Question: Discussion Question 4 - 4 ( LO . 3 ) Complete the following statements regarding whether a gain can ever be recognized in a 3

Discussion Question LO

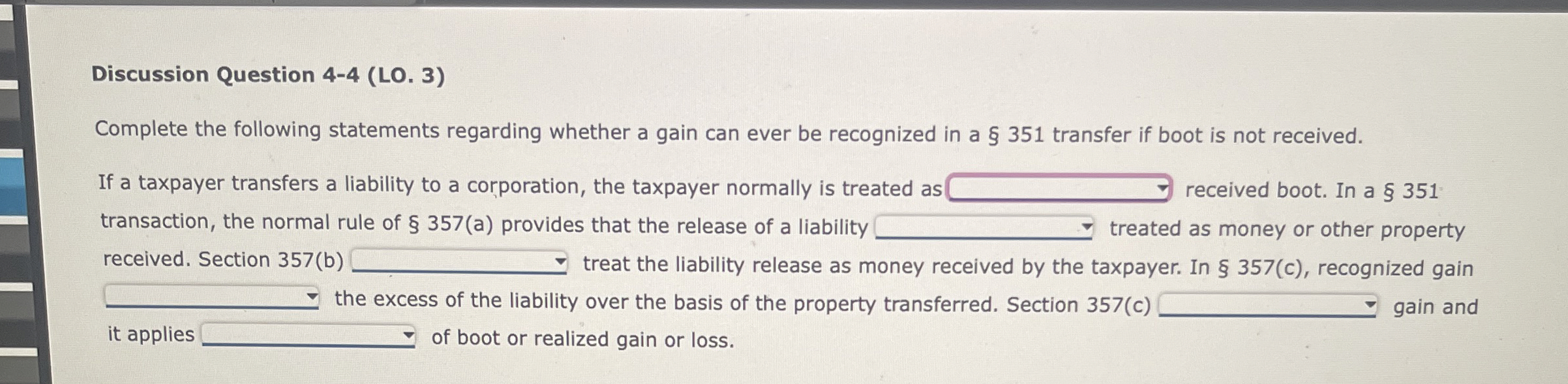

Complete the following statements regarding whether a gain can ever be recognized in a transfer if boot is not received.

If a taxpayer transfers a liability to a corporation, the taxpayer normally is treated as received boot. In a transaction, the normal rule of a provides that the release of a liability treated as money or other property received. Section b treat the liability release as money received by the taxpayer. In c recognized gain the excess of the liability over the basis of the property transferred. Section c it applies of boot or realized gain or loss.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock