Question: do it right way By rent PROBLEM 28 Mr. X of Daryaganj, New Delhi owns several properties which are let out to tenants. He is

do it right way

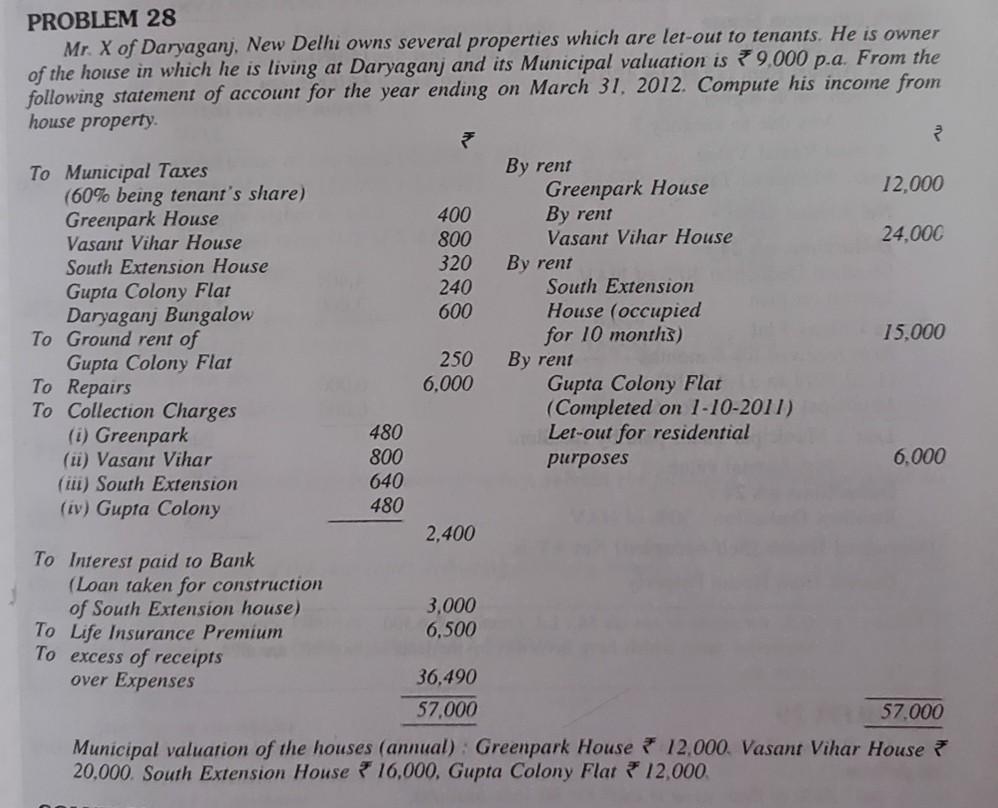

By rent PROBLEM 28 Mr. X of Daryaganj, New Delhi owns several properties which are let out to tenants. He is owner of the house in which he is living at Daryaganj and its Municipal valuation is 9.000 p.a. From the following statement of account for the year ending on March 31, 2012. Compute his income from house property 3 To Municipal Taxes By rent (60% being tenant's share) Greenpark House 12,000 Greenpark House 400 By rent Vasant Vihar House 800 Vasant Vihar House 24,000 South Extension House 320 Gupta Colony Flat 240 South Extension Daryaganj Bungalow 600 House (occupied To Ground rent of for 10 months) 15.000 Gupta Colony Flat 250 By rent To Repairs 6,000 Gupta Colony Flat To Collection Charges (Completed on 1-10-2011) (i) Greenpark 480 Let-out for residential (i) Vasant Vihar 800 purposes 6.000 (iii) South Extension 640 (iv) Gupta Colony 480 2,400 To Interest paid to Bank (Loan taken for construction of South Extension house) 3,000 To Life Insurance Premium 6,500 To excess of receipts over Expenses 36,490 57,000 57.000 Municipal valuation of the houses (annual) Greenpark House ** 12.000. Vasant Vihar House 20.000 South Extension House 16,000, Gupta Colony Flat 12.000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock