Question: Determine the systematic risk (Beta) for the three shares. Interpret your answers. The use of excel functions should be used to calculate Beta (slope function

Determine the systematic risk (Beta) for the three shares. Interpret your answers. The use of excel functions should be used to calculate Beta (slope function in excel). What are the implications around the impact of an asset's price given the beta of each share?

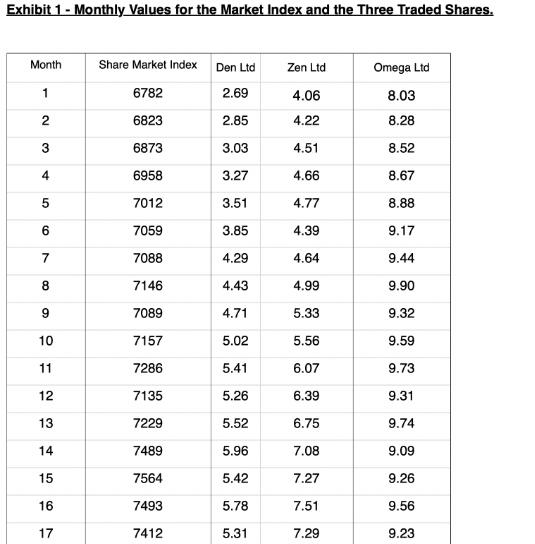

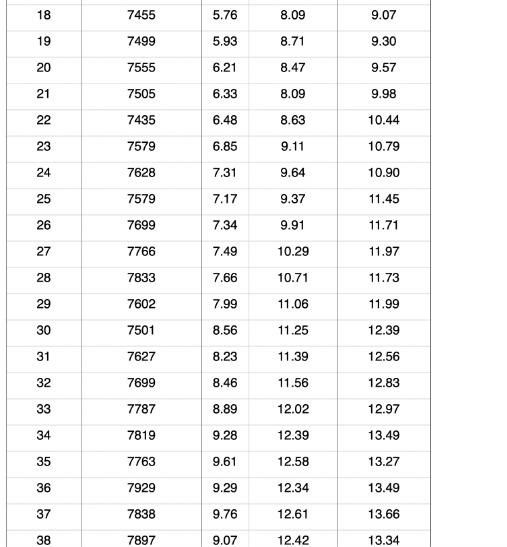

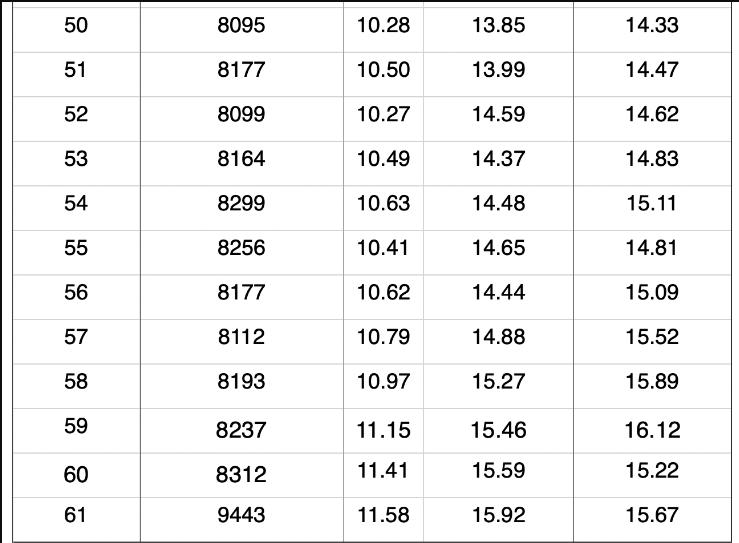

Exhibit 1 - Monthly Values for the Market Index and the Three Traded Shares. Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Share Market Index 6782 6823 6873 6958 7012 7059 7088 7146 7089 7157 7286 7135 7229 7489 7564 7493 7412 Den Ltd 2.69 2.85 3.03 3.27 3.51 3.85 4.29 4.43 4.71 5.02 5.41 5.26 5.52 5.96 5.42 5.78 5.31 Zen Ltd 4.06 4.22 4.51 4.66 4.77 4.39 4.64 4.99 5.33 5.56 6.07 6.39 6.75 7.08 7.27 7.51 7.29 Omega Ltd 8.03 8.28 8.52 8.67 8.88 9.17 9.44 9.90 9.32 9.59 9.73 9.31 9.74 9.09 9.26 9.56 9.23

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION IN DETAILS To calculate the systematic risk Beta for the three shares we need to first calculate the excess returns of each share relative to ... View full answer

Get step-by-step solutions from verified subject matter experts