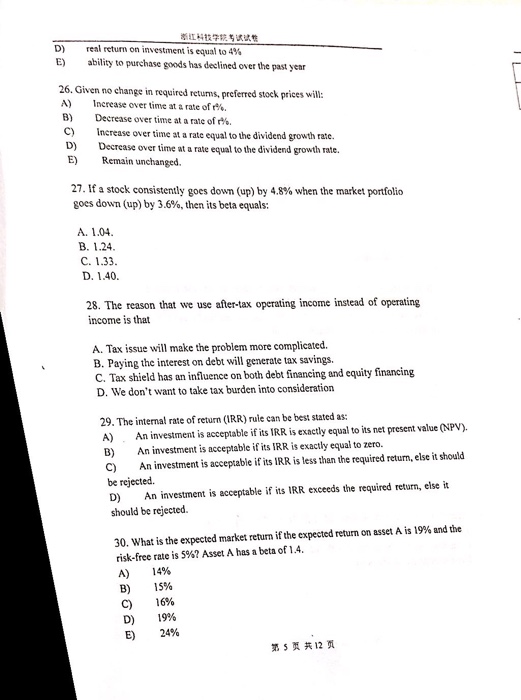

D) real return on investment is equal to 4% E) aity to purchase goods has declined over the past yenr 26. Given no change in required retuns, preferred stock prices will: A) Increase over time at a rate of%. B) Decrease over time at a rate of%. C) Increase D) Decrease over time at a rate equal to the dividend growth rate. E) Remain unchanged. over time at a rate equal to the dividend growth rate. 27. If a stock consistently goes down (up) by 4.8% when the market portfolio goes down (up) by 3.6%, then its beta equals: A. 1.04 B. 1.24 C. 1.33 D. 1.40 28. The reason that we use after-tax operating income instead of operating income is that A. Tax issue will make the problem more complicated B. Paying the interest on debt will generate tax savings. C. Tax shield has an influence on both debt financing and equity financing D. We don't want to take tax burden into consideration 29. The internal rate of return (IRR) rule can be best stated as: A) An investment is acceptable if its IRR is exactly equal to its net present value (NPV) B) An investment is acceptable if its IRR is exactly equal to zero. C) An investment is acceptable if its IRR is less than the required return, else it should be rejected. D) An investment is acceptable if its IRR exceeds the required return, else it should be rejected. 30, what is the expected market return if the expected return on asset A is 19% and the risk-free rate is 5%? Asset A has a beta of 1.4. A) 14% B) 15% C) 16% D) 19% E)24% 512

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts