Question: do it same way like example (4) The projected costs for a new plant are given below (all numbers are in $ 106): Land cost=

do it same way like example

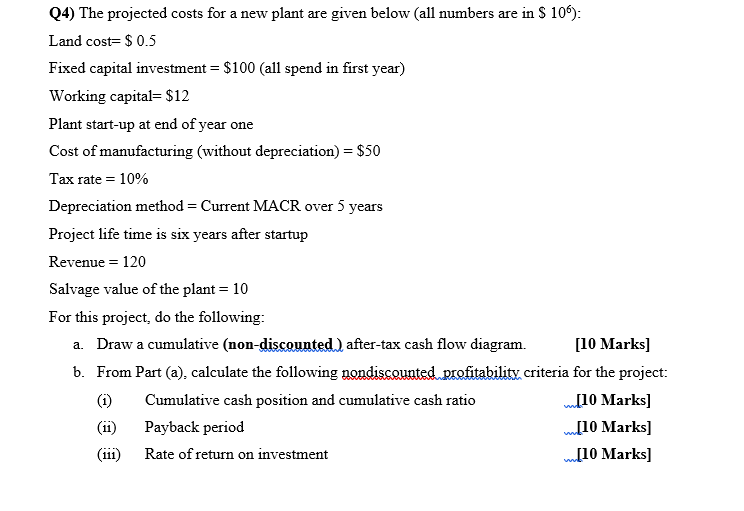

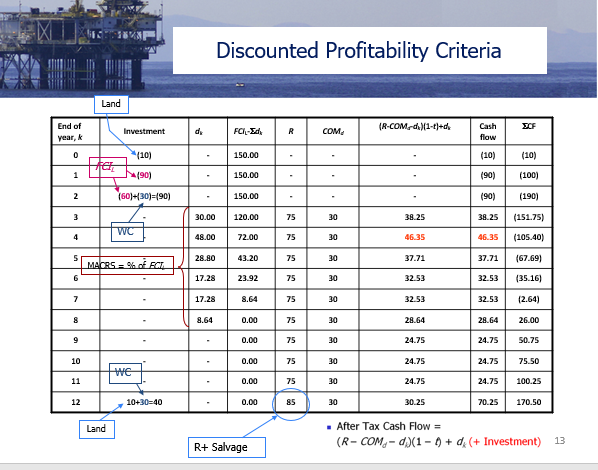

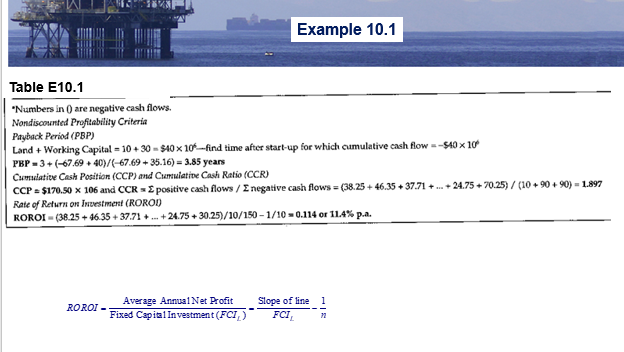

(4) The projected costs for a new plant are given below (all numbers are in $ 106): Land cost= $ 0.5 Fixed capital investment = $100 (all spend in first year) Working capital= $12 Plant start-up at end of year one Cost of manufacturing (without depreciation) = $50 Tax rate = 10% Depreciation method = Current MACR over 5 years Project life time is six years after startup Revenue = 120 Salvage value of the plant = 10 For this project, do the following: a. Draw a cumulative (non-discounted) after-tax cash flow diagram. [10 Marks) b. From Part (a), calculate the following nondiscounted profitability criteria for the project: (1) Cumulative cash position and cumulative cash ratio mflo Marks] (11) Payback period m[10 Marks) (111) Rate of return on investment [10 Marks] 18 Discounted Profitability Criteria Land (R-COM-x)(1-1)+d Cash End of year, Investment d. FCI-SK R COM flow 0 (10) 150.00 (10) (10) Her 1 190) 150.00 (90) (100) 2 (60)+(30)=(90) 150.00 (90) (190) 3 30.00 120.00 75 30 38.25 38.25 (151.75) WC 4 48.00 72.00 75 30 46.35 46.35 (105.40) 5 28.80 43.20 75 30 37.71 37.71 (67.69) MACRS = % BOT 17.28 23.92 75 30 32.53 32.53 (35.16) 7 17.28 8.64 75 30 32.53 32.53 (2.64) 8.64 0.00 75 30 28.64 28.64 26.00 9 0.00 75 30 24.75 24.75 50.75 10 0.00 75 30 24.75 24.75 75.50 WE 11 0.00 75 30 24.75 24.75 100.25 12 10+30-40 0.00 85 30 30.25 70.25 170.50 Land After Tax Cash Flow = (R-COM,- 0) (1 - 1) + d: (+ Investment) 13 R+ Salvage Example 10.1 Table E10.1 "Numbers in are negative cash flows. Nondiscounted Profitability Criteria Payback Period (PBP) Land + Working Capital - 10 + 30 - 40 X 10 --find time after start-up for which cumulative cash flow-$40 x 10 PBP = 3 + (-67.69 40)/(-67.69 +35.16) - 3.85 years Cumulation Cash Position (CCP) and Cumulatie Cash Ratio (CCR) CCP = $170.50 X 106 and CCR - positive cash flows / negative cash flows = (38.25 +46.35 + 37.71 + ... +24.75 + 70.25) / (10 +90 +90) - 1.897 Rate of Return on Investment (ROROD ROROI - (38.25 +46.35 + 37.71 + ... + 24.75 +30.25)/10/150-1/10 - 0.114 or 114% pa. ROROI- Average Annual Net Profit Fixed Capital Investment (FCI) Slope of line 1 FCI, (4) The projected costs for a new plant are given below (all numbers are in $ 106): Land cost= $ 0.5 Fixed capital investment = $100 (all spend in first year) Working capital= $12 Plant start-up at end of year one Cost of manufacturing (without depreciation) = $50 Tax rate = 10% Depreciation method = Current MACR over 5 years Project life time is six years after startup Revenue = 120 Salvage value of the plant = 10 For this project, do the following: a. Draw a cumulative (non-discounted) after-tax cash flow diagram. [10 Marks) b. From Part (a), calculate the following nondiscounted profitability criteria for the project: (1) Cumulative cash position and cumulative cash ratio mflo Marks] (11) Payback period m[10 Marks) (111) Rate of return on investment [10 Marks] 18 Discounted Profitability Criteria Land (R-COM-x)(1-1)+d Cash End of year, Investment d. FCI-SK R COM flow 0 (10) 150.00 (10) (10) Her 1 190) 150.00 (90) (100) 2 (60)+(30)=(90) 150.00 (90) (190) 3 30.00 120.00 75 30 38.25 38.25 (151.75) WC 4 48.00 72.00 75 30 46.35 46.35 (105.40) 5 28.80 43.20 75 30 37.71 37.71 (67.69) MACRS = % BOT 17.28 23.92 75 30 32.53 32.53 (35.16) 7 17.28 8.64 75 30 32.53 32.53 (2.64) 8.64 0.00 75 30 28.64 28.64 26.00 9 0.00 75 30 24.75 24.75 50.75 10 0.00 75 30 24.75 24.75 75.50 WE 11 0.00 75 30 24.75 24.75 100.25 12 10+30-40 0.00 85 30 30.25 70.25 170.50 Land After Tax Cash Flow = (R-COM,- 0) (1 - 1) + d: (+ Investment) 13 R+ Salvage Example 10.1 Table E10.1 "Numbers in are negative cash flows. Nondiscounted Profitability Criteria Payback Period (PBP) Land + Working Capital - 10 + 30 - 40 X 10 --find time after start-up for which cumulative cash flow-$40 x 10 PBP = 3 + (-67.69 40)/(-67.69 +35.16) - 3.85 years Cumulation Cash Position (CCP) and Cumulatie Cash Ratio (CCR) CCP = $170.50 X 106 and CCR - positive cash flows / negative cash flows = (38.25 +46.35 + 37.71 + ... +24.75 + 70.25) / (10 +90 +90) - 1.897 Rate of Return on Investment (ROROD ROROI - (38.25 +46.35 + 37.71 + ... + 24.75 +30.25)/10/150-1/10 - 0.114 or 114% pa. ROROI- Average Annual Net Profit Fixed Capital Investment (FCI) Slope of line 1 FCI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts