Question: Developing a Strategic Move What one specific strategic move would you recommend in order to sustain or improve Southwests position? Why do you think it

Developing a Strategic Move

What one specific strategic move would you recommend in order to sustain or improve Southwests position? Why do you think it might be effective? Which way do you propose to move: vertically (taking advantage of a specific opportunity) or horizontally (focusing on a companys specific strength)? You might want to use TOWS approach to justify your choice (match an opportunity to a strength, for example)

Your suggestion:

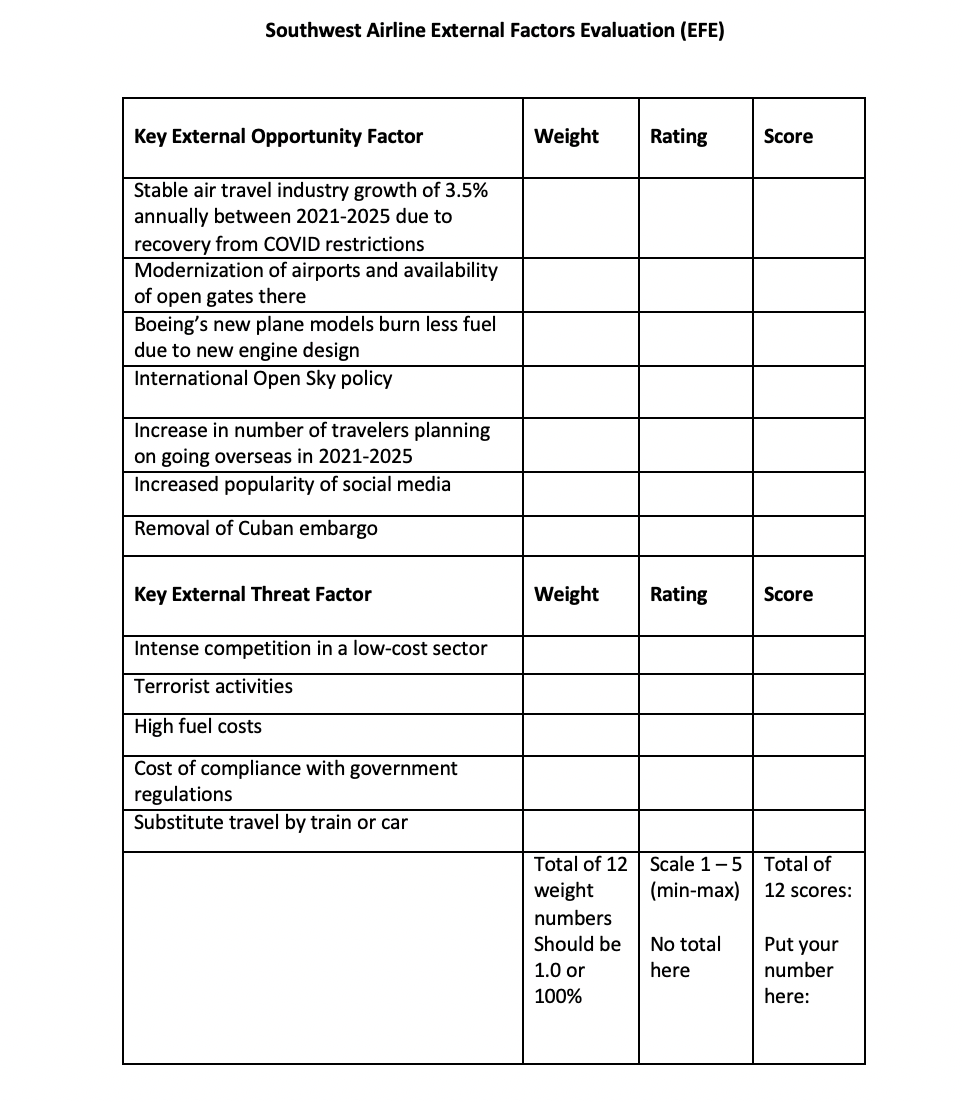

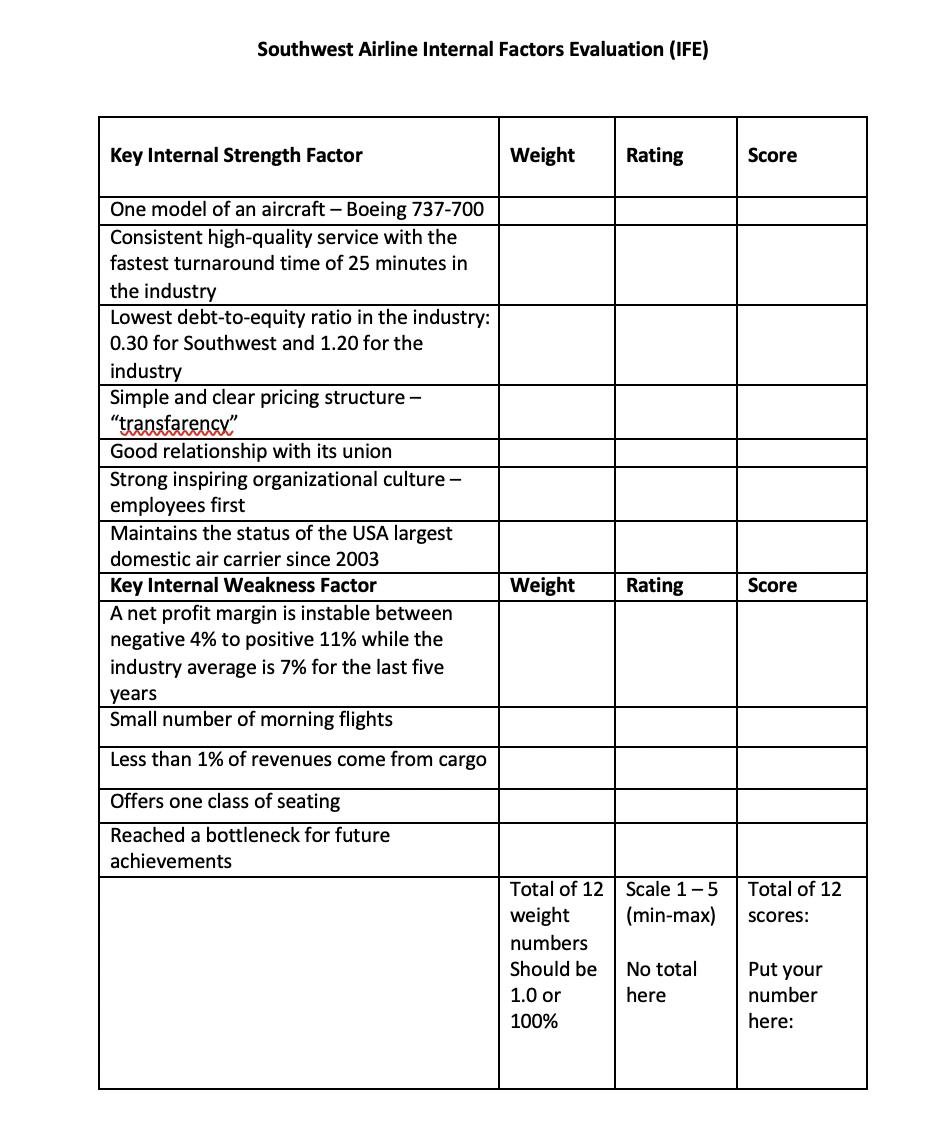

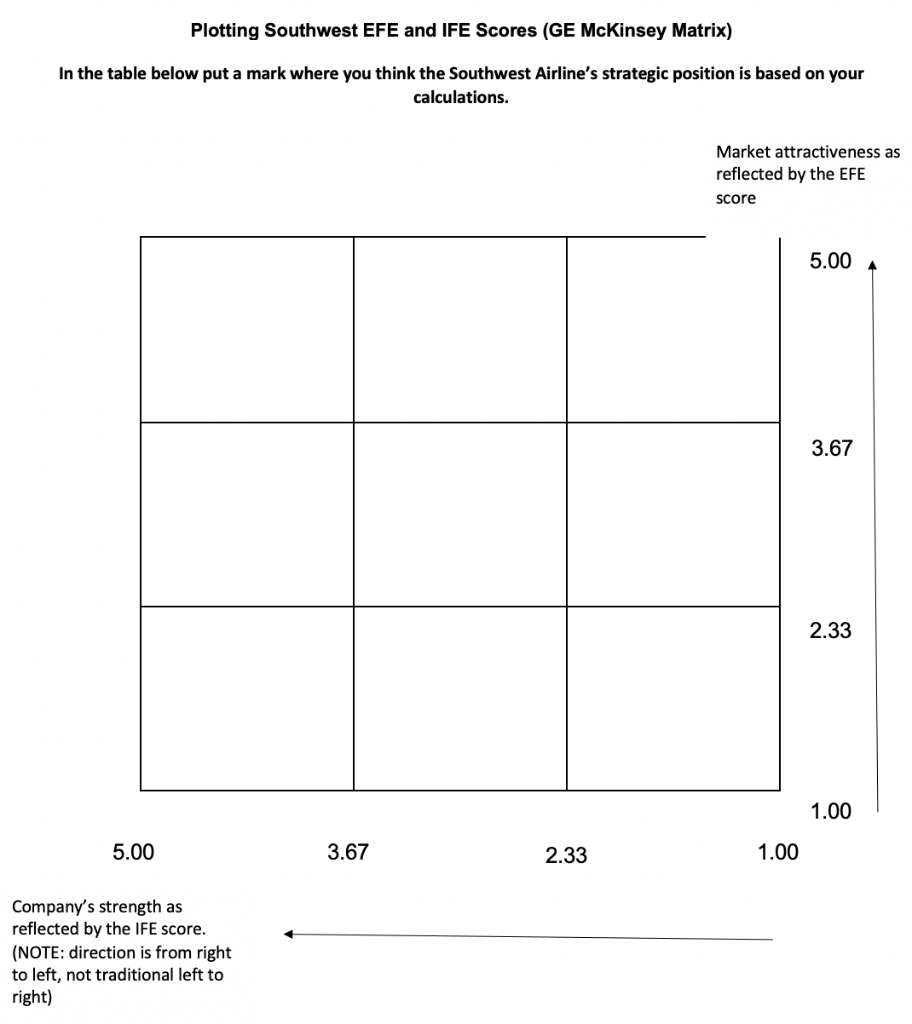

Southwest Airline External Factors Evaluation (EFE) Key External Opportunity Factor Weight Rating Score Stable air travel industry growth of 3.5% annually between 2021-2025 due to recovery from COVID restrictions Modernization of airports and availability of open gates there Boeing's new plane models burn less fuel due to new engine design International Open Sky policy Increase in number of travelers planning on going overseas in 2021-2025 Increased popularity of social media Removal of Cuban embargo Key External Threat Factor Weight Rating Score Intense competition in a low-cost sector Terrorist activities High fuel costs Cost of compliance with government regulations Substitute travel by train or car Total of 12 Scale 1-5 Total of weight (min-max) 12 scores: numbers Should be No total 1.0 or here number 100% here: Put your Southwest Airline Internal Factors Evaluation (IFE) Key Internal Strength Factor Weight Rating Score One model of an aircraft - Boeing 737-700 Consistent high-quality service with the fastest turnaround time of 25 minutes in the industry Lowest debt-to-equity ratio in the industry: 0.30 for Southwest and 1.20 for the industry Simple and clear pricing structure - "transfarency" Good relationship with its union Strong inspiring organizational culture - employees first Maintains the status of the USA largest domestic air carrier since 2003 Key Internal Weakness Factor A net profit margin is instable between negative 4% to positive 11% while the industry average is 7% for the last five years Small number of morning flights Weight Rating Score Less than 1% of revenues come from cargo Offers one class of seating Reached a bottleneck for future achievements Total of 12 scores: Total of 12 Scale 1-5 weight (min-max) numbers Should be No total 1.0 or here 100% Put your number here: Plotting Southwest EFE and IFE Scores (GE McKinsey Matrix) In the table below put a mark where you think the Southwest Airline's strategic position is based on your calculations. Market attractiveness as reflected by the EFE score 5.00 3.67 2.33 1.00 5.00 3.67 2.33 1.00 Company's strength as reflected by the IFE score. (NOTE: direction is from right to left, not traditional left to right)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts